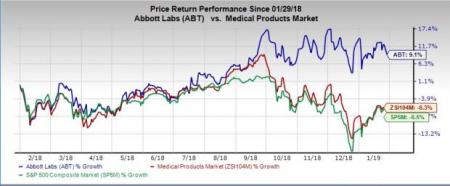

Abbott Laboratories (NYSE:ABT) has been gaining investor confidence on continued positive results. The company’s share price has outperformed its industry over the past year. The stock has gained 9.1% against its industry’s 6.3% decline and the S&P 500’s 6.5% fall in the said period.

This leading developer, manufacturer and seller of a diversified line of health care products has a market cap of $124.96 billion. The company has an expected earnings growth rate of 11.8% over the next three-five years.

With solid prospects, this Zacks Rank #2 (Buy) stock is an attractive pick for investors at the moment.

What’s Working in Favor of the Stock?

Strong EPD Business

Abbott’s EPD business operates solely in emerging geographies, with leading positions in many of the largest and fastest growing pharmaceutical markets for branded generics in the world. These markets include India, Russia, China and Latin America.

The company recently noted that banking on successful execution of the Branded Generic operating model, EPD is well positioned for sustained above-market growth in many of these growing pharmaceutical markets. Sales were strong in the last reported quarter, led by double-digit growth in both India and China.

Progress With Diabetes Business

This business achieved 35% growth in 2018, led by FreeStyle Libre, which achieved global sales of more than $1 billion during the year, reflecting a 100% increase from a year ago. At the end of 2018, there were approximately 1.3 million active users worldwide, of which nearly two-thirds constituted type 1 diabetics and one-third accounted for type 2.

In the United States, there has been an accelerating trend of new users as Abbott is ramping up its awareness efforts during the second half of the year. The pharmacy insurance coverage has continued to increase, including an emerging trend of seeing Libre granted preferred copay status versus competitive systems, due to its compelling overall value proposition. In Europe, during the fourth quarter, the company initiated the launch of Libre 2.0, which includes optional alarms that work when patients’ glucose levels fall below the normal range.

These developments are expected to enable the company to gain further traction in the Diabetes Care segment, which saw significant sales growth in the last reported quarter on continued consumer acceptance of FreeStyle Libre internationally.

Diagnostics Arm Gets a Boost From Alinity

Abbott is well placed on a healthy sales growth trajectory within Diagnostics over the past few quarters. Alinity, a family of highly differentiated instruments, is achieving accelerated growth and strong competitive win rates in Europe, where more than 50% of Alinity instrument placements are coming from share capture. The global rollout of Alinity positions this business for a consistent above market growth for years to come.

Other Key Picks

Other top-ranked stocks in the broader medical space include Omnicell, Inc. (NASDAQ:OMCL) , Amedisys, Inc. (NASDAQ:AMED) and Illumina, Inc. (NASDAQ:ILMN) .

Omnicell’s long-term earnings growth rate is estimated at 11.8%. The stock flaunts a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Amedisys’ long-term earnings growth rate is projected at 18.8%. The stock carries a Zacks Rank #2.

Illumina’s long-term earnings growth rate is expected at 20.9%. The stock carries a Zacks Rank of 2.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Omnicell, Inc. (OMCL): Free Stock Analysis Report

Abbott Laboratories (ABT): Free Stock Analysis Report

Illumina, Inc. (ILMN): Free Stock Analysis Report

Amedisys, Inc. (AMED): Free Stock Analysis Report

Original post

Zacks Investment Research