Henry Schein, Inc. (NASDAQ:HSIC) reported adjusted earnings per share (EPS) of $1.75 in the second quarter of 2017, up 6.7% year over year. Adjusted EPS also surpassed the Zacks Consensus Estimate of $1.73. The year-over-year upside in earnings was driven by strong revenue growth.

Henry Schein’s reported net income in the second quarter came in at $139.3 million or $1.75 per share, reflecting year-over-year growth of 2.9% and 6.7%, respectively.

Revenues in Detail

Henry Schein reported revenues of $3.06 billion in the second quarter, up 6.5% year over year and also above the Zacks Consensus Estimate of $3.05 billion. The year-over-year improvement came on the back of 7.7% growth in local currencies partially offset by a 1.2% decline owing to foreign currency exchange. At local currencies, internally generated sales increased 4.4% and acquisition growth was 3.3%.

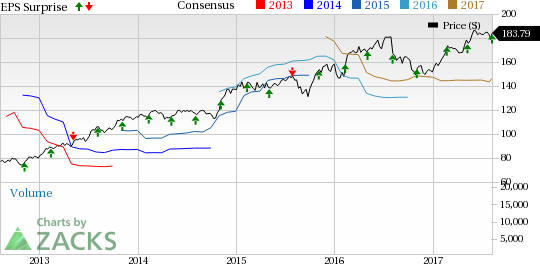

Henry Schein, Inc. Price, Consensus and EPS Surprise

The company recorded sales of $2.03 billion in the North American market, up 5.6% year over year. Sales were $1.03 billion in the international market, up 8.3% year over year.

Segment Analysis

Henry Schein derives revenues from four operating segments: Dental, Medical, Animal Health, and Technology and Value-added services.

In the second quarter, the company derived $1.49 billion in revenues from global Dental sales, up 8.4% year over year. This includes 9.4% growth in local currencies and 1% decline owing to foreign currency exchange. At local currencies, internally generated sales increased 3.1% and acquisition growth was 6.3%. Internal growth at local currencies included 3.8% growth in North America and 2% rise internationally.

The company's global Animal Health segment witnessed 4.4% improvement in revenues to $891.3 million. This includes 6.7% growth in local currencies and 2.3% decline related to foreign currency exchange. At local currencies, internally generated sales increased 5.8% and acquisition growth was 0.9%. The 5.8% internal growth in local currencies included 5.9% growth in North America and 5.7% growth internationally.

Worldwide Medical revenues scaled 6.1% year over year to $571.4 million. Growth in local currencies was 6.2%, with a 0.1% decrease owing to adverse foreign exchange.

Revenues from global Technology and Value-added Services grew 1.4% to $108.5 million. This included 2.8% growth in local currencies and a 1.4% decline related to foreign currency exchange. There was 0.6% contribution from acquisitions during the quarter under review.

Margin Trends

Gross profit increased 4.7% to $839.2 million in the reported quarter. However, gross margin declined 50 basis points (bps) from the year-ago quarter to 27.4% due to a 7.2% rise in cost of sales, higher than the revenue growth rate.

Despite a 4.7% rise in selling, general & administrative expenses of $628.5 million, adjusted operating income improved 4.8% year over year to $210.7 million. Moreover, adjusted operating margin remained flat year over year at 6.9% in the reported quarter.

Financial Position

Henry Schein exited second-quarter 2017 with cash and cash equivalents of $74.7 million, compared with $62.8 million at the end the first quarter. Year-to-date net cash provided by operating activities was $228.7 million, compared with $277.2 million in the year-ago period.

During the quarter under review, the company bought back approximately 289,000 shares for almost $50 million. At the close of the second quarter, the company had $150 million authorized for future repurchases of its common stock.

2017 EPS Guidance Intact

Henry Schein reaffirmed its 2017 reported EPS guidance (except for the $0.04 litigation settlement expense). The company still expects EPS in the range of $7.17–$7.30, reflecting 8–10% growth from the 2016 EPS figure of $6.61.

The Zacks Consensus Estimate for 2017 adjusted EPS is $7.28, within the guided range.

Our Take

Henry Schein exited second-quarter 2017 on a solid note with earnings and sales beating the Zacks Consensus Estimate. All four of its operating segments delivered strong year-over-year growth. The company’s strong share gains in both the North American and overseas markets along with strong revenues raise optimism.

However, despite the better-than-expected earnings performance, we are disappointed with the company’s unchanged EPS guidance for 2017. Meanwhile, the year-over-year deterioration in Henry Schein’s gross and operating margin was due to higher cost of sales and expenses. Also, foreign currency fluctuations continued to mar the company’s financials.

Zacks Rank & Key Picks

Henry Schein has a Zacks Rank #2 (Buy). A few other top-ranked medical stocks are Edwards Lifesciences Corporation (NYSE:EW) , INSYS Therapeutics, Inc. (NASDAQ:INSY) and Align Technology, Inc. (NASDAQ:ALGN) . Notably, Edwards Lifesciences, INSYS Therapeutics and Align Technology sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

INSYS Therapeutics has a long-term expected earnings growth rate of 20%. The stock posted a stellar four-quarter average earnings surprise of 60.7%.

Align Technology has an expected long-term adjusted earnings growth of almost 26.6%. The stock has added roughly 25.9% over the last three months.

Edwards Lifesciences has a long-term expected earnings growth rate of 15.2%. The stock has gained around 5.9% over the last three months.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Insys Therapeutics, Inc. (INSY): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Henry Schein, Inc. (HSIC): Free Stock Analysis Report

Original post

Zacks Investment Research