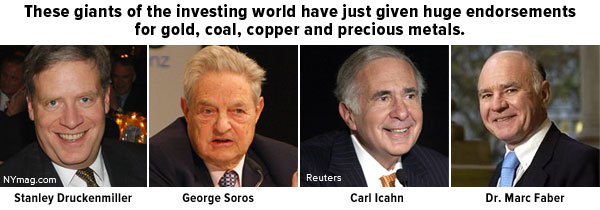

A few legendary influencers in investing are making huge bets right now on commodities, an area that’s faced—and continues to face—some pretty strong headwinds. What are we to make of this?

I already shared with you that famed hedge fund manager Stanley Druckenmiller made a $323-million bet on gold, now the largest position in his family office fund.

It’s also come to light that George Soros recently moved $2 million into coal producers Peabody Energy (NYSE:BTU) and Arch Coal (NYSE:ACI). Meanwhile, activist investor Carl Icahn took an 8.5-percent position in copper miner Freeport-McMoran (NYSE:FCX), which we own.

My friend Marc Faber, the widely-respected Swiss investor and editor of the influential “Gloom, Boom & Doom Report,” is now plugging for the mining sector and precious metals. Speaking to Bloomberg TV last week, Faber claimed that investors are running low on safe assets and suggested they revisit mining companies: If I had to turn anywhere where… the opportunity for large capital gains exists, and the downside is, in my opinion, limited, it would be the mining sectors, specifically precious metals and mining companies… like Freeport, Newmont (NYSE:NEM), Barrick (NYSE:ABX).

They’ve been hammered because of falling commodity prices. Now commodities may still go down for a while, but I don’t think they’ll stay down forever.

Late last month, Freeport became the first major miner to announce production cuts in response to depressed copper prices, which have slipped around 19 percent since their 2015 high of $2.95 per pound in May. This reduction should remove an estimated 70,000 tonnes of copper from global markets, according to BCA Research, and eventually help support prices.

Platinum and palladium miners in South Africa, a leading producer of both metals, also announced job cuts and mine closures, as platinum has slipped more than 16 percent this year, palladium a quarter.

But Marc sees opportunity, as I do. In my keynote speeches earlier this year, I suggested that 2015 would see a bottom in cost-cutting due to divesture and slashing of capital expenditures, and that in 2016 we should see higher returns on capital.

Furthermore, using our oscillators to measure the degree to which asset classes are overbought and oversold, we find that commodities are extremely oversold right now and currently bouncing off low negative sentiment. The smart money is buying.

When asked if he thought commodities had reached a bottom, Marc had this to say: I would rather focus on precious metals—gold, silver, platinum—because they do not depend on industrial demand as much as base metals and industrial commodities.

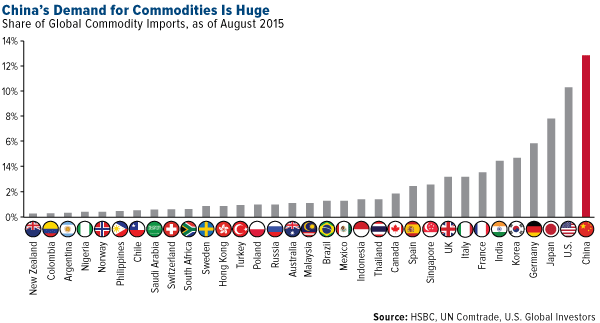

Marc was referring, of course, to China, the 800-pound commodity gorilla, as I’ve often described the country. The Asian powerhouse is currently responsible for nearly 13 percent of the world’s commodity demand, followed by the U.S. at a little over 10 percent.

But as I discussed recently, China is transitioning from a manufacturing-based economy to one that emphasizes services, consumption and real estate. Commodity demand is cooling, therefore, and we can expect it to cool even further. Aside from the strong dollar, this is one of the key reasons why prices have plunged to multi-year lows.

Commodities Seeking an Upturn to Global Manufacturing

The JPMorgan (NYSE:JPM) Global Manufacturing PMI continues to decline as well. Since its peak in February 2014, the reading has fallen 4.5 percent. The August score of 50.7, just barely indicating manufacturing expansion, is the sixth consecutive monthly reading to remain below the three-month moving average.

