The Hershey Company’s (NYSE:HSY) earnings and revenues missed the Zacks Consensus Estimate in fourth-quarter 2017 and also declined from the year-ago level. Nevertheless, the company will continue to invest in core brands and focus on strategies to drive growth.

Earnings & Revenue Discussion

Adjusted earnings per share of $1.03 missed the Zacks Consensus Estimate of $1.06 by 2.8%. Earnings declined 12% from the year-ago $1.17.

Net sales of $1.94 billion missed the Zacks Consensus Estimate of $1.97 billion. Net sales declined 1.6% year over year owing to the unfavorable timing of shipments last quarter and the sales increase from the Cookie Layer Crunch launch in the prior-year quarter. The sales decline breaks the streak of six straight quarters of improvement. Organically, excluding the impact of currency, sales fell 2%.

Volumes were down 2.3%. Meanwhile, net price realization had a favorable impact of 0.3% and currency drove revenues by 0.4%.

Quarterly Segment Discussion

North America (U.S. and Canada) net sales declined 0.9% to $1.67 billion. Currency benefited sales by 0.4% and pricing had a 0.3% positive impact. Meanwhile, volumes decreased 1.6%.

Fourth-quarter net sales at the International and Other segment declined 5.4% to $265 million. Currency had a positive impact on sales of 1.2%, while volumes posed a 6.6% headwind. Excluding currency, sales declined 6.6%.

Constant currency sales were solid (about 10%) in Mexico, Brazil and India. Net sales in China declined about 30% owing to volume declines.

Margins Detail

Adjusted gross margin declined 180 basis points (bps) to 42.7% due to unfavorable sales mix, higher freight and distribution costs, and other supply chain expenses.

Cost of sales dropped 9.8% to $1.1 billion in the fourth quarter. Again, total advertising and related consumer marketing expenses decreased 3.3% from fourth-quarter 2016. Adjusted operating margin contracted 240 bps to 16.8%.

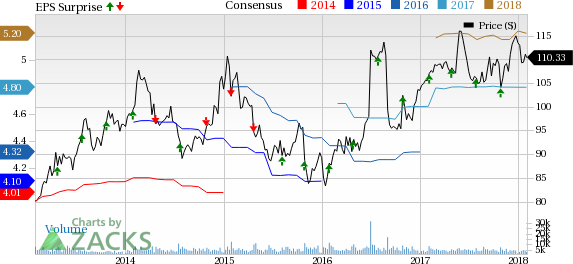

Hershey Company (The) Price, Consensus and EPS Surprise

2017 Performance

Adjusted earnings per share of $4.76 increased from the year-ago level of $4.41 by 7.9%.

Net sales of $7.5 billion increased from the year-ago $7.4 billion.

2018 Guidance

Net sales are expected increase 5-7%. Adjusted gross margin will likely be in line with the 2017 level.

Savings from the Margin for Growth program are estimated at $55 million to $65 million in 2018.

Effective tax rate should be around 20% to 22%.

The company reaffirmed its adjusted EPS guidance at $5.33-$5.43, reflecting a 12-14% increase from last year.

Zack Rank & Upcoming Peer Releases

Hershey carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Kellogg Company (NYSE:K) is slated to report fourth-quarter numbers on Feb 8.

The Kraft Heinz Company (NYSE:K) is set to release fourth-quarter results on Feb 16.

B&G Foods (NYSE:BGS) is expected to report quarterly results on Feb 22.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Hershey Company (The) (HSY): Free Stock Analysis Report

B&G Foods, Inc. (BGS): Free Stock Analysis Report

Kellogg Company (K): Free Stock Analysis Report

The Kraft Heinz Company (KHC): Free Stock Analysis Report

Original post

Zacks Investment Research