by Chaim Siegel of Elazar Advisors, LLC

Microsoft (NASDAQ:MSFT) reports earnings after the close on Thursday, April 27. We are at $.75 and $22.7B in sales versus The Street’s $.69 and $23.6B expected.

Microsoft is a must-own if you’re an index fund. If you’re a stock picker, Microsoft may work on earnings day but it likely becomes a market performer thereafter.

The cloud opportunity is huge for the company, but we haven’t seen it show up large enough yet to benefit the numbers. If you’re a trader, we love it for earnings. If you’re an investor it can be the type of exposure Microsoft makes up in an index fund, maybe 2-3% of your portfolio.

Don’t Feel The Cloud Much As An Investor

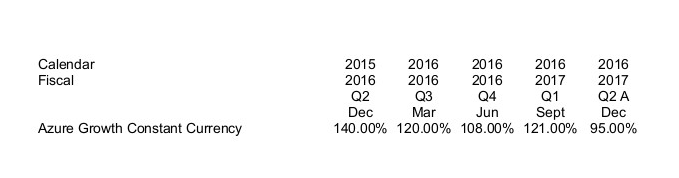

Let’s first focus on cloud. Azure, Microsoft's cloud computing platform and service, has been on fire.

While growth has slowed a little, 95% is still very strong. The problem is it hasn’t budged Microsoft's numbers overall.

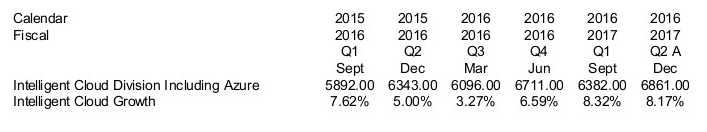

If you look at their total cloud business, it’s growing much more slowly than just Azure:

While Azure is off the charts, the overall cloud segment is building gradually. With the tiny slow-down of Azure in FQ2 the overall division slowed a touch as well.

If Microsoft can’t show something meaningful to the top and bottom line now, we worry that the space is only going to get more competitive.

In our recent report on Amazon (NASDAQ:AMZN), we showed that cloud makes up over 50% of their company profits. Cloud is moving the needle for Amazon investors. For Microsoft, however, cloud is not moving the needle, yet.

This is also, arguably, among the most exciting segments in tech right now. You just don’t have the exposure percentage-wise with Microsoft.

Profits show the same story. Amazon is showing profit growth in cloud of over 50%.

Microsoft’s cloud division has been declining in profits. Plus, Microsoft has needed huge investment to grab that revenue growth. Amazon has already seen profit leverage despite being much larger.

Microsoft is also just talking about coming into profitability with Azure, after more than 18 months of investment. They spent on their infrastructure and sales force and are only just starting to lever those expenses.

The problem here is, this is going to be a competitive space. Amazon has dropped price multiple times and has said this business will be “lumpy.” We know what that meant for competing retailers. Amazon having a huge lead in market share means risk for the next tier players.

So while cloud should be the most exciting part of the story for Microsoft, they are still in a show-me period for that part of the business, where they have to prove profitability and market share grab.

Where We Get Earnings Upside

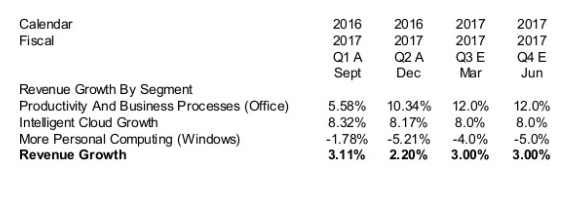

We have revenue growth picking up in the March quarter which is Fiscal Q3. Office 365 has helped the Productivity And Business Processes segment to accelerate. Computing has been weak and we spoke about Cloud above.

Linkedin should also add upside to revenues but the earnings are also not likely to show much.

We use these revenues to get to our earnings numbers using Microsoft’s non-GAAP historicals. The Street typically focuses on non-GAAP to decide earnings “beats” and “misses.”

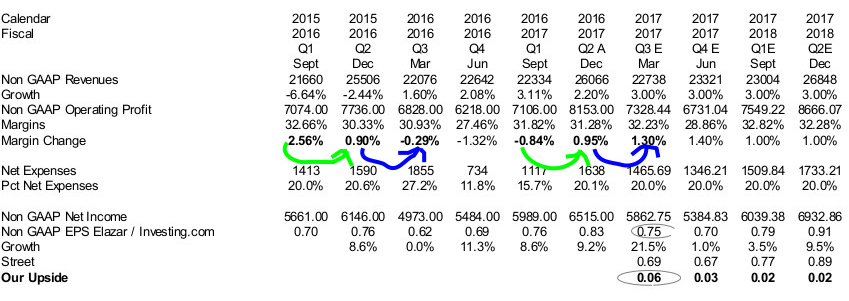

What we want readers to focus on is where we think last quarter's “beat” came from and you’ll then see where we think this next quarter’s “beat” will come from.

We drew two green arrows on the model below. The one on the left shows how last year, Operating Profit Margin went from up 2.56% in September 2015 to up .9% in December of the same year. That tells you that this year’s December quarter’s margin comparison was about 150bp easier.

Now look at the green arrow for calendar 2016’s numbers. In 2016, numbers improved from -.84% to +.95% or about 200bp. Of that total, 150bp were helped from last year’s December quarter being that much easier than the September quarter.

Now you’re ready to figure out this March quarter.

The blue arrows show that last year, the March quarter was about 120bp easier than the December quarter, right? December’s .9% went to -.29%.

Uh oh, you got me. You're probably thinking 'Elazar you’re being conservative. You only have margins improving by 35bp from the December to March quarter, yet last year they were 120bp easier.' And with that we’re already $.06 above the Street (Bottom line-item above).

That’s why we think there will be earnings upside when Microsoft reports on Thursday night.

We know we’re being a little conservative, giving some room for Linkedin integration and the fact that cloud hasn’t really proven the profitability momentum yet.

But The Shares Feel Fully Valued

Despite our getting upside in earnings, we can’t get to upside in the stock price. Our .13 upside for the calendar year gets us to $3.15. The average P/E for Microsoft is about 21-22x.

22 X $3.15 which gives us about 5% upside to the stock price. Margins have been historically great but earnings growth has averaged about 8% in the last couple of years. A 22 multiple makes sense.

If you love Microsoft and want to give it a higher multiple, that’s the only way you can buy it. If you give it a 25 multiple you have about 20% upside, which is a decent investment.

We’d prefer however to wait to about $55 which would give us 20% upside to our 22 multiple.

Conclusion

If you love Microsoft, which we respect, it’s a buy for you. We want to see them nail the cloud. Amazon is going to be very tough competition and Microsoft has not shown the profit in that arena yet. In the meantime, despite earnings upside, we’d wait for a pullback.

Disclosure: Portions of this report may have been issued in advance to subscribers or clients. All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC and their related parties harmless. Any trading strategy can lose money and any investor should understand the risks.