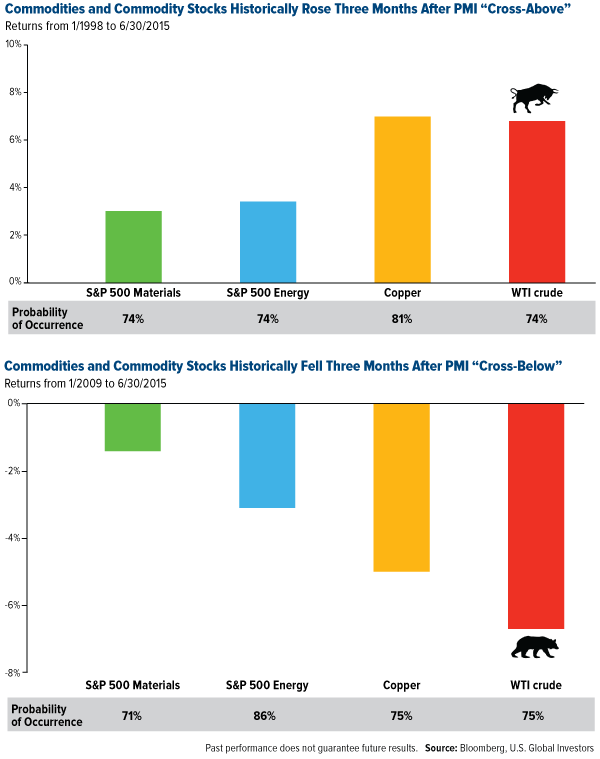

I’ve shown a number of times in the past that when this is the case—that is, when the one-month reading is below the three-month trend—commodity prices have tended to trade lower. Unlike other economic indicators such as gross domestic product (GDP), the PMI is forward-looking and helps investors manage expectations. Based on our own research, there’s a strong probability that copper and crude oil prices might dip three months following a “cross below.”

The opposite has also been true: Prices have a stronger probability of ticking up three months after the one-month crosses above the three-month.

This is why we believe prices will have a better chance at recovery after the global PMI crosses above its three-month moving average.

I have great respect and admiration for Druckenmiller, Soros, Icahn and Marc—all of whom are clearly bullish on commodities—but we would prefer to see global manufacturing growth reverse course.

In the meantime, low commodity prices are a windfall for many companies in Europe, Japan and the U.S. Metals and other raw materials are at their lowest in years, which is the equivalent of a massive tax break for the construction and manufacturing sectors.

Low gold prices are also expected to generate high demand in India as we approach fall festivals such as Diwali and Dussehra, not to mention weddings. According to estimates from Swiss precious metals refiner Valcambi, demand could reach 950 tonnes by the end of the year, compared to 891 tonnes in 2014.

Emerging Markets Might Have Found a Bottom

It might be challenging for the global PMI to cross above the three-year moving average since Chinese manufacturing has slowed, but there’s burgeoning strength in other emerging markets, many of them unexpected: the Philippines, Myanmar, Ethiopia. The Czech Republic has the highest PMI reading among emerging Europe countries and the fastest-growing economy in all of Europe.

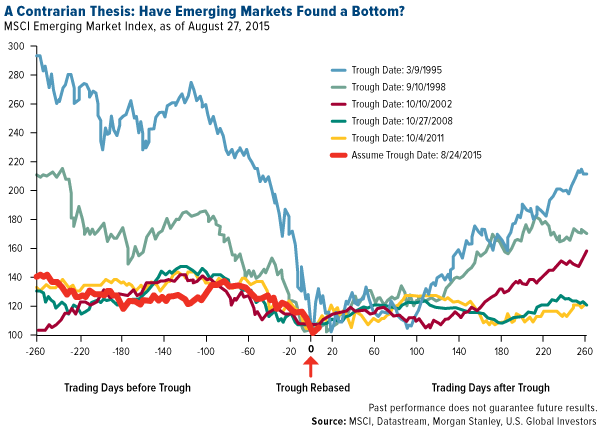

An interesting chart from Morgan Stanley (NYSE:MS) suggests that emerging markets might have found a trough and are ready to turn up. Assuming that August 24, 2015 was the bottom, the bank compares the recent bear market to five previous ones and finds that it’s tracking a similar price action as 1995, 2002 and 2011. It’s also much less severe than 1998 and 2008.

Additionally, Bloomberg reminds us that by 2050, 3 billion people will enter the middle class, nearly all of them in the developing world. Emerging markets might be struggling somewhat right now, but they’re still very much our future.

U.S. Travelers to Spend Big This Labor Day Weekend, but Airline Stocks Are Reasonably Priced

This Labor Day weekend, Americans were projected to spend a whopping $13.5 billion, according to the U.S. Travel Association (USTA). This figure included spending on goods and services as people traveled by automobile, jet or some other means to visit friends and family. Air travelers alone spent $2.9 billion, if expectations were accurate.

The International Air Transport Association (IATA) released air travel demand figures for the month of July, noting that demand continues to be robust both domestically and internationally.

