The Chemical and Mining Company of Chile (SQM) is definitely a laggard. It is in sectors that are currently unpopular, its earnings have not surprised on the upside since June 2012, and the consensus of analysts' estimates of future growth are a decline of 15% this year and 4% in 2014. The most recent catalyst that sent the stock tumbling to a price that might interest a value investor like us is that the Russian potash giant Uralkali began a price war to gain market share. As a result, all manufacturers of essential agricultural fertilizers, who must now match these lower prices or lose market share, have plummeted. This is definitely the stock of a company no momentum buyer would touch.

We, on the other hand, are just beginning to buy. Why? Because I believe that panicky institutions and individuals are throwing the (diversified chemical company) baby out with the (potash) bathwater. SQM is not merely a potash company; it is a well-diversified company that happens to sell potash as one of its products. Unlike companies like Potash Corporation of Saskatchewan, (POT) and the Mosaic Company, (MOS), however, if SQM decided to lower their potash production until prices recover, they could still have more than 80% of their revenue stream intact.

Fertilizers of all types provide 44% of SQM's gross profit, with potash just 20%. (Potassium chloride, KCl, is the commodity fertilizer Uralkali specializes in.) SQM also produces - actually, is the world leader with a 46% market share - potassium nitrate, which is a chlorine-free premium product for plant nutrition. With the likely decrease in potash prices, some farmers using this premium product will likely switch for a year to the low-priced spread, so SQM will feel some pain here, too.

But the company is also the world's #1 producer of specialty chemicals. They are the world leader in iodine production, used in X-rays, LCD screens and pharmaceuticals. SQM has a 34% market share, compared to all US producers' 4%. The company is also the leading lithium producer in the world, with a 35% market share. Lithium batteries, glass and lubricants are the current markets; with global sales of electric vehicles projected to reach 5-10 million annually by 2020, this is probably SQM's biggest growth business - unless its solar salts subsidiary, also the world's largest, overtakes them. Solar salts are used to store energy in power plants that use solar thermal collectors, and are more efficient at converting solar to electricity than photovoltaics.

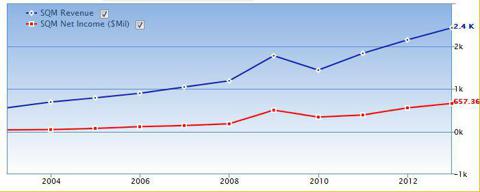

Gurufocus.com gives SQM 5 stars for business predictability. This is not a performance or a safety measure or even a predictive tool but, rather, an historical look at companies that slowly, steadily march forward providing steady returns. 1 star is the entry level rating, with 5 stars the highest. These are regularly reviewed, of course, and may be up-graded or down-graded as conditions dictate. But it is just one more arrow in SQM's quiver. Over the long term, they have always delivered:

There is no question that SQM will require patience. And there is always the risk that we will begin our purchases too soon in such a situation. But, then, I'm not a "momentum" buyer looking to buy high in the hopes of selling higher. If you buy SQM, you must do so with the expectation of future growth, but you may have to hold it for a while to see those gains. I'm fine with that; I'd rather own a quality firm that has temporary issues than some high-flyer that has only price momentum to recommend it.

SQM is not for everyone; but for those who see growth in the areas I mentioned above, SQM is a world leader with a nice moat around its core products. You can buy it today for 12.5 times earnings.

Disclaimer: As Registered Investment Advisors, we see it as our responsibility to advise the following: we do not know your personal financial situation, so the information contained in this communiqué represents the opinions of the staff of Stanford Wealth Management, and should not be construed as personalized investment advice.

Past performance is no guarantee of future results, rather an obvious statement but clearly too often unheeded judging by the number of investors who buy the current #1 mutual fund only to watch it plummet next month.

We encourage you to do your own research on individual issues we recommend for your analysis to see if they might be of value in your own investing. We take our responsibility to proffer intelligent commentary seriously, but it should not be assumed that investing in any securities we are investing in will always be profitable. We do our best to get it right, and we "eat our own cooking," but we could be wrong, hence our full disclosure as to whether we own or are buying the investments we write about.

Disclosure: I am long SQM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.