With the influx of a number economic metrics over the past few weeks, it becomes clearer than ever that the US economy is improving. However, with the latest ADP report on private payrolls showing that the US private sector created 208,000 jobs in November, which comes in below expectations, there is now one more reason to be less optimistic. However, from some data available to us, we should focus more on productivity data.

The problem with employment data

The reality of the current economic landscape is that the aim of bodies that need to hire a workforce is not to hire more people. Their aim is to be more productive. Hiring becomes only necessary when the existing workforce has been optimized. This is one of the lessons we learned from the last recession. With this in mind, productivity data could therefore present a better view of economic progress than employment data for now.

Ecommerce proof

The growth of the ecommerce industry also embodies why productivity is becoming more important. According to information provided by the Department of Commerce, US retail ecommerce sales for the third quarter of 2014 grew 4%from the second quarter of 2014 after adjusting for seasonal variations, but not price changes. This is accompanied by a 2.3 percent increase in non-farm productivity during the third quarter.

One thing to note here is that the growth of ecommerce doesn’t mean that unemployment rate will decrease, as the number of people needed to work onsite won’t be as high as before.

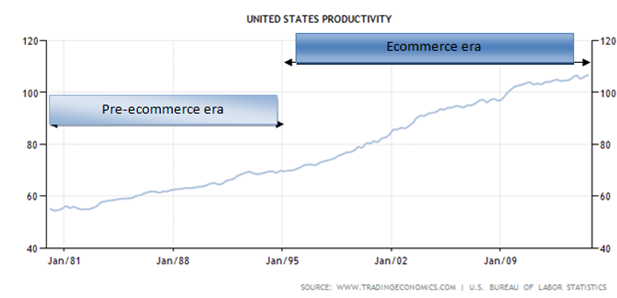

An interesting relationship has been developing between ecommerce and productivity over the years. This relationship was first noticed during the internet revolution between 1995 and 2000, when total output was on an average annual growth rate of 5.1% per year, faster than the preceding few years.

Looking at the chart above, you will notice that the growth in productivity between January 1981 and January 1988, and between January 1988 and January 1995 was less steep than between January 1995 and January 2009 and beyond. You will appreciate this better when you consider that unemployment rate in 1980 was around 6%, and it still hovers in that region at present. In addition, increase in productivity has also moved closely increase in ecommerce activities.

While other factors have contributed to the impressive productivity growth since the inception of internet and ecommerce, it is certain that the influence of ecommerce has been instrumental. Here is why.

According to a report from Federal Reserve Bank of Kansas City, the evolution of ecommerce helps improve productivity, even with firms that are not engaged in ecommerce. This happens mostly through cost savings. In the report, Cisco’s research on the impact of ecommerce on its cost savings during 1994 and 1999 was referenced. Cisco found that cost savings over the period was 5.3% of its 1999 revenue. Most notable is the fact that it attributed about 10% of the cost savings to workforce optimization, a direct measurement of productivity.

The fact that the ecommerce aims to cut cost and increase margin puts a bit of pressure on non-ecommerce firms. The impact is that it forces non-ecommerce firms to look for ways to cut costs and improve margins. Therefore, while ecommerce still accounts for small portion of commerce, the impact on the economy will grow.

Moreover, another study by Litan and Rivlin predicted that the ecommerce would add between 0.25 to 0.5 percentage point to the productivity of the economy as a whole between 2001 and 2005.

All of this goes to show us why we should focus a bit more on ecommerce data, as it gives us insight into how much pressure will be on the economy to be more productive, which in the end should help curtail excessive inflation growth.

Ecommerce will also help improve global economy

The latest slump in US export data indicates that the US economy cannot thrive if other economies are suffering. Therefore, the growth of ecommerce globally, especially in emerging markets, should also help improve productivity, which would help speed up economic growth.

For instance, a recent study by McKinsey & Company estimates that ecommerce could account for 10% of retail sales in Africa’s largest economies by 2025. As discussed above such improvement will be make these economies grow faster. If you’re looking for how this will play out, you might want to look at how things play out in Egypt, which went through a revolution four years ago. Ecommerce is on a rapid growth in the country as companies like Jumia Egypt is investing more into the sector. Specifically you should watch out for how inflation and productivity data changes in the country over the next few years to see the impact of ecommerce.

Other area to look out for the impact of ecommerce on the economy is in the property market. The growth of ecommerce, which, for instance, will increase the options of homebuilders for supplies, would also help keep inflation of properties at reasonable levels. For instance, companies like Kremer Signs, which designs, manufactures and installs high quality signage in London and throughout the UK and White Cap, a supplier of real estate materials and in the US and their competitors could help cut costs in the industry though competitive pricing, which should help keep inflation at reasonable levels in the real estate industry.

Long story short, we are moving into an era when ecommerce will become more important to determining the progress of the economy.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Here’s How Ecommerce Is Improving The Economy

Published 12/04/2014, 09:39 AM

Updated 07/09/2023, 06:31 AM

Here’s How Ecommerce Is Improving The Economy

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.