Value-oriented thinkers have labored to persuade investors to invest in Europe for nearly three years. Specifically, they’ve pushed forward the idea that miraculously low price-to-book ratios offer compelling bargains in European ETFs, in spite of the ongoing sovereign debt crisis and negligible economic growth.

However, deep discount investing during financial crises is a recipe for failure. For example, by 2007, Bill Miller built Legg Mason Value into the largest mutual fund on the planet. Unfortunately, the guru chose to pack his luggage with banks and insurers. Mr. Miller stubbornly stood by his “call” throughout the collapse in 2008, pointing to exceptionally attractive valuations like low price-to-book ratios. In the end, shareholders watched in horror as -75% returns had evaporated their asset. And Mr. Bill? He retired in reasonable comfort a year later.

Granted, there are differences between the credit crunch of 2008 and Europe’s sovereign debt mess. Yet there are more similarities than many care to admit. We’re still talking about major banks and insurers holding toxic debts (e..g, Greek 2-year notes, Spanish bonds, etc.) that threaten the global financial system. Saving the European banks will require more and more “bailout euros,” which is likely to erode the value of the currency in the near-term.

For this reason, I haven’t had any direct exposure to Europe for several years. There’s not enough diversification reasoning in the financial planning pot to persuade me that unhedged European ETFs are sensible risk-reward investments at this time.

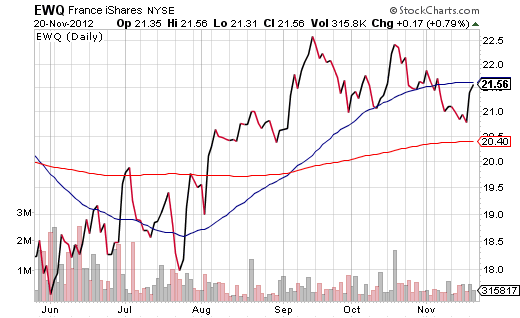

In contrast, Russ Koesterich, iShares Global Chief Investment Strategist, is the latest individual to suggest adding some European flare. He is recommending iShares MSCI France (EWQ). The reasons he cites include a price-to-book multiple of 1.14, a 31% discount to the MSCI World Index and a 15% discount to Germany.

If we were able to rely on fundamentals alone, I might share Mr Koesterich’s assessment. Yet France is a major component of a deepening recession in the region and the political leadership abhors capitalism. Moreover, a euro that depreciates against the dollar hurts EWQ’s chances, and I see little evidence that the euro will strengthen over the next 6 months.

Then there is the technical picture. When European Central Bank chief Mario Draghi proclaimed in July that he would do whatever it takes to save the euro, European assets like EWQ hit a series (July, August, September) of “higher lows.” That is a bullish pattern for stocks.

In contrast, shortly after Draghi announced the specifics of the ECB’s plans in September, EWQ has been hitting a series (September, October, November) of “lower highs.” That is a bearish pattern for stocks.

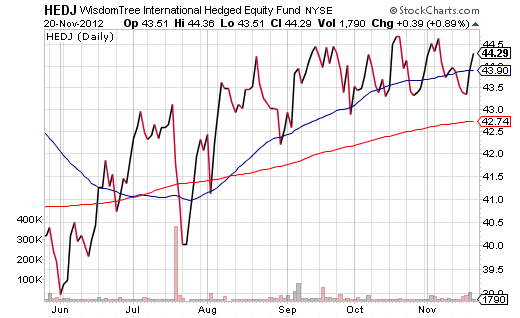

While I continue to hitch my cart to Asia Pacific ETFs for “foreign exposure,” I recognize that some ETF investors still want access to great European companies like Unilever (UL), Sanofi-Aventis (SNY) and Moet Hennessy Louis Vitton (MC.PA). If you feel the urge, then I advise using a currency hedged vehicle like WisdomTree European Hedged Equity (HEDJ).

This exchange-traded fund is hedged such that you can expect higher returns than a similar non-currency hedged investment like EWQ, assuming the value of the dollar is increasing relative to that of the euro. And right now, this is precisely what is happening. HEDJ is roughly 1% off its 52-week highs whereas EWQ is closer to 5% off its peak.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Here's One Way To Hedge Against The Euro

Published 11/21/2012, 12:26 AM

Here's One Way To Hedge Against The Euro

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.