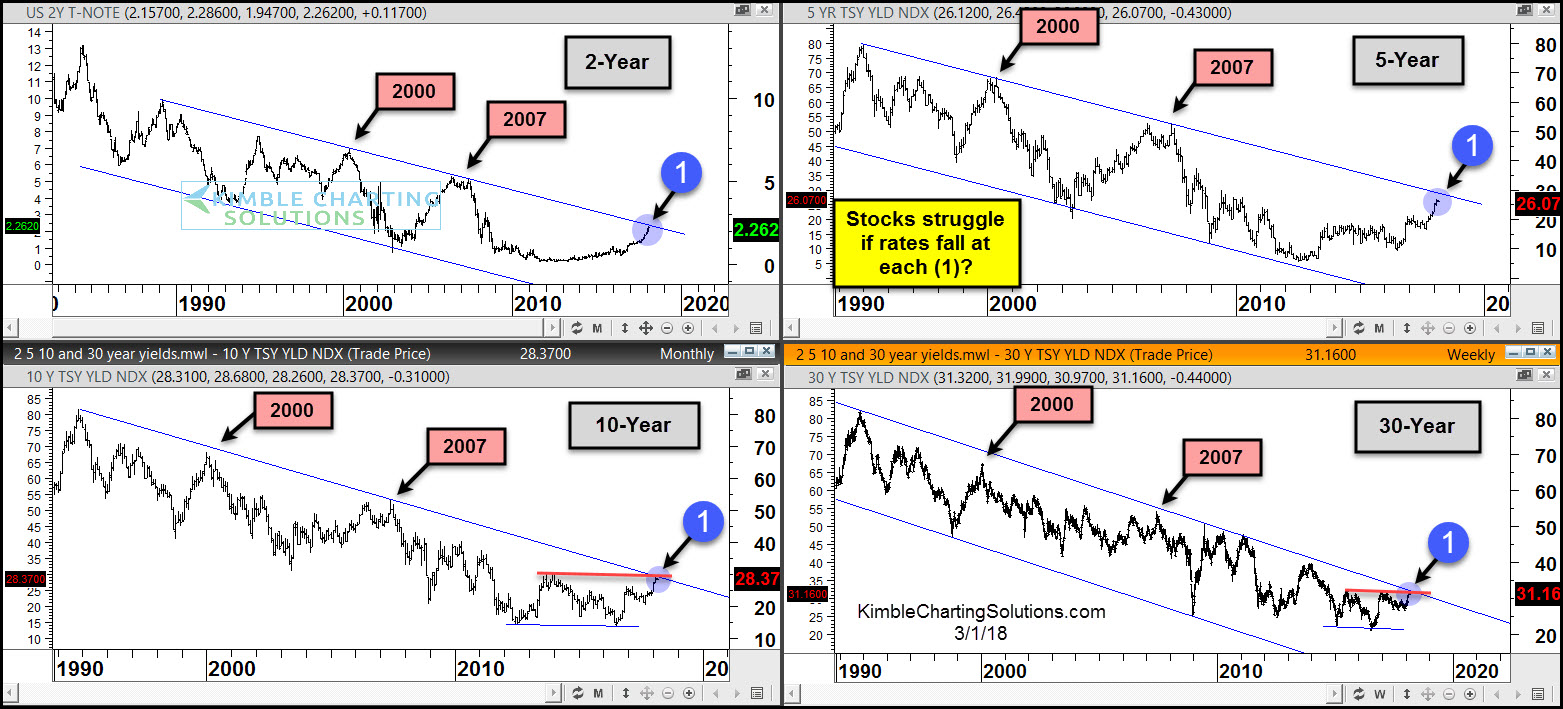

Below looks at the 2-, 5-, 10- and 30-year Treasury yields over the past 30 years. Yields remain inside of their respective 25 year falling channels. Rallies over the past couple of years find each testing the top of these falling channels.

When the tops of each falling channel were last touched in 2000 and 2007, yields declined and so did stocks.

Many have been concerned about rising rates. Should stock bulls now be concerned about rates falling at each (1)?

If they use these channels as guides, they should be.