Just in time for Halloween, The Hershey Company (NYSE:HSY) is ready to collect copious amounts of money in exchange for that sweet, sweet chocolate. The candy concoction creator is expected to post third-quarter earnings of $1.61 per share tomorrow, which is a YoY increase of 3.9%.

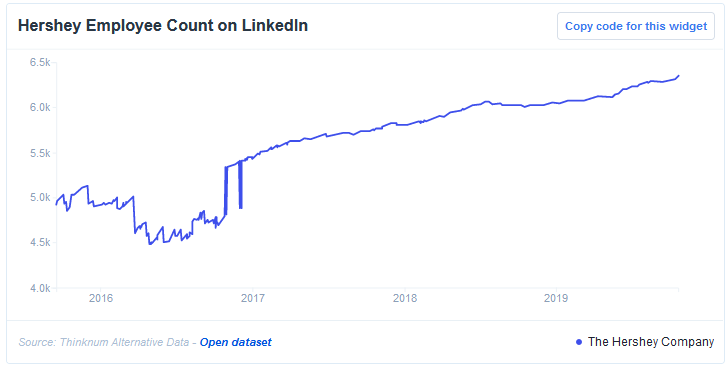

Right now, Hershey is at an all-time high in the employee count according to LinkedIn (NYSE:LNKD). You can see that over the last 4+ years there have been around 2,000 extra staffers added and there is no slowing down in sight. People LOVE chocolate, and they have every reason to. Chocolate is delicious.

In 2019, job postings from Hershey have risen 33% - although, year-over-year, they are down slightly. Job listings are typically up and down for Hershey, but it's been holding steady at the same basic rate over the past year or so. The chart shows healthy fluctuations, as opposed to giant spikes or cliffs in the data.

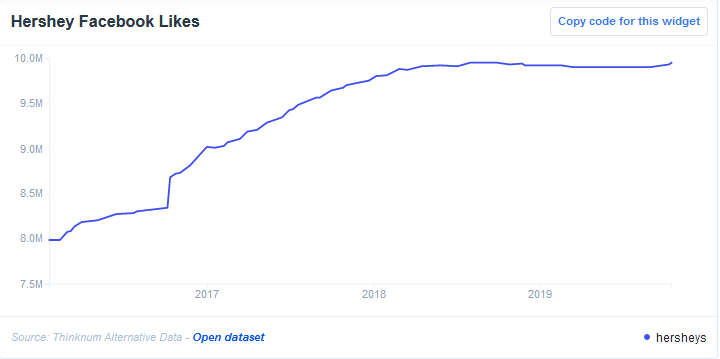

Twitter data (not shown here) and Facebook (NASDAQ:FB) likes are also at all-time highs. Millions of people correctly and rightfully approve of all chocolate products, and I can sense they might want good deals on candy even after October ends. Because no holiday should dictate when we eat chocolate. Don't let corporations convince you there is a right or wrong time to eat candy, because it's 24/7/365.

About the Data:

Thinknum tracks companies using the information they post online - jobs, social and web traffic, product sales and app ratings - and creates data sets that measure factors like hiring, revenue and foot traffic. Data sets may not be fully comprehensive (they only account for what is available on the web), but they can be used to gauge performance factors like staffing and sales.