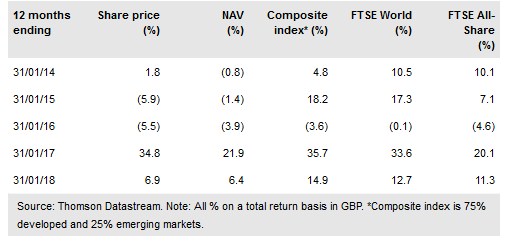

Henderson Alternative Strategies Trust (LON:HAST) has recently passed its three-yearly continuation vote, underlining investor confidence in the rebuilt portfolio of specialist and alternative funds. Medium-term NAV total returns are now in line with the informal annualised target of c 8% over rolling three-year periods, and in FY17 (to 30 September) all the underlying strategies – hedge funds, private equity, property, specialist sector and specialist geography – contributed positively to returns. In an environment of increased market volatility, the differentiated nature of many of the underlying assets could provide a source of diversification for investors, and a progressive dividend policy underpins the current yield of 1.8%.

Investment strategy: Focused and specialist

HAST aims to provide a ‘one-stop shop’ solution for investors seeking exposure to specialist and alternative assets. Run by the experienced duo of Ian Barrass and James de Bunsen, with support from Peter Webster and the wider multi-asset team at Janus Henderson Investors, the focused portfolio of 30-40 holdings blends open- and closed-end funds in areas such as private equity, hedge funds, property, credit, single-sector strategies and geographical specialists, aiming to achieve annualised NAV total returns of c 8% over rolling three-year periods.

To read the entire report Please click on the pdf File Below: