The origins of the GFC are more or less understood. The American consumer, tipsy at first, increasingly drunk and finally blind drunk, began throwing up. The drink: debt.

Enormous amounts of debt, secured against ever-rising home values, used to finance increased consumption (with historically-low interest rates engineered by central banks, terrified of the last boom ending) caused a painful reversion to the mean.

Financial alchemists converted the tidal wave of mortgages into exotic securities throwing off yield, and this is where the perversity of a centralized system showed it’s true colors.

Central bank overlords had (and continue to) destroyed yield and so, unsurprisingly, it is yield which every investor desperately chases. Selling yield in a yield-starved world is like selling crack to junkies. Global investors slurped back high-yield debt instruments like a 21-year-old college student at a beer pong party.

The assets allowed investment banks to finance a massive increase in short-term commercial lending. The financially illiterate, led by Greenspan at the time, applauded the sophistication of the financial system… oblivious, stupid, or simply turning a blind eye to what was shadow banking at its finest.

The Asian crisis highlighted the inter-connectivity of the global financial system, but the core of the system remained relatively unscathed - the core being the US and Europe. Lehman’s failure set off the worst global economic downturn since the great depression, and brought a new dynamic to the understanding of just how interconnected the global financial system had become.

This inter-connectivity became the very vector greasing the wheels of contagion, as losses cascaded through the tangled web of derivatives, counterparties and counterparties to counterparties. The world woke up to the fact that the underwriting of the assets underpinning the US housing market were now sitting on balance sheets halfway across the world at values unknown. Contagion no longer stopped at borders.

Governments stepped in to secure and guarantee banks, absorbing massive losses, forcing nationalization and pouring the foundations for the next crisis.

Today the implications and knock-on effects of this crisis are still being felt, and yet the lessons and the understanding of how and why this took place seem to be understood by only a few. Pareto’s law stands tall and strong.

Certainly 80% of the market participants discount the idea that a crisis is coming and coming fast. This while, just as before the GFC, the signs are there if one cares to look.

Which brings us squarely into 2016.

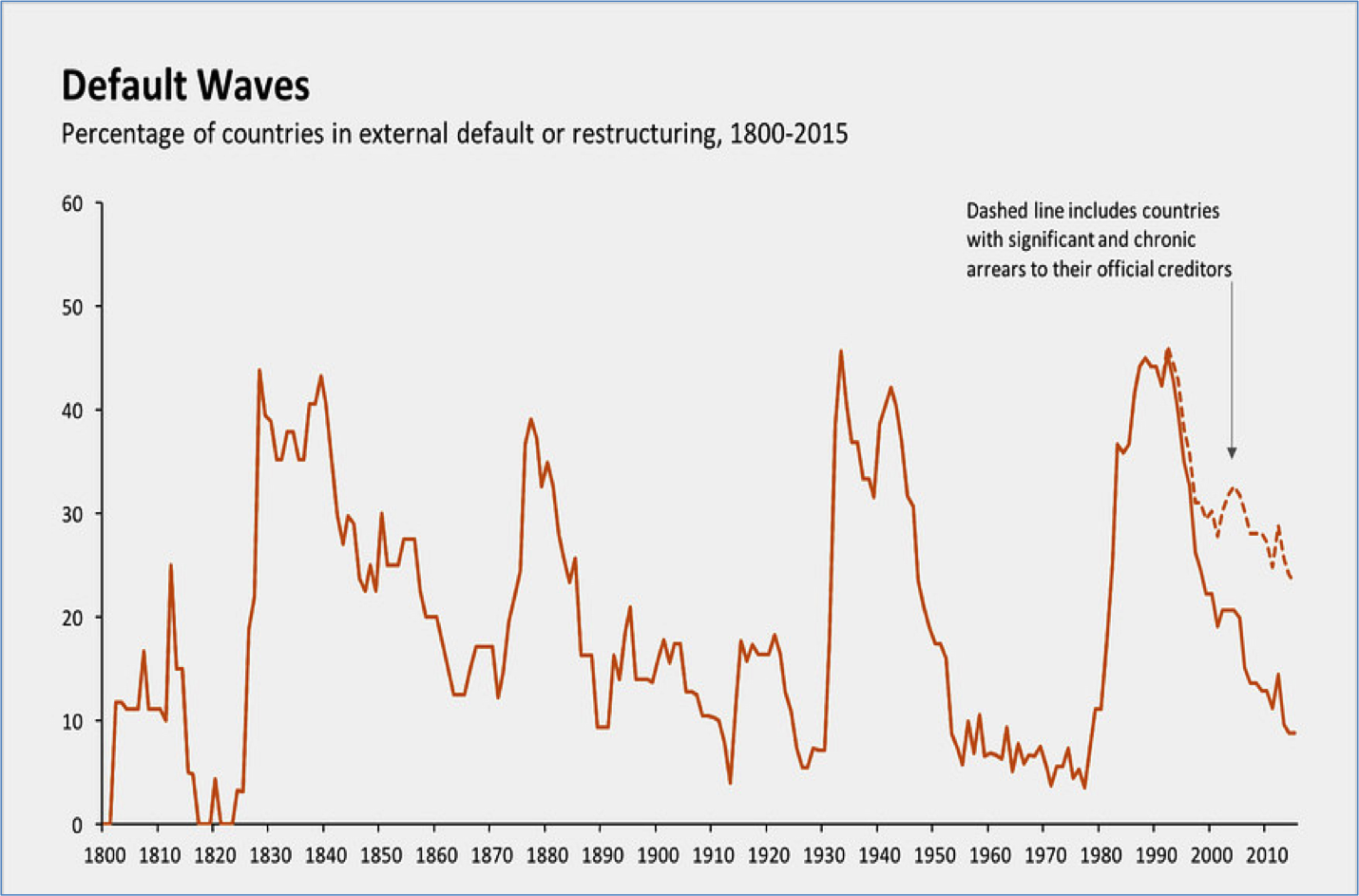

I shared this graph at a private Seraph Member briefing in Singapore last week. We’ll discuss this again, plus much more, at our upcoming 3-day Summit in Del Mar, California. You’ll want to book your seat now to avoid disappointment, as we strictly limit attendance to ensure higher value.

What are the implications?

Today we have the foundations poured for the next crisis, and that crisis will be emanating from the public sector, as this is where all of the asymmetry has built up. In that sector I incidentally include European banks, who today are as connected to the government coffers as any civil servant is.

Perhaps as important as the financial ramifications of a European banking crisis (yes, it’s coming) are the political ramifications.

One reason that the “buffoon” that is Donald Trump exists in the political arena today is due to the discontent boiling up in angry taxpayers, who now see economic integration, globalization, and international trade as a bad thing.

Nationalist movements in the US are simply mirroring those in Europe. If it weren’t Trump it would be another like him. Grass grows from sunlight, water, and fertile soil, and the times dictate the leaders… leaders do not dictate the times.

Ask yourself this question: do you think it even possible that Trump would have made it past the front gate 10 years ago? Then ask yourself what’s changed.

In Europe nationalism is on the rise… and why wouldn’t it be? Europe has ceded sovereignty to Brussels, and Brussels has allowed Europe to completely lose control of its borders. Security is the first and foremost social contract a nation state has with its citizenry. That social contract lies in tatters and the ramifications will continue to be felt for years to come.

A heartfelt sorry to my European friends, but Europe as we know it today, is toast.