Union Pacific Corporation (NYSE:UNP) has been looking to drive the bottom-line growth by curbing costs. Additionally, improvement in operating ratio (operating expenses as a percentage of revenues) in the second quarter is a reason to cheer for. Operating ratio in the quarter came in at 61.8%, reflecting an expansion of 340 basis points on a year-over-year basis. The company is on track to achieve its guidance of around 60% by 2019. Operating ratio of 55% is targeted beyond the same year.

Also this year, the company announced a $3.1 billion capital plan to promote safety and enhance productivity. Union Pacific’s crossing accident rate improved to 2.27 in the first half of 2017 compared with 2.4 recorded in the first half of 2016.

The company’s efforts to reward investors through share buybacks and dividend payouts also deserve kudos. In November 2016, the company hiked quarterly dividend to 60.5 cents per share ($2.42 per share annualized), representing an increase of 10% over the previous payout. The company returned around $5 billion to stockholders in 2016 via these investor-friendly measures. Of that staggering amount, approximately $3.1 billion were returned through share buybacks. During the first half of 2017, the company returned around $2.6 billion to the stockholders through dividends/buybacks.

Improvement in the coal related scenario also spreads around a positive vibe. Coal revenues (freight) rallied 25% year over year to $619 million in the second quarter. Business volumes climbed 17% and average revenue per car improved 7% year over year.

The industrial products unit is expected to perform well in the third quarter. Union Pacific expects overall volumes for full-year 2017 to rise in low single digits from last-year levels.

In a bid to promote efficient utilization of resources, Union Pacific announced that it intends to trim workforce by up to 750 employees. The process is expected to wind up by Sep 30 and anticipated to generate productivity savings (annual) to the tune of approximately $110 million.

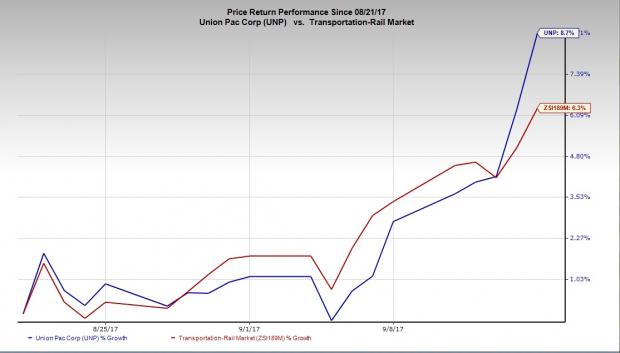

Shares of Union Pacific have outperformed the industry it belongs to in a month. The stock has gained 8.7% while the industry grew 6.3%.

In view of these positives, we believe investors should hold on to the Union Pacific stock for now.

Zacks Rank & Key Picks

Union Pacific currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the Transportation sector areAir France-KLM SA (OTC:AFLYY) , Deutsche Lufthansa (DE:LHAG) AG (OTC:DLAKY) and Canadian National Railway Company (NYSE:CNI) . While Air France-KLM and Deutsche Lufthansa sport a Zacks Rank #1 (Strong Buy), Canadian National Railway holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

While shares of Air France-KLM and Deutsche Lufthansa have soared more than 100% in a year, Canadian National Railway shares have surged 29.7% over the same time period.

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020.

The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.

Deutsche Lufthansa AG (DLAKY): Free Stock Analysis Report

Air France-KLM SA (AFLYY): Free Stock Analysis Report

Union Pacific Corporation (UNP): Free Stock Analysis Report

Canadian National Railway Company (CNI): Free Stock Analysis Report

Original post

Zacks Investment Research