Look, up in the sky. Is it a bird? Is it a plane? No its Super Dollar! Able to leap Emerging Market currencies in a single bound, more powerful than the Chinese Yuan locomotive and faster than a speedingEuro. Able to change the course of mighty Yen rivers, bend Aussie Dollars in its bare hands. Yes Super Dollar!

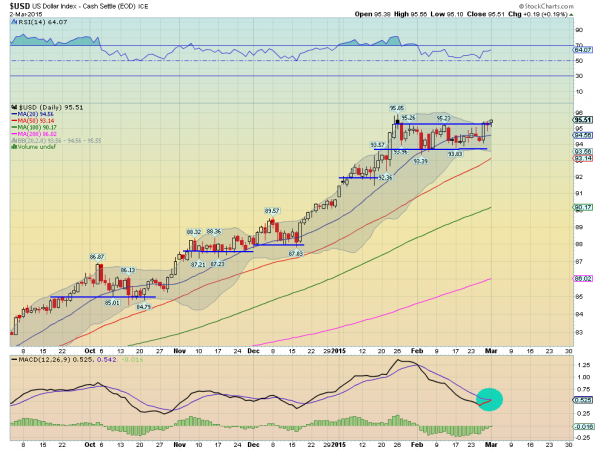

A throw back to my days of watching the black and white television program Superman. But wow, the superlatives really fit. The US Dollar has been on a tear higher since July. Look at the SMAs. Almost parallel moves running higher. That is a great trend. Looking at the price action a bit more closely though you can see a pause in early January and a consolidation range ever since.

But as the calendar turns to March there are several signs that the strength is about to re-emerge. Take a look at the chart above. The Index moved above the range it has traded in Monday, the first clue. The Bollinger Bands® that had squeezed are now expanding, allowing it to move higher. The RSI is moving back higher and bullish. And the MACD is about to cross up, giving a buy signal.

If the breakout higher holds, there is some resistance overhead at 99. But looking at the run-up from the last major consolidation between 87.50 and 89, the breakout would give a target of 100.75. Get ready for an even strong Dollar, because here it comes again.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.