- Dow Jones FXCM Dollar Index continues to hold key lows

- US Treasury Yields and other key reasons behind Dollar resilience

- Watching forex sentiment for timing on next US Dollar trade

- The next move in yields and, by extension the Dollar, depends almost completely on the FOMC’s next policy action.

- The FOMC stated its next policy shift depends almost completely on economic data, and the US economic calendar remains relatively empty this week and the next.

- Forex volatility prices have tumbled post-FOMC, and traders are betting on/hedging against relatively modest FX moves in the days and weeks ahead.

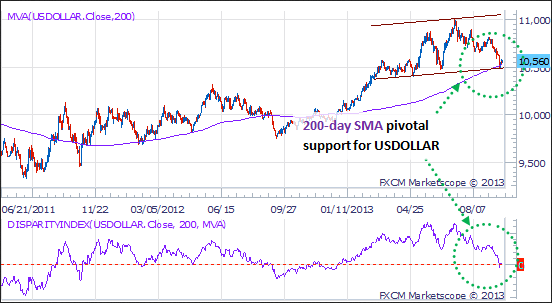

The US Dollar plummeted as the US Federal Reserve failed to taper its Quantitative Easing purchases, but why hasn’t the Dollar fallen harder this week? Source: FXCM Trading Station Desktop, Prepared by David Rodriguez

Source: FXCM Trading Station Desktop, Prepared by David Rodriguez

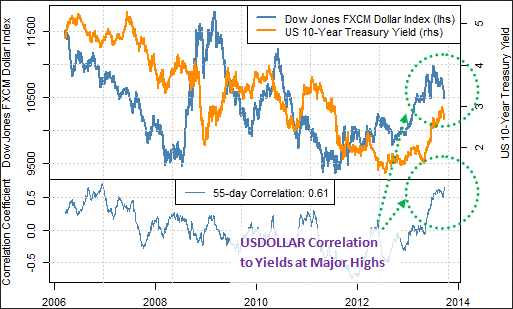

To understand the Dollar’s resilience here, let’s take a look at a major USD driver: yields. Data source: Bloomberg

Data source: Bloomberg

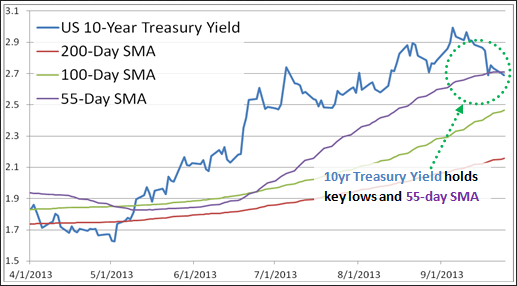

The US 10-Year Treasury Yield recently fell to its lowest levels in over a month and now trades at key congestion at 2.7 percent, which likewise represents its 55-day Simple Moving Average. Data source: Bloomberg

Data source: Bloomberg

The fact is, however, that sharp declines in Treasury Yields and Dollar losses seem relatively unlikely herefor three key reasons.

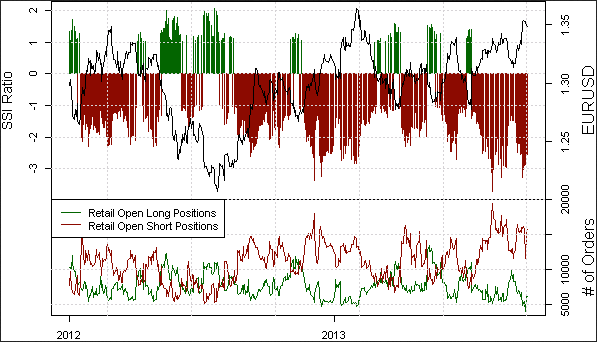

In the absence of US economic data, where might we look for a potential market timing tool for the next US Dollar move? Retail Forex Sentiment Favors Dollar Weakness, but Next Move is KeyWe recently highlighted extremely one-sided retail forex sentiment as a key reason to favor USD weakness. Yet the fact that the Dollar Index continues to hold key lows leaves us on the lookout for a potential turn higher.We most often use our sentiment data as a contrarian indicator to price action. In other words, if everyone’s selling we prefer to buy and vice versa.Traders recently hit their most bearish EUR/USD since the pair set a secondary top near the $1.3450 mark through August, and sentiment remains extremely net-short. Source: FXCM Execution Desk Data

Source: FXCM Execution Desk Data

Until we see an important shift in retail FX sentiment, we see little choice but to favor continued Dollar weakness versus the Euro and other counterparts.Indeed, our forex sentiment-based trading strategies have done well going against the crowd as they’ve broadly sold into USD weakness (bought into EUR/USD and GBP/USD strength, among others).Past performance is not indicative of future results -- just because they’ve done well recently isn’t reason enough to expect continued outperformance. That said, we’ll watch our SSI-based Momentum2 system for the next cues on the EURUSD and broader US Dollar pairs.In the absence of a sharp shift, we’ll keep an eye on US Treasury Yields as a potential catalyst for the next Greenback move.

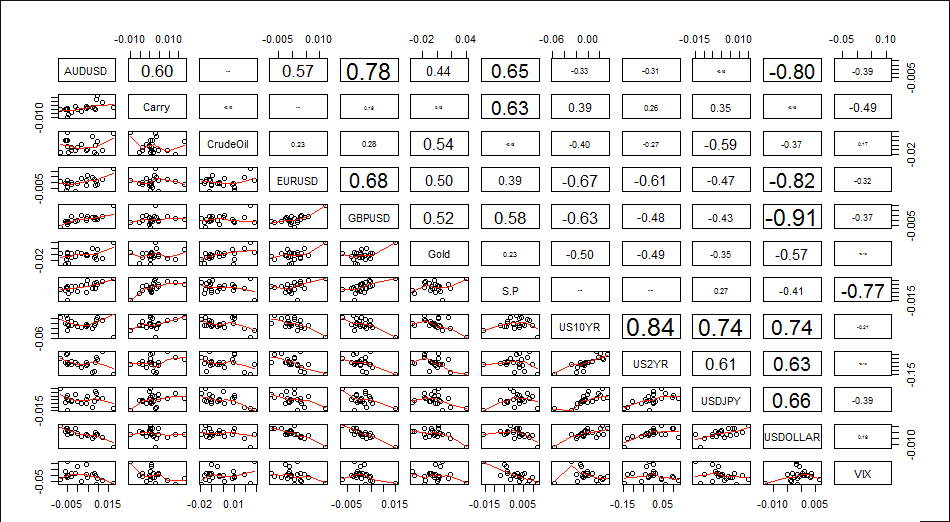

Forex Correlations Summary Data source: Bloomberg

Data source: Bloomberg