Rapid technological changes have created a spur in the retail landscape. The ongoing digital transformation attracts an increasing number of consumers to technologically upgraded products, radically shifting away from traditional offerings. Moreover, increasing competition has led to greater promotional spending. Retailers are struggling to maintain mall and store traffic, as a greater number of consumers are shifting to online purchasing. Companies that are able to adapt to such changing phenomenons have been thriving well in the industry, while many are striving to cope and adapt.

One such company bearing the brunt of rapid changes in the retail world is Fossil Group, Inc (NASDAQ:FOSL) . The company has been struggling with lower sales of its traditional watches and increasing promotional activities denting its margins. This Zacks Rank #4 (Sell) company’s shares have plummeted 48.9% compared with the industry’s decline of 16.4% over the past six months.

Let’s delve into the factors impacting this manufacturer and marketer of watches, leather goods and other accessories.

Traditional Watches Failing to Drive Sales

Fossil Group has been witnessing soft sales in traditional watches since quite some time, due to increased competition in the market. Rising demand for technology in watches have dented demand for traditional watches. Also, the success of the Michael Kors brand is overshadowing other brands’ performance. Moreover, the announcement of Burberry exiting the watch business in January 2016, has hurt the company’s business. The brand will not renew its license agreement with Fossil upon its expiration at the end of 2017. The company continues to expect weakness in this category in the near term.

Increased Promotional Spending Weakens Profits

Fossil Group has also been witnessing lower margins in the retail channel due to increased promotions to drive sales in its store outlets and online platform. New brands added to the company’s smartwatch portfolio have led to greater promotional spending. Nevertheless, the company continues to invest in such promotional spending to drive sales and therefore expects the increased promotional spending trend to continue.

Other headwinds Impacting Performance

In addition to the watch category, company’s jewelry and leather businesses have been depicting persistent weakness across its geographical regions owing to weak consumer response. Moreover, the company has been witnessing economic challenges in many of its key markets such as U.K., Middle East, Japan and Australia. We note that the company’s sales have lagged the Zacks Consensus Estimate in nine out of the last 11 quarters.

Bottom Line

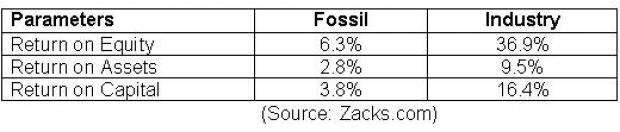

Although Fossil Group has been striving hard to revive its watch segment by adding new connected wearable’s to its smartwatch line up, the company has not been able to offset the decline experienced in traditional watches sales. Also, Fossil Group’s licensing agreements with several brands such as Michael Kors and Emporio Armani along with restructuring initiatives have offered fewer contributions to its overall growth. Moreover, some of the key financial ratios of the company are below the industry levels, as depicted in the figure below.

Owing to the greater risks embedded in the stock, Fossil Group is currently not a favorable pick for investors.

Looking for Retail Stocks? Check these 3 Picks

Investors may consider better-ranked stocks from the same sector such as Burlington Stores Inc (NYSE:BURL) , Five Below Inc (NASDAQ:FIVE) and The Children's Place Inc (NASDAQ:PLCE) , all carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Burlington Stores delivered an average positive earnings surprise of 17.7% in the trailing four quarters. It has a long-term earnings growth rate of 16.2%.

Five Below delivered an average positive earnings surprise of 8.7% in the trailing four quarters. It has a long-term earnings growth rate of 28.5%.

The Children's Place delivered an average positive earnings surprise of 16.3% in the trailing four quarters. It has a long-term earnings growth rate of 9%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Fossil Group, Inc. (FOSL): Free Stock Analysis Report

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Five Below, Inc. (FIVE): Free Stock Analysis Report

Original post

Zacks Investment Research