All global markets saw growth in July, with domestic flight demand rising 5.9 percent year-over-year. At an eye-popping 28.1 percent, India posted the strongest growth.

As GARP (growth at a reasonable price) investors, we still find airline stocks attractively priced, as do many others. Barron’s recently made note of this, stating: “Major airline stocks are trading 9.4x our 2015 EPS (earnings per share) estimates and 9.0x our 2016 EPS estimates, below their historical trading range of 10x – 12x.”

We own a number of these carriers in our funds: Delta Air Lines (NYSE:DAL) (which announced a $5-billion stock buyback program in May), Alaska Air (NYSE:ALK), and JetBlue (NASDAQ:JBLU) in the Holmes Macro Trends Fund (MEGAX); Ryanair (NASDAQ:RYAAY) (which just hit a new 52-week high) and Aegean Greece (AT:AGNr) in the Emerging Europe Fund (EUROX). We also own several names in the aircraft manufacturing and airport services areas, including Pegasus Hava Tasimaciligi (IS:PGSUS), Wizz Air Holdings (LONDON:WIZZ) and Tav Havalimanlari (IS:TAVHL).

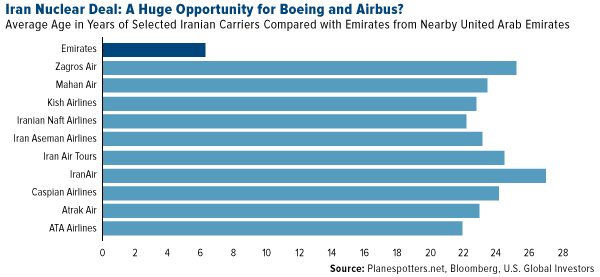

The Iran Nuclear Deal Could Be a Boon to Boeing (NYSE:BA) and Airbus

On a final note, if you’ve been paying attention to the news, you’re probably familiar with the pending nuclear deal with Iran. When implemented, trade barriers will be lifted for the first time in decades. Whether you approve or disapprove of the deal, you have to recognize that this could be a huge opportunity for many companies that, up until now, have been cut off from doing business with the Middle Eastern country.

One area that’s in dire need of an overhaul is Iran's aging jet fleet. The average age of the United Arab Emirates’s planes is 6.3 years. In Iran, meanwhile, it’s 27 years. These are ancient relics!

The total number of jets that will need replacing is estimated to be 400—and cost $20 billion.

Aircraft manufacturers Boeing (NYSE:BA) and Airbus (OTC:EADSF) already have a growing backlog of new aircraft orders—10,000 jets altogether, according to the Wall Street Journal—and the Iran deal has the potential to increase it even further.

We also see it as an opportunity for energy companies in particular that the median age of Iran’s educated population is 28 years—this is a market with promising growth potential.

You might have seen headlines that energy officials from Iran and Saudi Arabia secretly met to cooperate on trying to get crude oil prices stable at between $70 and $80 per barrel. Oil prices spiked this past week in response, but as far as we can tell, this is only chatter. Don’t bet on rumors, but rather on good government monetary and fiscal policy, excellent management and undervalued stocks.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. Distributed by U.S. Global Brokerage, Inc.

Stock markets can be volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, a regional fund’s returns and share price may be more volatile than those of a less concentrated portfolio. The Emerging Europe Fund invests more than 25% of its investments in companies principally engaged in the oil and gas or banking industries. The risk of concentrating investments in this group of industries will make the fund more susceptible to risk in these industries than funds which do not concentrate their investments in an industry and may make the fund’s performance more volatile.

The J.P. Morgan Global Purchasing Manager’s Index is an indicator of the economic health of the global manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the Holmes Macro Trends Fund (MEGAX) and Emerging Europe Fund (EUROX) as a percentage of net assets as of 6/30/2015: Peabody Energy Corporation (NYSE:BTU) 0.00%, Arch Coal Inc. 0.00%, Freeport-McMoRan Inc. 0.00%, Newmont Mining 0.00%, Barrick Gold Corp. 0.00%, Valcambi SA 0.00%, Delta Air Lines 0.00%, Alaska Air Group Inc. 0.00%, JetBlue Airways Corporation 0.00%, Ryanair Holdings plc 0.00%, Aegean Airlines SA 0.00%, Pegasus Hava Ta??mac?l??? SA 0.50% Emerging Europe Fund, Wizz Air Holdings plc 0.00%, TAV Havalimanlar? Holdings 1.09%, The Boeing Co. 1.50% Holmes Macro Trends Fund, Airbus Group (PARIS:AIR) 0.00%.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.