The bearish sentiment in gold and miners is running rampant.

Let‘s get right into the charts (all courtesy of www.stockcharts.com).

Dollar and Treasuries

The world reserve currency is on the doorstep of another powerful decline, and not initiating a bull market run. The caption says it all – this is the time for anti-dollar plays to thrive in our era of ample credit, unprecedented money creation that‘s triggering a Roaring '20s style of speculative environment, not a Kondratieff winter with a deflationary shock as you might hear some argue.

Look around, check food, energy or housing prices, and you‘ll see how connected to reality are the calls of those writing that inflation isn‘t a problem (monetary inflation lifting many asset classes). Check that against Fed President Daly stating that the inflationary pressures now point downwards. Make your own conclusions about the new money wave hitting the real economy.

Gold, Silver And Miners

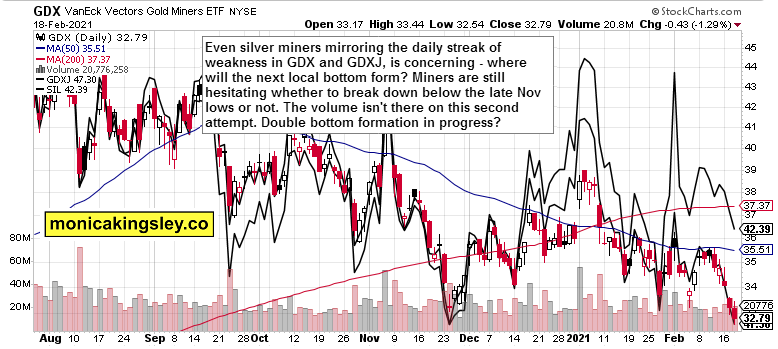

Just as gold is challenging (resting on) the late November lows, so is the miners-to-gold ratio. Seeing the latest two-day losing streak, it‘s not happening, and the late January breakdown which might have turned out to be false, may not materialize in the short run. Let‘s get a proper perspective by displaying this chart in weekly format.

Is this the dreadful breakdown threatening doom and gloom in the precious metals? Zooming out definitely provides a very different take – a more objective one than letting fear run high.

We‘re still consolidating, and not making lower lows – regardless of this week‘s increased gold sensitivity to rising yields as seen in the plunging iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) values. Inflation is making its way through the system as surely as Titanic‘s watertight compartments were filled with water. I‘ve discussed on Wednesday at length inflation, past Fed action and asset appreciation, and yesterday explained why the central bank will be tied into a war on two fronts as it gets to seek control over the yield curve at the long end too.

Another short-term worrying chart is silver miners. Even the juniors lost their short-term edge over the seniors, making me think that a potential washout event before a more universal sectoral rebound, might be at hand.

Pretty worrying for those who are all in gold – unless they took me up on last Friday‘s repeated idea that silver is going to outperform gold in the next precious metals upleg, which I formulated that day into a spread (arbitrage) trade long silver, short gold. Check out the following chart how that would have worked out for you.

The dynamics favoring silver are unquestionable – starting from varied and growing industrial applications, strengthening manufacturing and economy recovery, poor outlook in silver above ground stockpile and recycling, to the white metal being also a monetary metal. Silver is bound to score better gains than gold.

Summary

Bearish dollar, $1.9T or similar stimulus not priced in, and yet gold isn‘t taking a dive. Amid very positive fundamentals, it‘s the technicals that are challenging gold in the short term. We‘re in truly unchartered territory given the economic policies pursued. I stand by my call to watch the TLT chart very closely. It looks like an orderly TLT decline is what gold needs, not a selling stampede. Despite the current dislocation with gold being the weakest of the weak (I am looking at commodities for cues), I still stand by the call that a new precious metals upleg is only a question of time.