- Strong job growth suggests the Fed may delay interest rate cuts.

- However, despite robust job numbers, a decrease in job openings could show lower inflation ahead.

- The bond market doesn't yet reflect expectations for imminent rate cuts, but a modest cut might occur by December this year.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

Investors hoping for imminent interest rate cuts from the Fed may be disappointed. Despite some predictions for swift cuts, recent economic data suggests a different story.

Firstly, strong job growth continues. Last week's jobs report revealed a much higher-than-anticipated number of new jobs added (272,000 vs. expected 182,000).

This robust jobs market weakens the argument for the Fed needing to cut rates soon, potentially pushing back any potential cuts by at least 6 months.

However, a silver lining still exists. While the overall job picture remains positive, the number of job openings has decreased. This historically correlates with lower inflation, which could influence the Fed's future decisions.

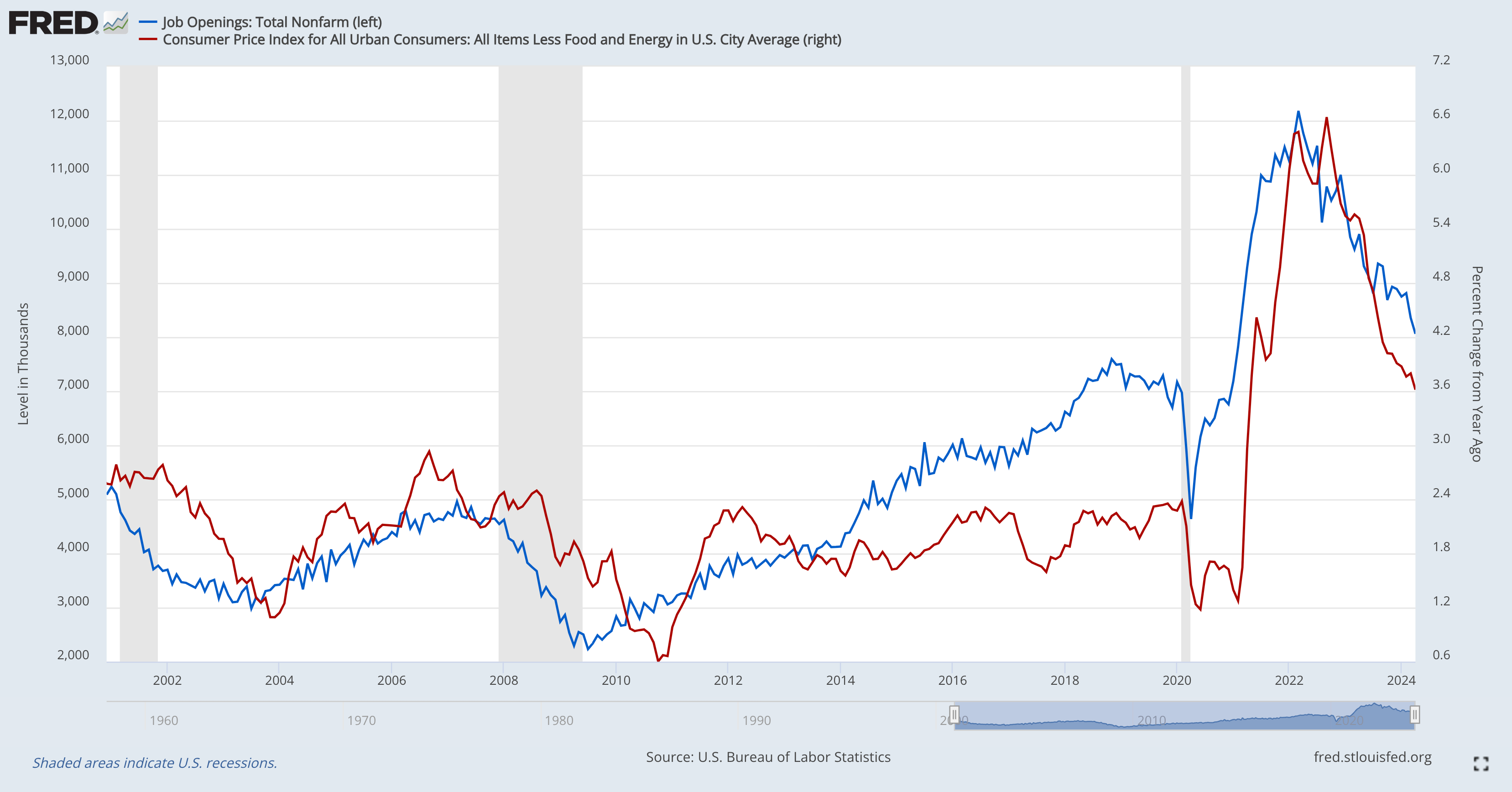

Look at the chart showing the correlation between job openings and year-on-year CPI below:

The significant decline in job openings, evident from the graph, suggests a potential deceleration of inflation through the labor market. This provides further evidence for the Fed that inflation may be moving towards their desired 2% target finally.

While the strong job growth might argue against immediate rate cuts, other factors paint a more nuanced picture.

