The price of oil has dropped 60% in little over a half year. In the past few days, the price has jumped 15%. It's the first significant rally in oil since the plunge began.

So, has the drop in oil prices ended? Probably not.

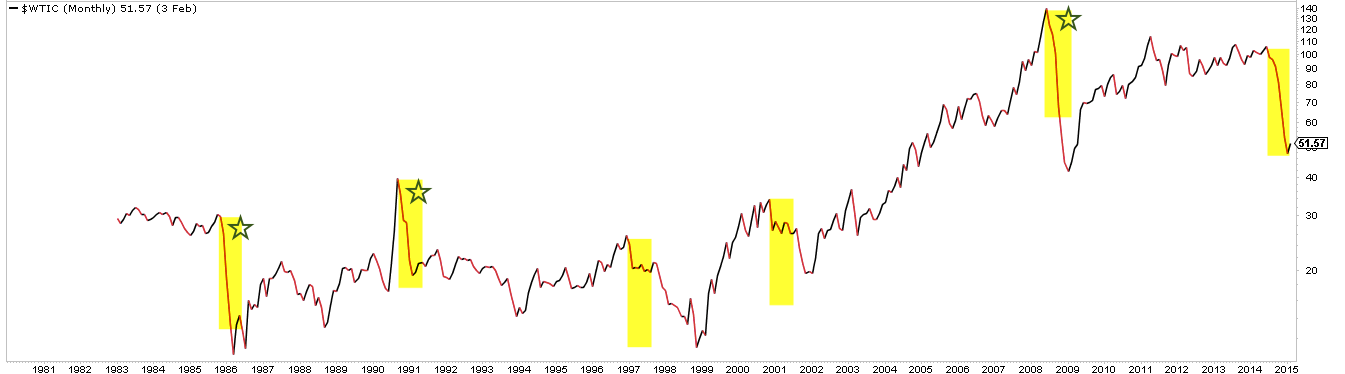

Let's look at other drops in oil over the past 30 years. Below is a monthly chart of crude oil (WTIC). The yellow bars indicate the size and duration of each fall. Note the current fall in oil since June 2014. Three other instances look similar in that the drop was swift and without a pause (marked with stars: 1986, 1990 and 2008). Two others took twice to four times as long to unfold (1997 and 2000).

Let's look at each case in turn, starting with the three that are most similar to today.

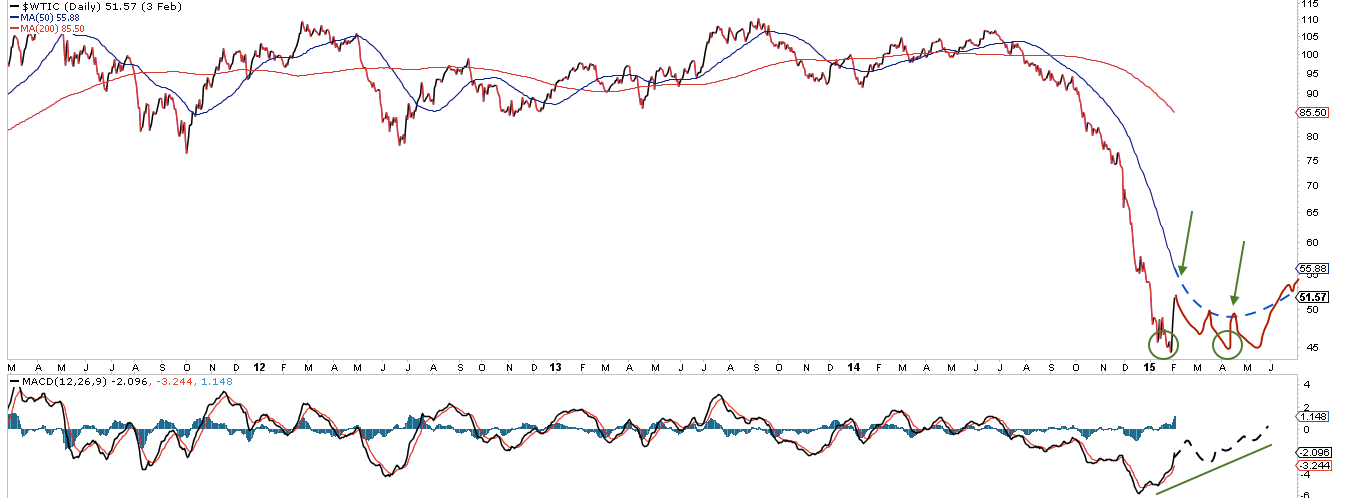

First, here is the current drop in oil. The blue and red lines are the 50-dma and the 200-dma, respectively. Note: (1) price has not yet tested the 50-dma (blue line); (2) the 50-dma is falling with a very steep slope; (3) there's a positive divergence in the MACD (lower panel); (4) this is the first significant rally in oil in 6 months.

