With the state of post-Op/Twist systemic dysfunction, there are no absolutes, but…

Generally, a rising yield curve signals changes in financial markets. But it is not as simple as saying ‘the curve is rising… it’s bearish!’ or ‘the curve is rising… it’s bullish!’. It is potentially both of those things and it will have different implications for different markets and asset classes.

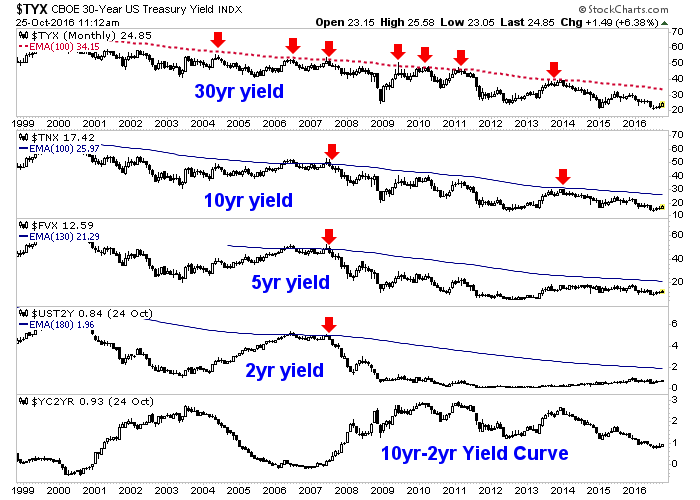

Trending Down

First, here is the state of yields and the yield curve in a big-picture view. Trends are down in the deflationary continuum on the biggest picture for all items, but have been neutral on the 5yr. and somewhat up on the 2yr. ever since Goldilocks gulped the bears’ porridge in 2013. The yield curve is in a downtrend.

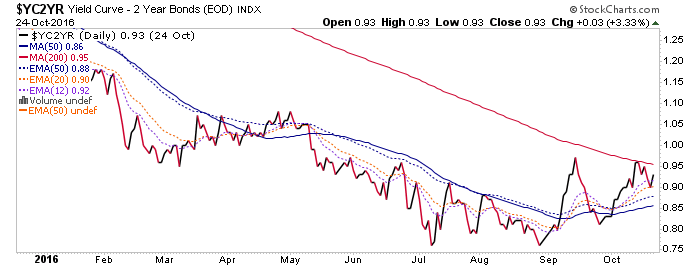

Dialing in to the daily view, we find YC2yr. still looking interesting, but as it climbed above the 50-day moving average, it tested it, rose again and is currently dealing with resistance at the 200-day moving average. It’s constructive to a potential bottom.

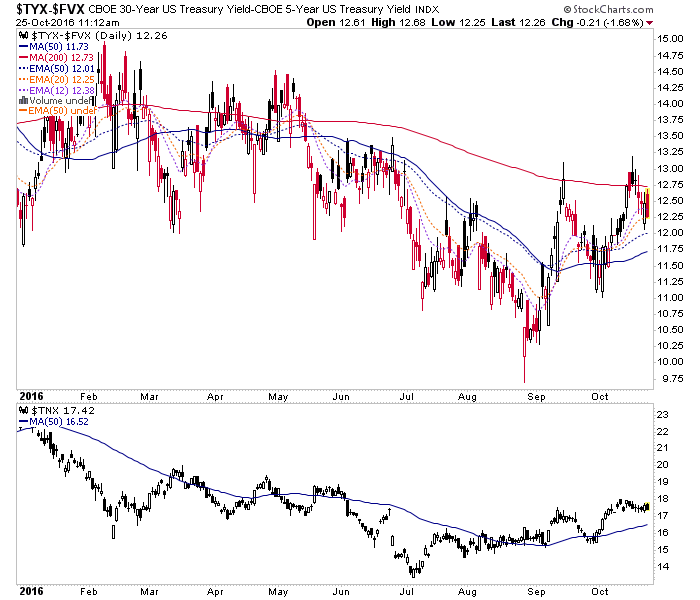

The chart above is a daily close, but to get a similar ‘in-day’ view, I subtract the 5yr. from the 30yr. for a real-time view of a longer-duration yield curve. It’s easing a bit.

But again, what does a rising curve mean? Well, when nominal yields are rising as they are, modestly, since July (10yr. yield in the lower panel above) the implication of a rising yield curve is inflationary and so players would seek to speculate in assets that would rise during inflation or, in the case of gold, seek refuge in a monetary asset of long-term value. This speculation could well include stocks and is like a macro game of musical chairs because in reality, players are simply trying to game the inflationary policy that is ever more intensively promoted by increasingly deranged central bankers the world over.

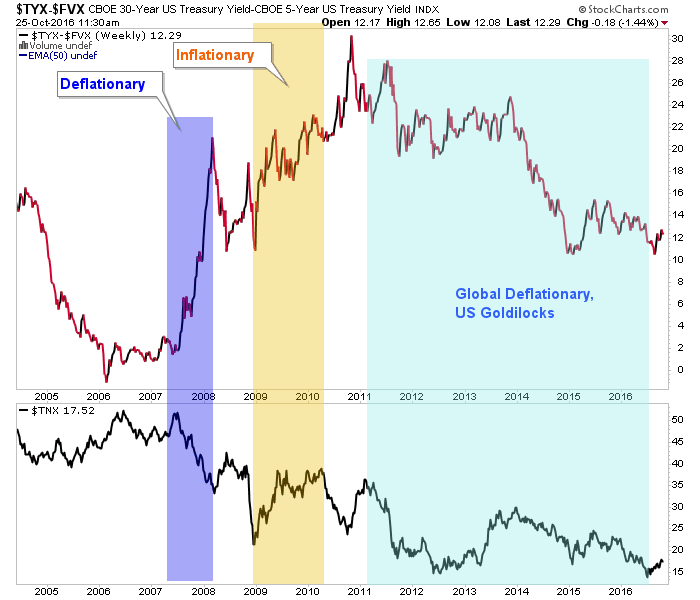

When nominal yields are declining and the curve is rising, however, the implication is systemic stress with a deflationary force at work. Here is a long-term view of the same chart, dialing back to show the last virulent deflationary episode. It also shows the benign environment for US stocks post-2011, as global deflation manifested in the US during a Goldilocks environment with a declining curve and declining nominal interest rates. In other words, the lack of inflation signals juxtaposed against a strong dollar-driven services economy did a good job of keeping the tepid post-2008 recovery going.

Today, referencing the 2nd and 3rd charts above, the most important thing to note is that yield curves are at least constructive to rise. Right up there in importance is the state of nominal yields. If – and it is not yet nearly conclusive – the yield curve establishes a new uptrend, then we are either going to cycle into a new inflationary episode or face liquidity pressure on the bloated credit system (i.e. deflationary pressures).

So the 2 panels on the 3rd chart above will have a big impact on coming events.