We believe that Graco Inc. (NYSE:GGG) is a solid choice for investors seeking exposure in the industrial machinery space. Development of new products, expanding international operations, entrance into new markets and synergistic benefits from acquired assets will be advantageous for the company.

The stock has been upgraded to a Zacks Rank #1 (Strong Buy) on Feb 9. It currently has a market capitalization of approximately $7 billion.

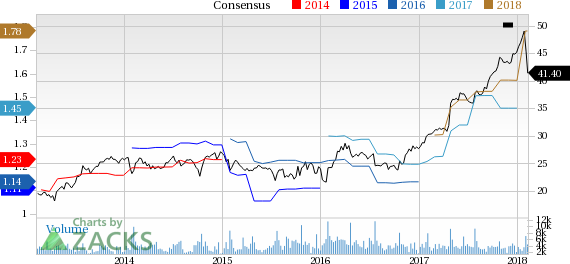

Graco reported better-than-expected earnings in three of the last four quarters, pulling off an average positive earnings surprise of 18.54%. Notably, the company’s shares have rallied 36.5% last year, outperforming 21.6% gain of the industry.

Why the Upgrade?

Graco’s bottom-line results for fourth-quarter 2017 lagged the Zacks Consensus Estimate by 5.56% but increased 3% on a year-over-year basis. Net sales were up 7% on the back of double-digit growth in the Process and Contractor segments and single-digit growth in the Industrial segment.

For 2018, Graco anticipates healthy demand environment for its products to drive top-line results. It believes that organic revenues, on a constant currency basis, will grow in mid-single digits in the year. Also, results in all the three segments will be solid while that in the Americas, Asia Pacific and EMEA regions will increase in mid-single digits.

Graco is focused on developing new products, expanding its geographical reach and exploring new markets. Products worth mentioning in the Process segment are Power Pro ESP electric sampling pumps, stainless steel air-operated double diaphragm (AODD) pumps, AODD chemical pumps and others. Some important products in the Industrial segment are portable abrasive blasting equipment, spray automation and kitchen paint equipment while in the Contractor segment handheld airless sprayers and line striper (battery powered) are worth mentioning. Also, the company is spending huge amounts for improving efficiency of plants, capacity and initiatives to lower costs. It aims at increasing earnings per share by more than 12% in the long run.

In addition, Graco believes in expanding its businesses through acquisition of meaningful businesses. Notably, the company acquired Florida-based grinding equipment and surface preparation manufacturer — Smith Manufacturing — in December 2017. The acquired assets helped in strengthening the company’s maintenance equipment offering for pavements.

In the last 30 days, earnings estimates for Graco have been revised upward by nine brokerage firms for 2018 and by three for 2019. The Zacks Consensus Estimate stands at $1.78 for 2018 and $1.95 for 2019, reflecting increase of 13.4% and 16.1%, respectively, from their tallies 30 days ago.

Graco Inc. Price and Consensus

Roper Technologies, Inc. (ROP): Free Stock Analysis Report

Dover Corporation (DOV): Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT): Free Stock Analysis Report

Graco Inc. (GGG): Free Stock Analysis Report

Original post

Zacks Investment Research