We issued an updated research report on Universal Forest Products Inc. (NASDAQ:UFPI) on Sep 19. A large customer base, impressive near-term growth opportunities and synergistic benefits from acquisitions will prove advantageous for the company. However, headwinds related to international operations, rising costs and expenses as well as industry competition might restrict its growth momentum in the near term.

It currently carries a Zacks Rank #3 (Hold).

Below we discuss why investors should hold Universal Forest’s stock for now.

Growth Drivers

Diversification Benefits: We believe Universal Forest is poised to benefit from its vast customer base — including retailers, distributors, builders of single and multifamily homes, and others — in the retail building material, construction and industrial end markets. Also, international diversity has played a major role in building the company’s profitability over time. It operates through its subsidiaries in North America, Europe, Asia and Australia. The company is working hard to strengthen its foothold internationally.

Inorganic Strategies and Shareholder-Friendly Policies: Universal Forest remains keen on making meaningful acquisitions to expand its foothold in unexplored markets and enhance its product offerings. Notably, acquisition of certain assets of Quality Hardwood Sales, LLC and completion of Robbins Manufacturing Co. buyout in March 2017 are noteworthy. These two acquisitions are likely to fortify the company’s position in the hardwood products market, improve its customer base and bolster sales, going ahead. Also, the company acquired Go Boy Pallets, LLC in May. This buyout has expanded its industrial packaging business.

Share buybacks and dividend payments are the prime means of returning value to shareholders for Universal Forest. In first-half 2017, the company repurchased shares worth $9.9 million and paid dividend of $9.2 million.

Promising Near-Term and Long-Term Targets: We believe that initiatives to rebuild homes, offices and infrastructure damaged by Hurricane Harvey will spur growth for products offered by Universal Forest Products.

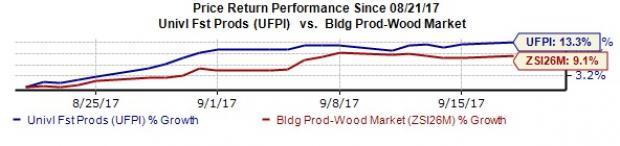

In the last month, shares of Universal Forest have yielded a return of 13.3%, outperforming roughly 9.1% gain of the industry.

Also, for 2017, the company expects an improvement in the top line, backed by the addition of new customers and products to its portfolio. Also, strengthening demand in the U.S. construction market will support the company’s top-line growth.

Over the long term, the company aims to grow sales roughly 4-6% above GDP growth. New product sales are anticipated to constitute at least 10% of total sales while earnings before interest, tax, depreciation and amortization growth will exceed unit sales growth. Also, the company anticipates offering high-quality products to its customers, having started new development and testing facilities.

Headwinds Restricting Universal Forest’s Growth Prospects

Rising Costs: Universal Forest has been suffering from adverse impact of higher costs and expenses over time. In second-quarter 2017, its bottom line was adversely impacted by 24.8% increase in costs of goods sold and 21.2% rise in operating expenses. Also, volatility in the lumber market was a concern. One of the major cost components of goods sold is cost of lumber products. We believe that unwarranted rise in cost of sales and operating expenses might dent the company’s profitability going forward.

Diversification Woes: We believe Universal Forest’s geographical expansion has exposed it to risks arising from foreign currency movements and geopolitical issues. Also, global uncertainties might hinder economic growth in developed and emerging nations. This, in turn, will adversely impact the housing markets and hence, demand for related products and services.

Stiff Competition & Others: Universal Forest is exposed to headwinds arising from stiff industry rivalry and customer-concentration risks. For instance, the company derives a major portion of its sales from The Home Depot (NYSE:HD). Any reduction in orders from this source may hurt its financial growth.

Stocks to Consider

Universal Forest currently has $1.8 billion market capitalization. We believe that the above-mentioned positives and negatives clearly justify the stock’s current Zacks Rank #3.

Some better-ranked stocks in the industry are Potlatch Corporation (NASDAQ:PCH) , Trex Company, Inc. (NYSE:TREX) and Rayonier Inc. (NYSE:RYN) . While Potlatch Corporation sports a Zacks Rank #1 (Strong Buy), both Trex Company and Rayonier carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Potlatch Corporation’s earnings estimates for 2017 and 2018 were revised upward in the last 60 days. Also, the company delivered an average positive earnings surprise of 41.16% for the last four quarters.

Trex Company’s earnings estimates for 2017 and 2018 improved in the last 60 days. Also, it pulled off an average positive earnings surprise of 7.58% for the last four quarters.

Rayonier’s earnings estimates for 2017 improved in the last 60 days. The company delivered better-than-expected earnings in three of last four quarters, with an average positive surprise of 59.94%.

4 Promising Stock Picks to Keep an Eye On

With news stories about computer hacking and identity theft becoming increasingly commonplace, the cybersecurity industry looks like a promising investment opportunity. But which stocks should you buy? Zacks just released Cybersecurity: An Investor’s Guide to Locking Down Profits to help answer this question.

This new Special Report gives you the information you need to make well-informed investment choices in this space. More importantly, it also highlights 4 cybersecurity picks with strong profit potential.

Get the new Investing Guide now>>

Trex Company, Inc. (TREX): Free Stock Analysis Report

Universal Forest Products, Inc. (UFPI): Free Stock Analysis Report

Rayonier Inc. (RYN): Free Stock Analysis Report

Potlatch Corporation (PCH): Free Stock Analysis Report

Original post

Zacks Investment Research

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Here's Why You Should Hold On To Universal Forest (UFPI) Now

Published 09/18/2017, 10:00 PM

Updated 07/09/2023, 06:31 AM

Here's Why You Should Hold On To Universal Forest (UFPI) Now

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.