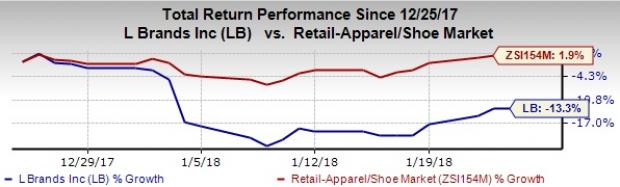

L Brands, Inc. (NYSE:LB) has been witnessing a downtrend in the Zacks Consensus Estimate after the company updated fourth-quarter fiscal 2017 guidance. Shares of this specialty retailer of women’s intimate and other apparel, beauty and personal care products, home fragrance products and accessories has declined 13.3% in a month, underperforming the industry’s growth of 1.9%.

Management projects earnings in the band of $3.05-$3.20 per share for fiscal 2017, which is well below fiscal 2016 and 2015 earnings of $3.74 and $3.99, respectively. Moreover, the company now expects earnings per share for the fourth quarter to be nearly $2, in comparison with previous guided range of $1.95-$2.10. Analysts polled by Zacks are now less constructive on the stock. This is evident from the movement witnessed in the Zacks Consensus Estimate that declined 0.5% and 0.3% to $2.02 and $3.12, respectively, in the past 30 days.

Further, declining bottom-line and shrinking gross margin remain major concerns. Management anticipates gross margin to deteriorate year over year during the fourth quarter as well as fiscal 2017.

Turnaround Strategy Bode Well

However, the Zacks Rank #3 (Hold) company continues to revamp business by improving store experience, localizing assortments and enhancing direct business. We believe these measures facilitate it to generate incremental sales and increase store transactions through higher conversion rate. The company is repositioning its La Senza brand by focusing on the younger generation and providing fashionable assortments at a reasonable price.

Moreover, to drive growth, the company remains focused on adding the entire PINK and lingerie assortments at its Victoria’s Secret stores and seeks to expand in the adjacent categories. In an effort to streamline Victoria’s Secret business, the company made some strategic changes in 2016. L Brands stated that the strategic efforts will continue in 2017, which is likely to put pressure on the results. However, it is confident of achieving growth in the long run and anticipates annual operating income to increase by 10%.

Further, the company’s foray into international markets is likely to provide long-term growth opportunities and generate increased sales volumes.

Hot Stocks in the Retail Space Worth Checking Out

Investors interested in the retail space may consider better-ranked stocks such as American Eagle Outfitters, Inc. (NYSE:AEO) , Boot Barn Holdings, Inc. (NYSE:BOOT) and The Children's Place, Inc. (NASDAQ:PLCE) . These three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

American Eagle Outfitters has a long-term earnings growth rate of 7.5%.

Boot Barn Holdings has an impressive long-term earnings growth rate of 15.7%.

Children's Place has reported better-than-expected earnings surprise in three of the trailing four quarters, with an average earnings beat of 14%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

American Eagle Outfitters, Inc. (AEO): Free Stock Analysis Report

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

L Brands, Inc. (LB): Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT): Free Stock Analysis Report

Original post

Zacks Investment Research