Gold Crosscurrents

The gold market has a lot of crosscurrents at the moment, with the main negative as we write that it doesn`t pay a yield. Given the abundance of cheap money chasing every utility, bond and stock that pays a yield, the precious metal has lost favor in that regard over the past several years.

Bearish Factors

The interest rate cycle is also a negative for gold, and as the Fed starts hiking rates, gold will need other strong factors to overcome this headwind. The other headwind is that there currently isn`t a momentum trade, and since Wall Street often trades with a herd mentality, in the absence of a strong trend, money just doesn`t get sucked into this trade.

Bullish Factors

Some of the bullish factors for gold are geo-political concerns, but this has mainly just provided short covering rallies so far this year. So far, no strong bullish trend has emerged after the short covering. Another factor will be if inflation starts ramping up, and inflation expectations start spiking ahead of the Fed`s ability to get in front of the inflation curve by being too deliberate on rate hikes.

If we start getting insolvency issues in Europe, once again gold could start ramping based in euro as investors try to hedge their European currency risk. There are physical buying-bullish pressures as consumers generally like to own gold, and they especially feel like they are getting a bargain when prices sell off. This holds true as well for gold bugs that envision an ultimate end to global fiat monetary systems where currency debasement runs its course in an extreme momentous collapse.

Shark Attacks

Consequently there are a lot of cross currents in the gold market, and so far in 2014 we haven`t really had the severity of ‘shark attacks’ from the big banks such as what we saw in 2013. You know the scenario: three banks all downgrade gold overnight, gold drops like a rock by $200 to 300 dollars, causing forced liquidations. Then, once the short covering occurs, gold goes right back to where it was originally trading before the shark attacks. This is a ‘shark attack’ and many markets experience them from time to time when a bunch of players gang up on a market to make money in the short term.

Federal Reserve

I do think for the near term, gold investors should be worried about the downside, and I am talking about the futures market, (however, this still effects the physical market in the short term) as you saw some nervous investors exiting before the Jackson Hole speech, they just didn`t want the exposure before the event given the chance that Janet Yellen really signaled to financial markets in a strong manner to start exiting positions that were based upon 25 basis point borrowing.

Rate Hike Cycle

Along these lines, as the biggest driver is probably going to be the upcoming rate hike cycle by the Federal Reserve in the US, and with expectations for the Bank of England early next year to hike rates as well, there are bound to be some hawkish interpretations made, meaning gold is likely going to get smacked around really hard sometime in the next three-to-six months.

Hot Inflation Readings

Unless there is some counterbalancing force such as inflation spiking well ahead of current market expectations—around the 2% level—some of these hawkish market undercurrents with regard to monetary policy are going to play out in the gold market, putting downward pressure on the commodity. Just how far it goes, and to what degree bearish sentiment will bring in players who don`t normally participate in the gold market will determine how much of a sale price buyers get before they feel it is safe to come in and take advantage of lower prices for their beloved commodity.

Forced Liquidations of 2013

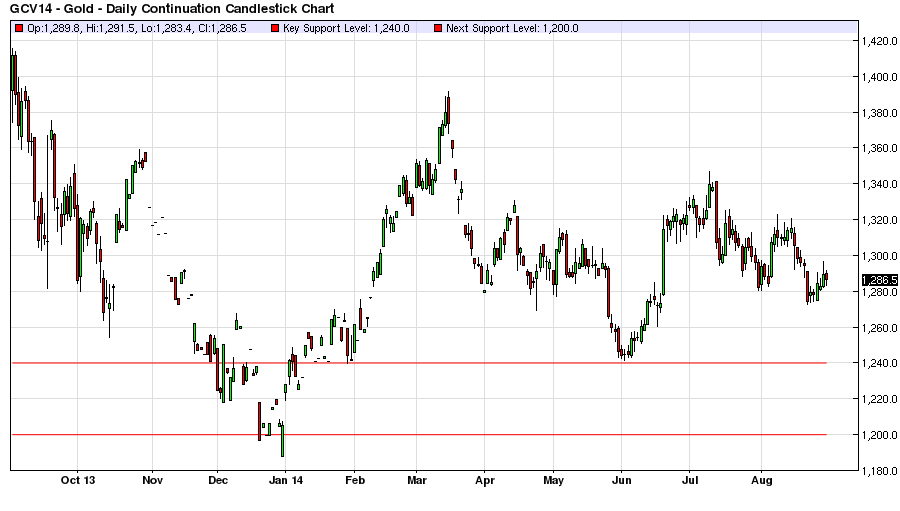

Last year, some buyers stepped in initially at a level they thought would hold, and the gold market took another leg down. Those forced liquidations provided a real buying opportunity for gold last year. But remember the Fed didn`t actually raise rates last year, so what happens when there are actual rate hikes after seven years of easy money? We will probably follow up with an article on the technical levels to watch, but the bigger point right now is just to be aware of what is coming down the gold turnpike: there will definitely be some substantial ‘shark attacks’ over the next six months. Expect some downside pressure for the commodity.

Gold Bears Have Wind at their Backs as Technicals likely to fail to the downside over Near-Term

The feeling here is that the last six months will seem comatose compared to the volatility and strength of some of the moves in the gold market that are about to occur as key technical levels of support fail to hold. We not only expect these technical levels to get tested, we expect that the momentum during this period will be sufficient enough to break many key technical levels that have held so far this past year.

Be selective and careful in playing the long side of the gold market in the near term as the primary catalysts and ultimate drivers are probably bearish in the near term, and gold bulls will be running against a severe headwind in the marketplace.