The price of corn is at an historic low vs. the price of meal

In a previous life I traded grains at the Chicago Board of Trade. My focus was on the price relationship of various grains and grain-by products — Corn vs. Wheat, Spring Wheat vs. Winter Wheat, Meal vs. Oil, Soybeans vs. Corn, etc. Extremes in historic relationships often yield excellent trading opportunities.

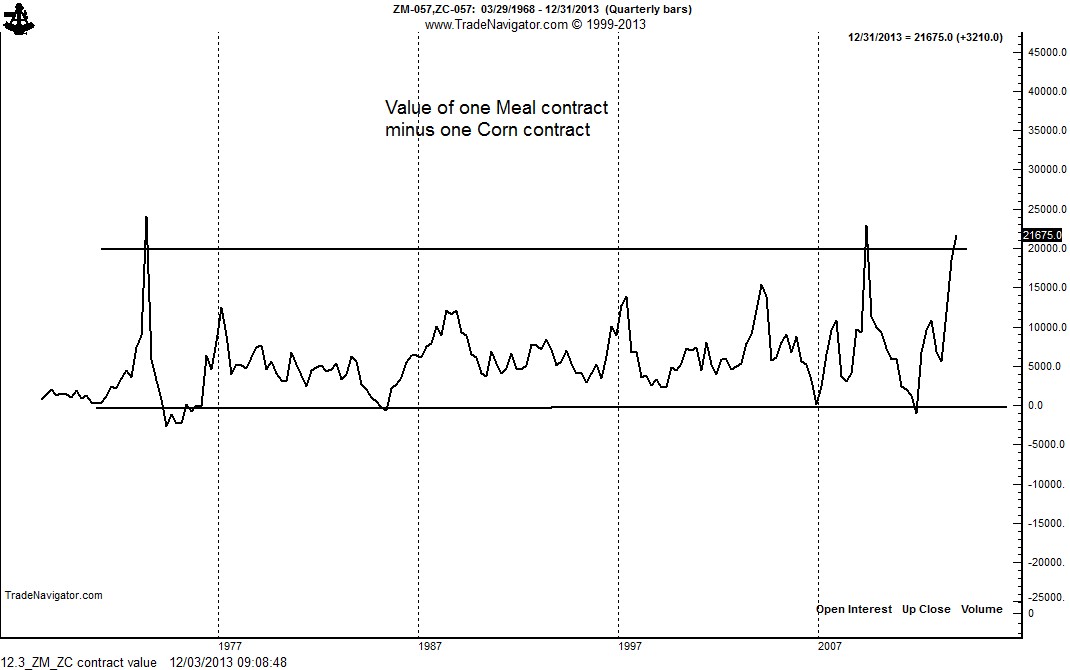

Presently the price of Soybean Meal is at an historic high conpared to the price of Corn. The first chart below shows the value of one contract of Meal minus the value of one contract of Corn. Obviously, this could be traded as a straight spread.

