Urban Outfitters (NASDAQ:URBN), Inc. URBN looks promising on the back of its robust business strategies and continued digital strength. The company has been strengthening its direct-to-consumer business, enhancing productivity in the existing channels, expanding product assortments and optimizing inventory level. Its strategic growth initiative FP Movement and store-growth endeavors are also yielding results.

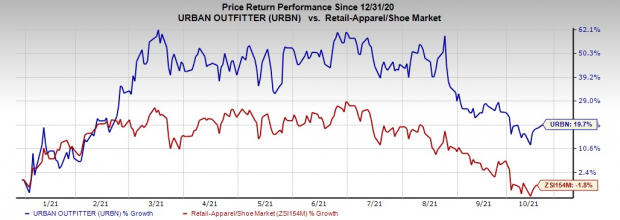

Benefiting from these drivers, shares of this Philadelphia, PA-based player have appreciated 19.7% against its industry’s 1.8% dip in the year-to-date period.

More on Strategies

Urban Outfitters is a multi-brand and multi-channel retailer with a flexible merchandising strategy. The company is also making strategic agreements to enhance its assortments. It teamed up with Hims & Hers Health, Inc. HIMS, which operates as a multi-specialty telehealth platform and enables it to provide personalized wellness offerings. Through this collaboration, the company looks to bolster skin care, hair and more personal care items.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Speaking about the FP Movement, management believes that this initiative will lure a wider base of customers to the Free People brand. Having a differentiated position in the fitness and wellness space, this program offers a major growth opportunity and is driving Free People’s brand revenues. During second-quarter fiscal 2022, the movement’s customer base grew more than 80% year over year and above 300% from the second-quarter fiscal 2020 reading. The Free People brand’s net sales jumped 40.3% year over year to $249.7 million.

In addition, the company’s subscription rental service for women’s clothes known as Nuuly seems encouraging. During the fiscal second quarter, Nuuly’s sales of $9.9 million increased 110.6% from the year-ago period’s level. The brand also announced the launch of its sister brand Nuuly Thrift. This is a resale marketplace where customers can buy or sell women's, men's or kids apparel and accessories through the iOS device.

Wrapping Up

The company is witnessing sturdy consumer demand across the majority of its product categories. This coupled with the solid execution of growth strategies is constantly boosting its retail segment comparable sales. On its second-quarter earnings call, management had anticipated a steady sales improvement from the fiscal 2020 level. It believes that the retail segment comp sales will grow in mid teens.

The above upsides will drive the overall company’s sales in low double digits. The gross margins for the same quarter are likely to improve 100 basis points from the fiscal 2020 figure. Lower markdown rates on solid consumer demand, robust product performance and a disciplined inventory control aid the gross margin.

Urban Outfitters’ earnings status also looks favorable. A glimpse of the company’s trailing four-quarter performance reflects that it delivered an earnings surprise of 93.2%, on average. These factors together with an expected long-term earnings growth rate of 18% and a VGM Score of B clearly justify the currently Zacks Rank #1 (Strong Buy) stock’s solid run on the bourses. You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Key Picks in Retail Space

Abercrombie ANF has a long-term earnings growth rate of 18% and a Zacks Rank of 1, currently.

Tapestry (NYSE:TPR) TPR presently has a Zacks Rank #2 (Buy) and a long-term earnings growth rate of 12.3%.

Zacks' Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create "the world's first trillionaires." Zacks' urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

Urban Outfitters, Inc. (URBN): Free Stock Analysis Report

Tapestry, Inc. (TPR): Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research