Cliffs Natural (NYSE:CLF) has been disappointing investors of late. Shares of this iron ore producer have logged a negative return of around 21% year-to-date, partly due to its reduced profit outlook for 2017.

Should investors dump this stock from their portfolio? Let’s find out.

An Underperformer: Cliffs has underperformed the Zacks categorized Mining-Iron industry over the past six months. The company’s shares have lost around 23% over this period, compared with roughly 5% decline recorded by the industry.

Unfavorable Zacks Rank & Score: Cliffs currently carries a Zacks Rank #5 (Strong Sell) and a VGM Score of “C”. Here 'V' stands for Value, 'G' for Growth and 'M' for Momentum. The company’s score is a weighted combination of these three scores (Value - F, Growth - D, Momentum - A). A score of ‘A’ or ‘B’ is generally considered favorable and allow investors to rule out the negative aspects of stocks and select the valuable picks.

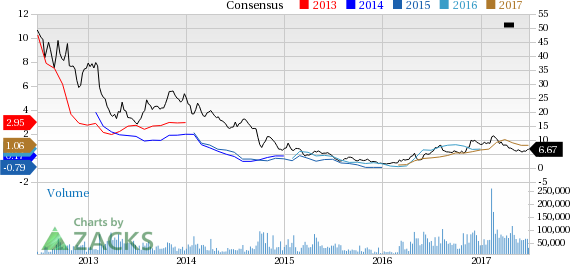

Estimates Southbound: Annual estimates for Cliffs have moved south over the past 60 days, reflecting the negative outlook of analysts. Over this period, the Zacks Consensus Estimate for 2017 has declined by around 30.7% to $1.06 per share. The Zacks Consensus Estimate for 2018 has also moved down 2.5% over the same timeframe to $1.16.

Negative Earnings Surprise History: Cliffs missed the Zacks Consensus Estimate in the last reported quarter, recording a negative surprise of 168.75%. In the trailing four quarters, the company posted an average negative earnings surprise of 3.82%.

Downbeat Outlook: Cliffs remains exposed to a challenging operating environment and pricing headwinds. The company, in April, reduced its profit outlook for 2017 due to lower expected iron ore prices. The company now sees net income of roughly $380 million, down from its earlier view of $510 million. The company also cut its adjusted EBITDA guidance to around $700 million from $850 million expected earlier.

The revised outlook incorporates assumptions based on realization of Asia Pacific Iron Ore revenues, which are likely to be impacted by lower IODEX (the benchmark price index for seaborne iron ore) prices, heavy iron ore content discounts and lower lump premiums.

Stocks to Consider

Some better-ranked companies in the basic materials space include The Chemours Company (NYSE:CC) , Stepan Company (NYSE:SCL) and Kronos Worldwide, Inc. (NYSE:KRO) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has an expected long-term earnings growth of 15.5%.

Stepan has an expected earnings growth of 8.2% for the current year.

Kronos has an expected earnings growth of 354.8% for the current year.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively. And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Stepan Company (SCL): Free Stock Analysis Report

Cliffs Natural Resources Inc. (CLF): Free Stock Analysis Report

Original post