It's the day of the Brexit vote and all seems well. Markets are calm, we’re seeing good buying in crude and Asian equities. The JPY is lower versus all G10 FX as traders look to pick up carry. Talk of further tax cuts and stimulus in China is clearly helping sentiment.

It’s interesting that the GBP is the best performer on the session in the G10 FX universe, with GBPJPY currently testing ¥140, which seem an important pivot on the daily.

There is little doubt that the market wants to buy GBP, and it’s interesting that we can see the analysts Q419 consensus forecast for GBPUSD sitting up at 1.3600, with Nomura calling for 1.5900, while Morgan Stanley) have 1.5000 pencilled in—this, of course, is partly premised on a weak USD forecast.

Cynically, forecasts are not usually worth the paper they are written on, but analysts tend to give them as they are used in other financial models, such as to understand an equity net present value. Forecasts can offer interesting insights into a thought process, and that can throw up some interesting considerations. However, for traders they often just create a bias, and that can be disastrous, as falling ‘in love’ with a trade and refusing to understand when you are wrong is what hurts so many traders – it falls into the notion that the best traders are the best losers, as they can accept that they’re wrong and cut losing trades early.

The point though, is that GBP could arguably be the best performing currency in 2019, but there is this storm cloud hanging over the UK economy. We can see from the options skew that GBP call vols have ramped up relative to put vols (chart in the video), showing a greater demand for GBP upside structures.

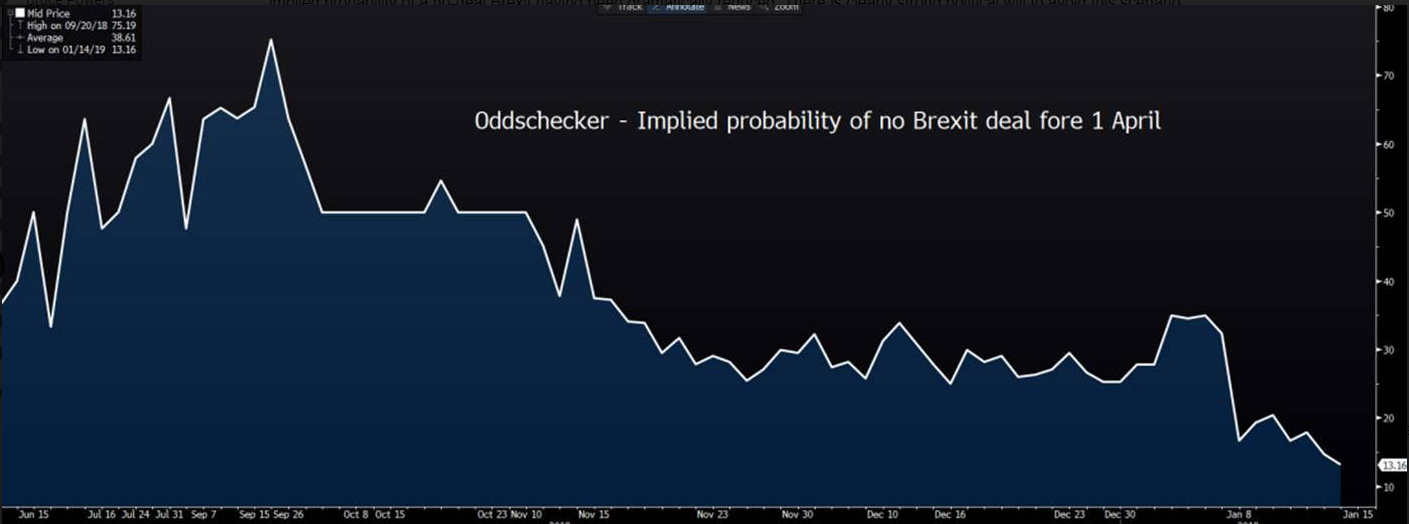

GBPUSD, itself, has had a progressive melt-up from 1.2500 from 12 December, and has reclaimed the 1.29-handle, with traders reducing GBP downside hedges, with the implied probability of a no-deal Brexit having been dramatically reduced. There is clearly strong political will to avoid this scenario.

I describe the process of today's Meaningful Vote in the video and the implied moves on the day. My own preference is to hold no GBP exposure over the vote, using weakness (should it come) as a buying opportunity.

I have no more clarity than others, but my own view is the vote fails, with some 220-229 MPs will vote yea, and while that is shy of the 320 needed to form a simple majority, Theresa May would consider this a small win by the fact it's not a disaster. It seems inevitable Jeremy Corbyn will call a vote of no confidence in the Tory government, although whether this comes today or Monday is one consideration.

The other is that it will likely fail anyhow as the DUP party will not vote for this, and it seems bizarre to think any Tory party members will either. After three sitting days (i.e. Monday) Theresa May will return to debate a ‘Plan B’, which will inevitably lead to an extension of Article 50.

I personally sit in the camp that then we either see a general election called by May herself, or we see a deal that resembles a Norway model be voted through. In my probability matrix I see the GBP is higher. While I personally dislike having exposures over volatility events, especially political ones that are outside of my control, I like the idea of GBPNZD longs in small size, adding on a close through 1.9000, while closing through 1.8750.