- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why Timing the Market Based on Recession Predictions Will Never Pay Off

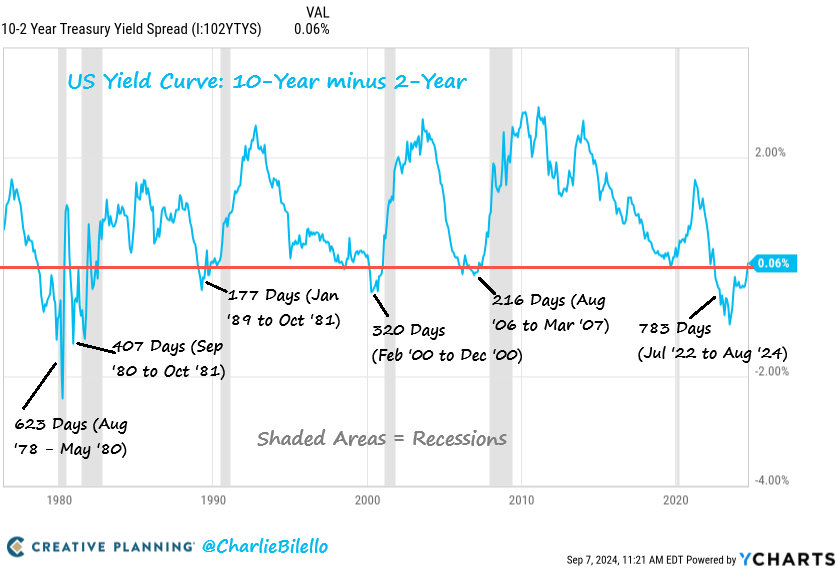

- The yield curve's longest inversion in history ended recently.

- Despite many predictions, a recession did not follow the inversion.

- This captures a valuable lesson for investors.

- For less than $9 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

Since early July 2022, the U.S. yield curve began what was the longest inversion on record. Back then, the rule of thumb was clear: an inverted yield curve meant a recession was likely within 12-18 months.

This prompted many headlines to claim that a recession was right around the corner.

Fast forward to today, and the story is quite different. The yield curve has normalized, and stock indexes hit new highs earlier this year, showing no signs of a looming recession.

The once-unshakable link between curve inversion and economic downturns has now given way to new theories, with some experts suggesting that a recession might only come after the curve returns to normal.

Yield Curve Inversion Isn't a Market Timing Tool

Can we pinpoint when a recession will hit?

Is it wise to base our entire financial strategy on these predictions?

To me, investing well means aiming to capture market returns aligned with our asset allocation and life goals while limiting losses during tough times.

This approach is quite different from the usual market-timer who constantly tries to anticipate shifts and ends up being outpaced by the market.

Chasing the market based on news or trends rarely pays off. For a recession to happen, we need more than just an inverted curve—like a credit crisis, which the Fed skillfully avoided in March 2023. And even then, it might not be enough.

The real question is whether it’s even possible to time the market perfectly - going all-in during the good times and then getting out right before a recession hits.

As I often say, this kind of precision is nearly impossible. Active management frequently falls short of market returns over the long run.

Bottom Line

In today’s information-packed world, the real challenge is sticking to the basics.

Mastering and following key investment principles is essential. While we might wish for control over every outcome, uncertainty is part of the game.

So, as we navigate the unpredictable path ahead, focus on staying informed, remaining disciplined, and making decisions based on well-established investment principles. After all, the only certainty in investing is uncertainty.

***

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe and unlock access to several market-beating features, including:

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- AI ProPicks: AI-selected stock winners with proven track record.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Related Articles

1. S&P 500 Likely to Hold at 200-Day MA (1) Will S&P 500 indexes find support at their 200-day moving averages? We think so. Sentiment is quite bearish and the next batch...

According to the most recent Polymarket odds, 39% of betters believe recession is on the table during 2025, which is an uptick of 18% over the last week. However, many hold the...

Lately, volatility has been off the charts. We’re seeing triple-digit swings in stocks, and the market is getting a real taste of the wild ride that comes with a president who...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.