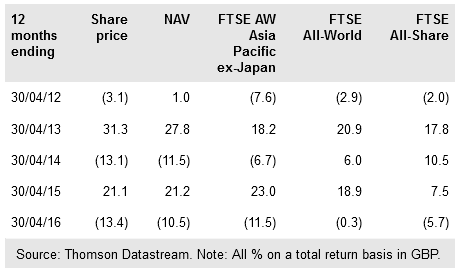

Henderson Far East Income Ltd (LON:HFEL) seeks to blend the superior growth prospects of investing in Asia with a focus on generating a high income. With a current dividend yield of 6.9%, it is comfortably the highest yielding of its close peer group, and manager Michael Kerley also sees potential for double-digit dividend growth in the portfolio over the next 12 months. Capital performance has been more muted in a period of volatility as investors have focused on the risks arising from a slowdown in China, but NAV total returns in the half-year ended 29 February 2016 were positive in absolute terms and ahead of the FTSE Asia Pacific Ex Japan benchmark. Having traded at an average premium to NAV of 0.6% since launch in 2007, the fund currently stands at a small discount.

Investment strategy: High income with income growth

HFEL is managed by Michael Kerley of Henderson Global Investors (based in London), supported by a team in Singapore. To arrive at a focused portfolio of 40-60 stocks chosen for total return potential, the manager sifts the universe using quant screens, macro analysis, company meetings and industry intelligence. Candidate stocks are analysed using a proprietary discounted cash flow model focusing on quality and sustainability of earnings, as well as valuation. Kerley seeks a balance between high-yielding stocks and those with high dividend growth potential, and the portfolio is unconstrained by index sector or geographical weightings.

To read the entire report Please click on the pdf File Below