Analog Devices Inc. ( (NASDAQ:ADI) is currently one of the top-performing stocks in the technology sector and a rise in share price and strong fundamentals signal its bullish run. Therefore, if you haven’t taken advantage of the share price appreciation yet, it’s time you add the stock to your portfolio.

The company has performed extremely well this year and has the potential to carry on the momentum in the near term.

Why an Attractive Pick?

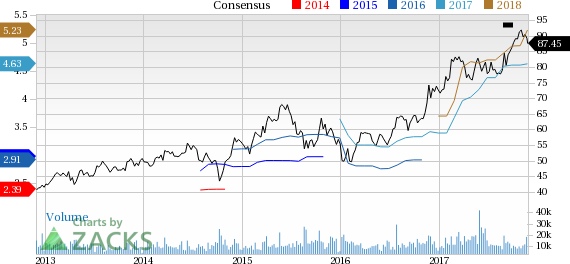

Share Price Appreciation: A glimpse of the company’s price trend shows that the stock has had an impressive run on the bourses year to date. Analog Deviceshas returned 20.4%, comparing favorably with the S&P 500’s gain of 16.7%.

Solid Rank: Analog Devices sports a Zacks Rank #1 (Strong Buy) and has a Momentum Score of A. Our research shows that stocks with a Momentum Score of A or B when combined with a Zacks Rank #1 or 2 (Buy) offer the best investment opportunities. Thus, the company appears to be a compelling investment proposition at the moment.

Northward Estimate Revisions: Twelve estimates for the current year have moved north over the past 30 days against no southward revisions, reflecting analysts’ confidence in the company. Over the same period, the Zacks Consensus Estimate for the current year has increased 5.0%. Also, for fiscal 2019, the Zacks Consensus Estimate has inched up 4.0% to $5.59.

Positive Earnings Surprise History: Analog Devices has an impressive earnings surprise history. The company outpaced the Zacks Consensus Estimate in the trailing four quarters, with an average positive earnings surprise of 16.3%.

Strong Growth Prospects: The company’s Zacks Consensus Estimate for fiscal 2018 earnings of $5.21 reflects year-over-year growth of 10.41%. Moreover, earnings are expected to register 7.22% growth in fiscal 2019. The stock has long-term expected earnings per share growth rate of 10.4%.

Growth Drivers: Analog Devices is a leading supplier of analog and DSP integrated circuits.

In the recently concluded fiscal fourth quarter, the company’s pro forma earnings of $1.45 per share beat the consensus mark by 8 cents. Earnings also increased 15.1% sequentially and 38.1% year over year. Also, revenues of $1.54 billion beat the consensus mark by $37 million and were at the high end of the guided range of $1.45-$1.55 billion.

The better-than-expected results were driven by strength across all the markets — industrial, automotive, consumer and communications.

While its investments are aimed at strengthening the product line and countering increasing competition, the policy of returning cash through dividends and share buybacks also ensures investor loyalty.

Going forward, Analog Devices will see significant opportunities from super trends like autonomous driving and the electrification of the powertrain.

We believe that Analog Devices is in a great position to grow sustainably and profitably based on its strong pipeline of enabling technologies, supported by expanding opportunities on the semiconductor front and strength in all its end markets.

Other Stocks to Consider

Some other top-ranked stocks in the broader technology sector are NVIDIA Corporation (NASDAQ:NVDA) , SMART Global Holdings, Inc. (NASDAQ:SGH) and Lam Research Corporation (NASDAQ:LRCX) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings per share growth rate for NVIDIA Corporation, SMART Global and Lam Research is projected to be 11.2%, 15.0% and 14.9%, respectively.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Analog Devices, Inc. (ADI): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

SMART Global Holdings, Inc. (SGH): Free Stock Analysis Report

Original post

Zacks Investment Research