The Basics

The Bank of Japan (BOJ) announced that it will be increasing its government bond holdings at a rate of ¥80 trillion per year ($726 billion, up from ¥60-70 trillion). It is also tripling its purchases of exchange-traded funds, real estate investment trusts, and individual domestic and international stocks. This move gives a positive impetus to stocks worldwide. It will keep downward pressure on global interest rates and force investors into stocks and real estate to find positive, above-inflation returns. The Japanese move caught investors by surprise, as few investors were expecting a further intervention.

What's It Mean For U.S. Bonds?

Demand for safety declined in U.S. Treasury bond markets this morning in response to the BOJ’s bond purchase plans, extending losses into this week. The BOJ decision followed Federal Reserve (Fed) comments that the US economy is maintaining enough strength to end the Fed’s bond purchase program.

The difference between U.S. 10-Year and Japanese yields widened to 1.88 percentage points. This is the widest in almost three weeks. The benchmark US 10-year yield increased three basis points to 2.33. The yield on Japan’s 10-year bond was as low as 0.435%, a level not seen since 2013. Japan’s bond rally pushed yields within 10-, 20-, and 30-year tenors to lows not seen in over 1½ years. The Japan 20-year yield dropped as low as 1.265%, and the 30-year fell to 1.52%.

Munis

On the tax-free municipal bond side, there is little reaction to the Japanese move. New-issue supply is lower than last year. Yields have dropped from last year as the oversold conditions from bond fund selling have reverted to the mean and bond funds have resumed seeing inflows instead of outflows. We expect muni supply to build into next year from issuers refunding older bonds.

Cumberland Advisors’ bonds accounts moved to a lower-duration profile during 2Q2014 and 3Q2014. The reason is that the risk-reward profile on bonds is not as compelling as it was at the start of the year.

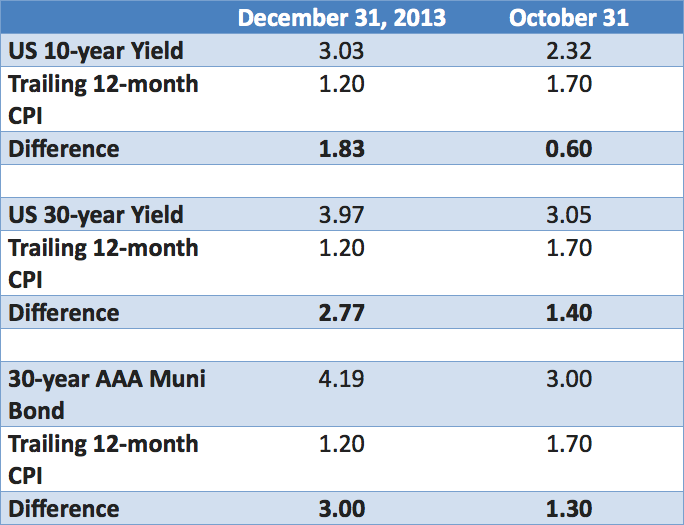

The difference between interest rates and inflation has narrowed significantly (see table above). While we expect that rates should remain range-bound for a while, we feel our recent actions are warranted given the current conditions.

John Mousseau, CFA, Executive Vice President & Director of Fixed Income

Nannette Sabo, Vice President & Portfolio Manager - Fixed Income