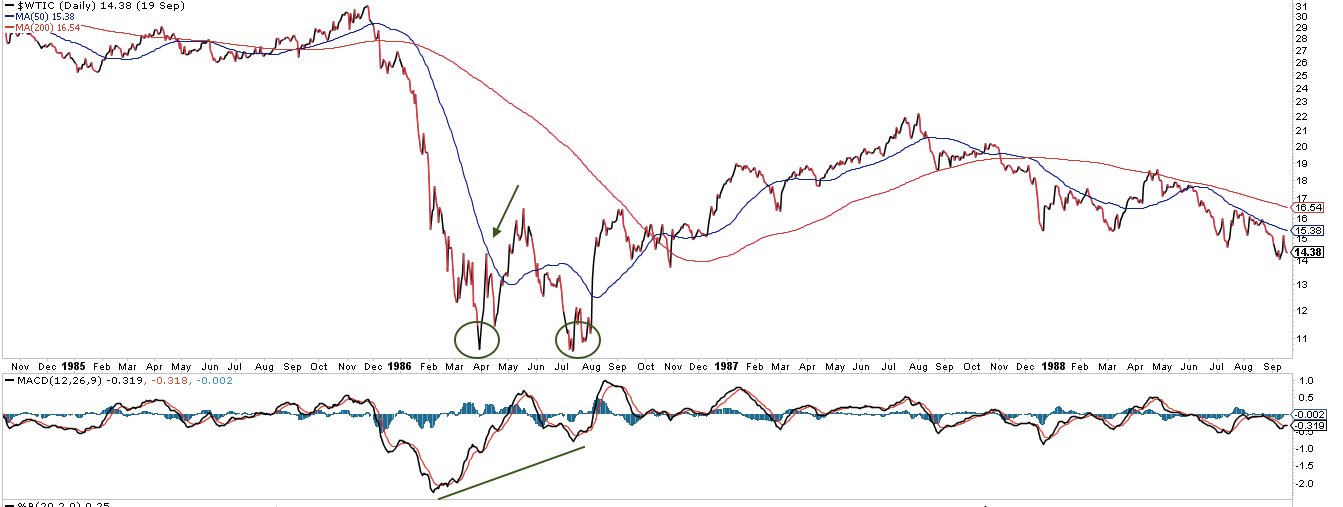

1986 is similar to today in that the price fall was in a straight line and over a short time period. The first rally failed near the 50-dma (arrow). Price retested the low the following month, then rallied into May before retesting the low again 3-4 months later (circles). Note the positive divergence in MACD and that the 50-dma flattened out.

1990 is also similar in that the price fell over a short period of time. It's dissimilar in that price rallied several times on the way lower. Nonetheless, the rallies failed at the sharply falling 50-dma (arrows). Price didn't bottom until the MACD had a positive divergence.

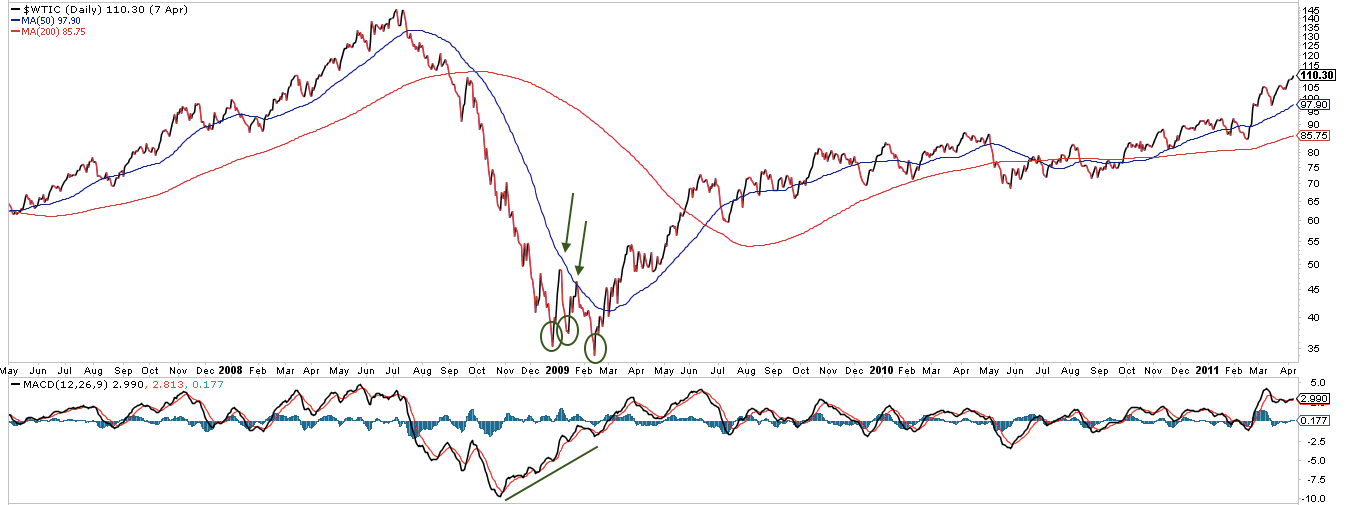

The fall in 2008 was the largest in the past 30 years. It's similar to today in that price fell in a straight line and over a short time period. The first two rallies failed at the 50-dma (arrows). Note the multiple bottoms 2 months apart (circles). Also note the positive divergence in MACD and the slight flattening in the 50-dma at the last low.

