Are you eager to know how Helmerich & Payne Inc. (NYSE:HP) performed in fiscal Q3 in comparison with the market expectations? Let’s quickly scan through the key facts from this Tulsa, OK-based company’s earnings release this morning:

About Helmerich & Payne:

Incorporated in 1940, Helmerich & Payne is engaged in the contract drilling of oil and gas wells in the U.S. and internationally. The company supplies drilling rigs, equipment, personnel, and camps on a contractual basis to explore for and develop oil and gas from onshore areas and from fixed platforms, tension-leg platforms, and spars in offshore areas. Helmerich & Payne’s contract drilling business consists of three business segments: U.S. land drilling, offshore drilling and international land drilling.

Zacks Rank & Surprise History:

Currently, Helmerich & Payne has a Zacks Rank #3 (Hold) but that could change following its fiscal third quarter 2017 earnings report which has just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Coming to earnings surprise history, the company has a dismal record: It missed earnings estimates in three out of last four quarters, posting a negative average earnings surprise of 4.24% in the trailing four quarters.

We have highlighted some of the key details from the just-released announcement below:

A Narrower-than-Expected Loss: Helmerich & Payne’s net operating loss per share – excluding special items – came in at 18 cents, narrower than the Zacks Consensus Estimate for a loss of 31 cents.

Revenue Came in Higher than Expected: Revenues beat expectations. Revenues of $498.5 million were above the Zacks Consensus Estimate of $440 million.

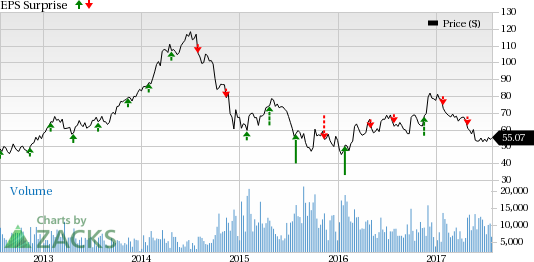

Helmerich & Payne, Inc. Price and EPS Surprise

Key Stats: The ‘U.S. Land’ segment reported an operating loss of $8 million as against earnings of $25.8 million the year ago quarter. Helmerich & Payne’s ‘Offshore’ unit earned $6.4 million in the third quarter, as against 2.1 million in the prior year quarter. Lastly, the ‘International Land’ segment reported operating earnings of $4.9 million, as against the loss of $5 million in the year ago quarter.

Operating costs increased by approximately 81.2% to $337.4 million when compared to the prior year quarter.

Share Performance: Shares have declined almost 29% year-to-date, while the industry has declined 36 %.

Check back later for our full write up on this Helmerich & Payne earnings report later!

Helmerich & Payne, Inc. (HP): Free Stock Analysis Report

Original post