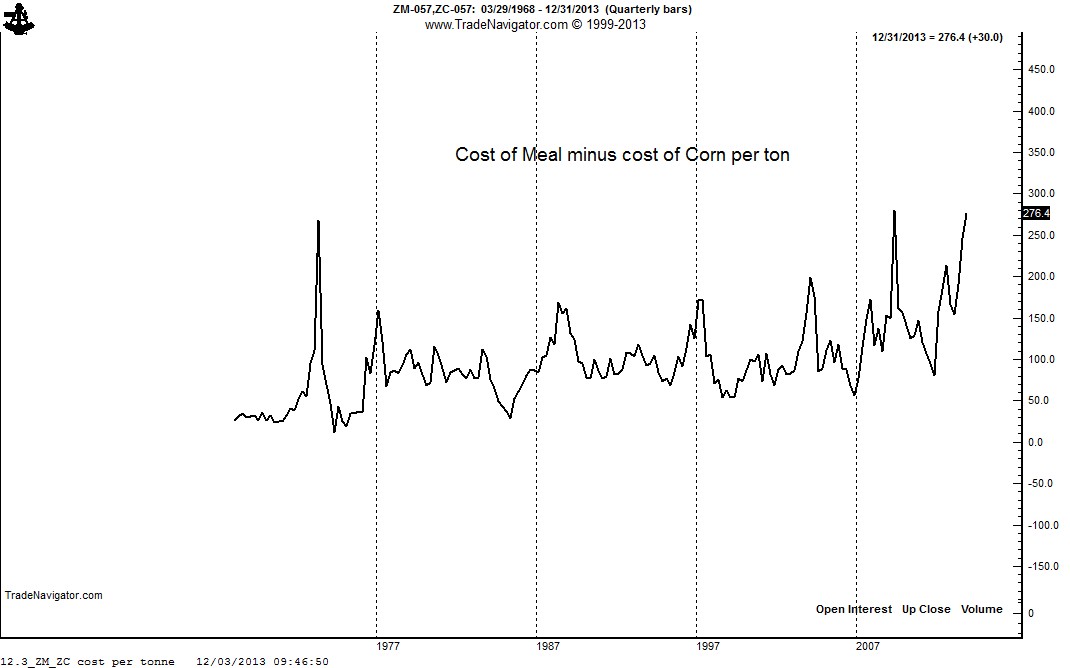

The second chart shows the value of a tonne of Meal minus the value of a tonne of Corn. There are 100 tonnes of Meal in each Meal contract and 140 tonnes of Corn in each Corn contract.

I have no urgent desire to pick the top of this spread, although I believe history will show that we are at or near the top. Yet, I have a desire to be long Corn based on this market pricing structure.

Here's why:

1. Meal supply is very tight. Meal spreads have been inverted for some time, with the nearby expiring December contract presently trading at a $25 premium to the March contract. As a general rule, it is never wise to be short a market that is inverted.

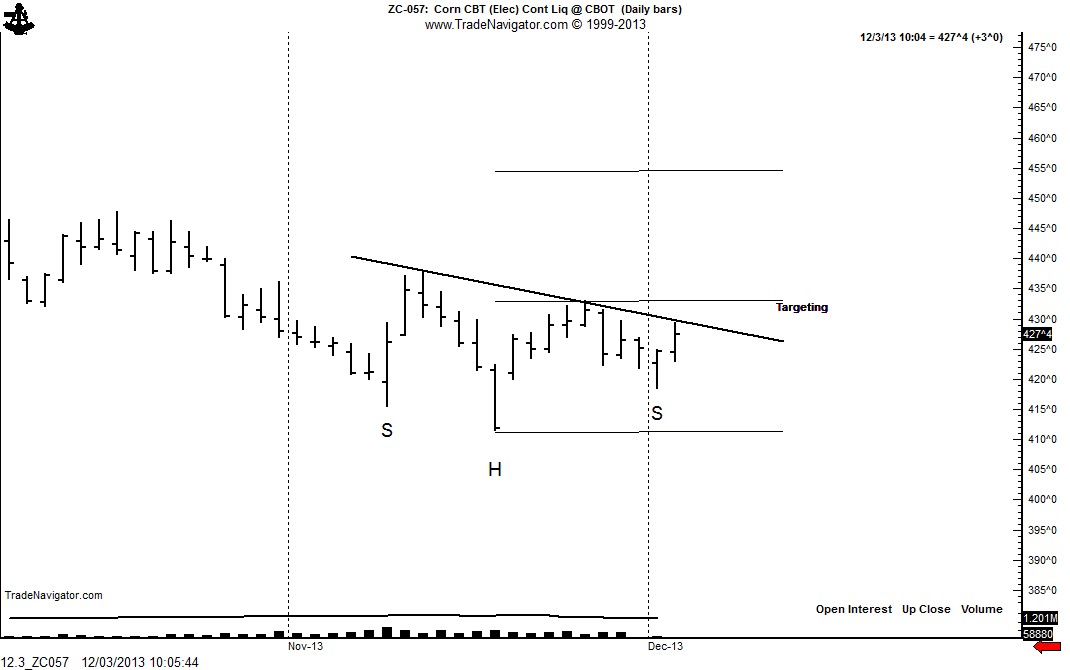

2. The nearby continuation chart of Corn displays a small H&S bottom (see below) — the individual contract charts do now show this pattern. A continuation chart tends to better reflect the cash market.

For the reasons cited above I am prepared to be net long Corn futures and will continue to monitor the Meal/Corn spread.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.