1997 is less similar than the first three above. Note the slope of the 50-dma: the price fall was more gradual for the first year and then accelerated in the second year. This wasn't a sharp fall over a short time period. It's harder to draw comparisons but the rallies in the second year still failed at the 50-dma. The positive slope of the 50-dma provided a few false hopes that the bottom was in in mid-1997 and in mid-1998.

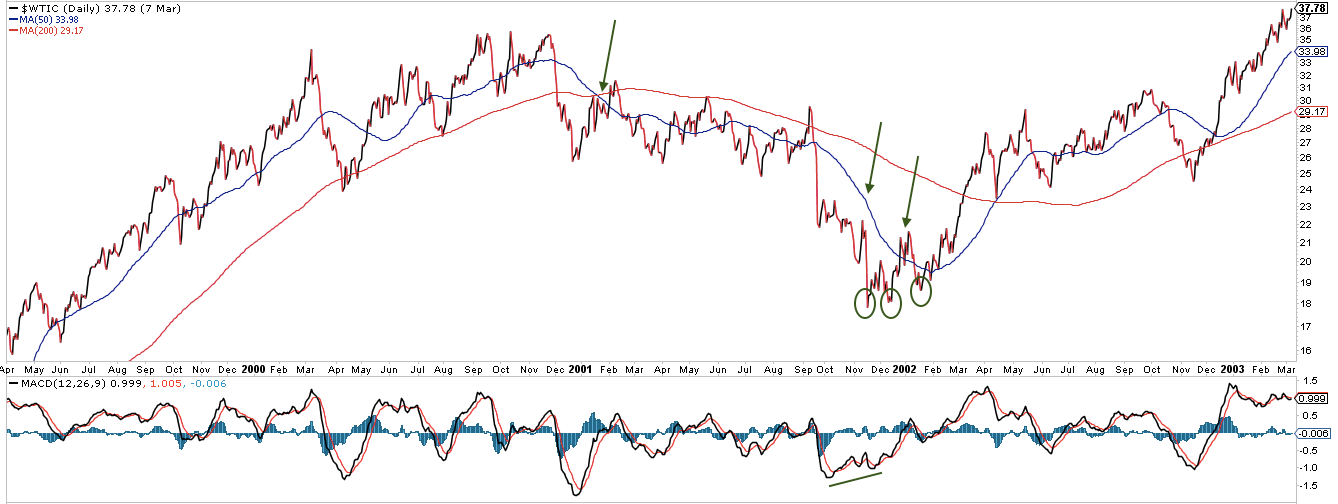

2000 was like 1997: price took more than a year to bottom with an acceleration in the price fall in the second half. The early rallies towards the end failed at the 50-dma and there were multiple bottoms 3 months apart (circles).

We are looking at a small sample and even within this there are variations. But there are some useful lessons applicable to today.

Oil is not likely to "v-bottom": it will likely retest the low at least once if not twice or more. These retests could be higher or lower than the first low. They'll likely be spread over the next 2 to 4 months.

The point of these failed rallies and bottom retests is to work off the downward momentum in price. This is true of oil as well as any other traded good. That is why the slope of the 50-dma begins to flatten and the MACD shows a divergence near the low.

The first rallies will likely fail near the 50-dma. We are using a crayon, not a pencil, to mark these.

If past is prologue, there will be swings back and forth at the bottom, a change from the seven consecutive month fall in price so far. This will be a positive sign.

Drawing from the examples above, we have illustrated what might take place next in oil. Price will emphatically not bottom exactly like this. But if the current rally is the start of a bottoming process, this will be a general approximation of what to expect: (1) the 50-dma flattens (blue line); (2) multiple bottoms spread a few months apart (circles); (3) at least one failed test near the 50-dma (arrows); and (4) a positive divergence in the MACD (bottom panel).

The short term path of oil is highly unpredictable. Experts in this area have tried and failed to correctly predict the price of oil. The price is driven as much by supply and demand as politics between the west, Saudi Arabia, Iran, Russia and others. But, assuming the world is not on the brink of a major recession, we think the price of oil will be higher in the next year (post).