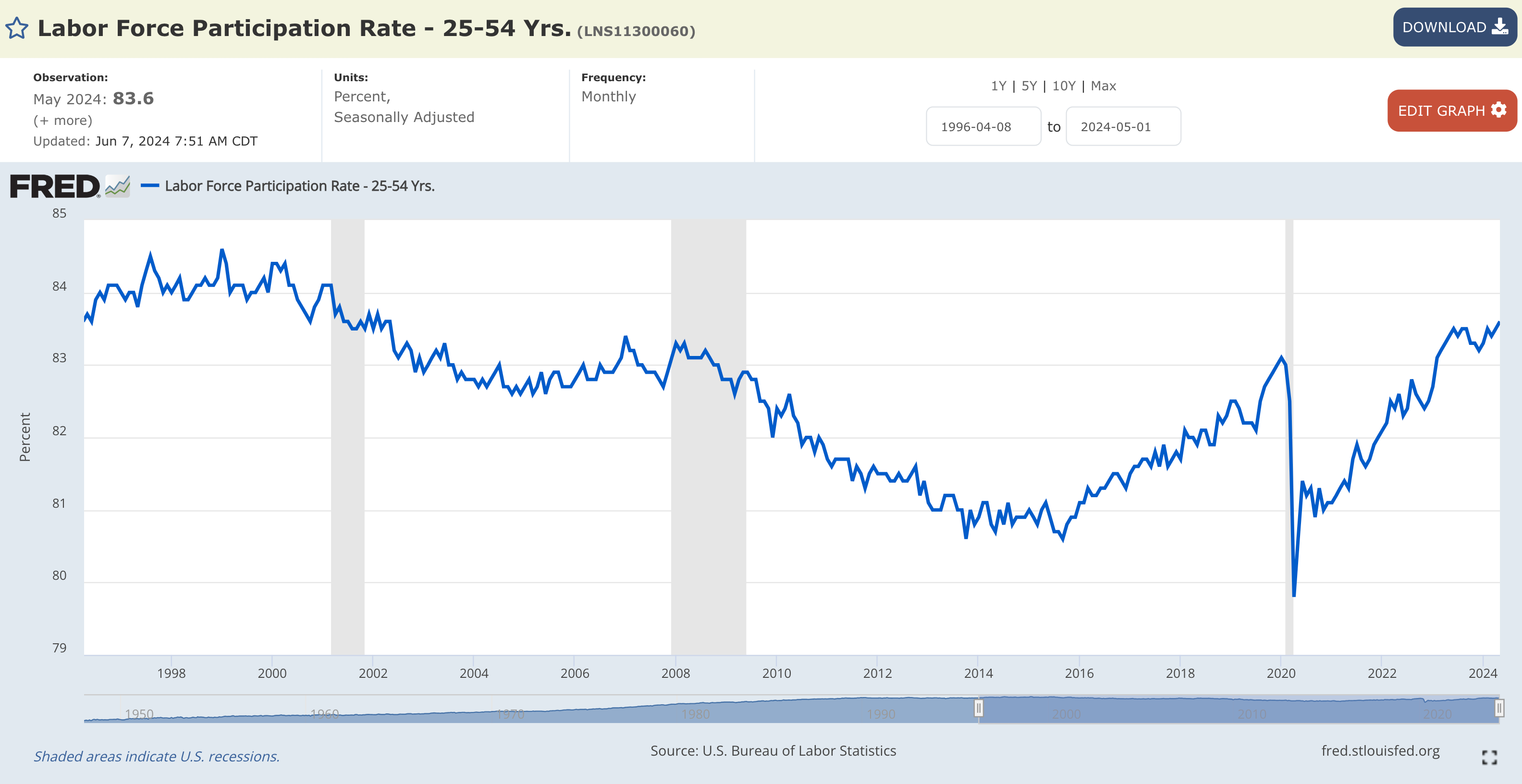

The unemployment rate has risen to 4.0% (above the anticipated 3.9%), and the labor force participation rate, particularly for people aged 25-54, is reaching new highs.

The graph reveals a critical data point: labor force participation has surged by over 83%, the highest since May 2002 and the entire post-Covid era. This strong participation rate, especially among those aged 25-54, suggests a robust labor market.

So, should we worry about the slight uptick in the unemployment rate (4.0% vs. expected 3.9%) or the potential activation of the Sahm rule? Not necessarily. With a healthy labor participation rate, these factors might hold less weight.

The chart below offers valuable insights about when there might be a higher probability of a potential Fed rate cut:

The bond market is offering clues about potential Fed rate cuts, but the timing remains uncertain.

Traditionally, when the bond market anticipates a rate cut within the next 6 months, the United States 6-Month yield falls at least 0.25% below the Fed funds rate. Currently, the 6-month yield doesn't reflect such an expectation.

This suggests that a rate cut isn't imminent, but December's FOMC meeting could be a turning point. Based on this data, the most likely scenario is a single, modest 0.25% cut in December 2024. Overall, the bond market hints at a potential shift, but for now, expect limited cuts this year.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor. The author owns shares in the company mentioned.