Investing.com’s stocks of the week

July 31 will prove to be one of those days that sets the tone for the market over the next 3 to 6 months. Seriously.

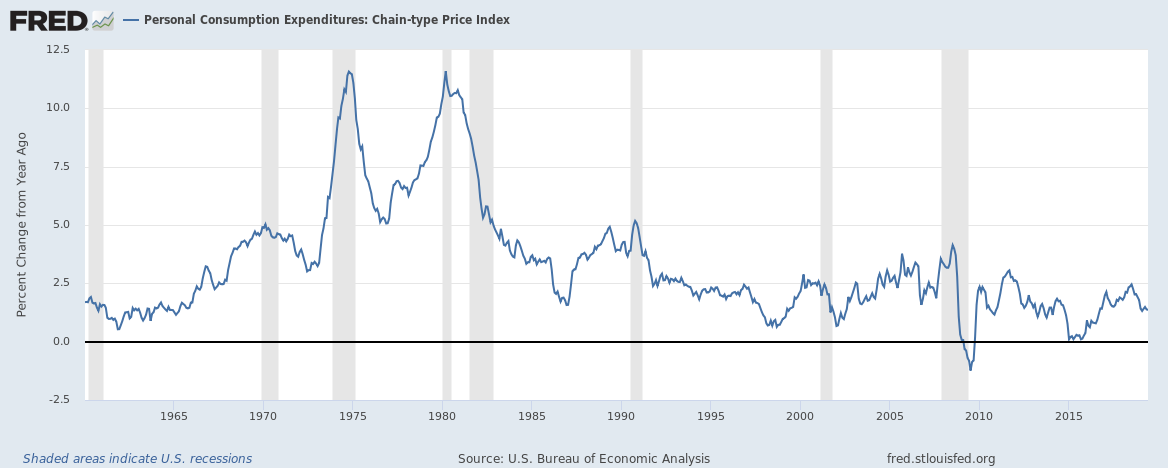

The market is expecting three rate cuts by January 2020. The Fed will need to communicate this to the market somehow, correctly. The good news is that the Fed got some more ammunition today to call for lower rates with PCE reading of +1.4 versus last year. The current path of PCE doesn’t look very encouraging either.

Core PCE wasn’t any better at 1.6%. Based on the Fed could cut much more than 25 basis points, and to be honest, I’m not sure it would be enough to get the prices in the US rising.

Will It Be Enough?

The U.S dollar has been strengthening since June 24, rising from 96 to 98. Meanwhile, the Euro has plunged from 1.14 to 1.12, and the Pound has dropped from 1.26 to 1.21. The yen has been unchanged.

It would suggest to me that whatever action the Fed takes tomorrow it is not going to be enough, at least the market doesn’t think so. The dollar should be falling in the face of lower rates, not rising.

Spreads

The German 10-year yield fell to near its lowest level ever, at negative 41 basis points.

Meanwhile, the falling yields in Germany are causing the spread for the US 10-year and German 10-year to start rising again. It tells me at least that market is expecting the ECB to be far more aggressive in its monetary policy than the Fed.

Borrowing Dollars

Meanwhile, the cost to borrow dollar overseas is rising, with eurodollar rates up. Somebody wants to own more dollars and less local currency. It would indicate to that foreign investor believe the dollar will continue to strengthen and their local currency to weaken versus the dollar.

Good luck to the Fed.

S&P 500 (SPY)

Stocks fell on July 30 by roughly 25 basis points to around 3014.

Salesforce (CRM)

The chart for Salesforce.com Inc (NYSE:CRM) doesn’t look all that strong. I also saw some bearish options bets on the stock. I think $144.50 is possible based on it.

NXPI

NXP (NASDAQ:NXPI) Semi put together a good day rising to resistance at $106. The stock fell sharply to start the day, but once the market realized the recently were pretty good, the stock reversed higher. A break out sends the stock to $115.50.

AMD (AMD)

Advanced Micro Devices Inc (NASDAQ:AMD) reported results after the close that where inline on both the top and bottom line. Revenue guidance appears to be a bit light, but it doesn’t seem like a major shortfall on the surface. The company guided 3Q revenues to $1.8 billion at the mid-point versus expectations of $1.94 billion. Resistance will remain at $34.50, meanwhile, support is $32.30 then $31.40.

Apple

Apple Inc (NASDAQ:AAPL)’s stock is rising after hours after topping analysts earnings and revenue forecasts. Also, the revenue guidance for the fourth quarter came in higher than expected at $61 to $64 billion. $217.50 will continue to be resistance for AAPL.

Wearable had a big quarter rising by around 48% to $5.5 billion from $3.7 billion last year.