On Aug 18, Zacks Investment Research downgraded DST Systems Inc. (NYSE:DST) to a Zacks Rank #5 (Strong Sell).

Of late, the stock has been witnessing downward estimate revisions. In fact, the Zacks Consensus Estimate for fiscal 2017 dropped 6.5% to $3.04 over the last 30 days. All four estimates for fiscal 2018 declined in the same time frame, resulting in a drop of 4.5% in the Zacks Consensus Estimate to $3.57.

The negative estimate revision was primarily due to disappointing second-quarter 2017 bottom-line results. The company posted non-GAAP earnings (excluding amortization of intangible assets, restructuring charges and one-time items) of 76 cents per share, which missed the Zacks Consensus Estimate by a couple of cents.

DST has lost 4.8% of its value year to date against 24.2% growth of its industry.

Factors Affecting the Company

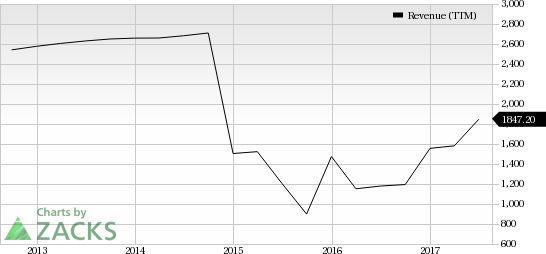

We believe persistent decline in registered accounts, ongoing consolidation in the U.S. financial services market is putting the company’s fundamentals under pressure. Additionally, a high debt burden remains a major concern.

The impact of client migrations, reduction in membership and decline in healthcare technology spending resulting from changes in government policy also negatively impacted the company.

Moreover, there was an increase in total cost and operating expenses in the second quarter, which soared 63.9% from the year-ago quarter to $525.2 million. This in turn put pressure on margin. Operating margin was down 620 basis points on a year-over-year basis to 12.2% in the last quarter.

Furthermore, in the last quarter, the company delivered a negative earnings surprise of 2.56%.

Additionally, stiff competition from International Business Machines (NYSE:IBM) and Fiserv Inc. (NASDAQ:FISV) is also a headwind for the company.

Key Pick

A stock to consider in the broader technology sector is Lam Research Corporation (NASDAQ:LRCX) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Lam Research is projected to be 17.20%.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

International Business Machines Corporation (IBM): Free Stock Analysis Report

DST Systems, Inc. (DST): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Fiserv, Inc. (FISV): Free Stock Analysis Report

Original post