Heliad Equity Partners KGAA (DE:HPBGn) is a DACH-focused (Germany, Austria and Switzerland) closed-ended fund investing in the tech, e-commerce and lifestyle sectors. It is managed by Heliad Management GmbH, a company wholly owned by Heliad’s largest shareholder, FinLab (A7A). Stakes in listed tech companies Fintech Group AG (DE:FTKG)and Magforce AG (DE:MF6G) account for 69% of the portfolio value and their value currently exceeds Heliad’s market cap, having appreciated 36% and 82%, respectively, in 2017 to date. The performance of these holdings and the diversification offered by Heliad’s 12 other investments may make it an attractive way to access the German tech, e-commerce and lifestyle sectors at a discount.

Q117 NAV growth expected to continue

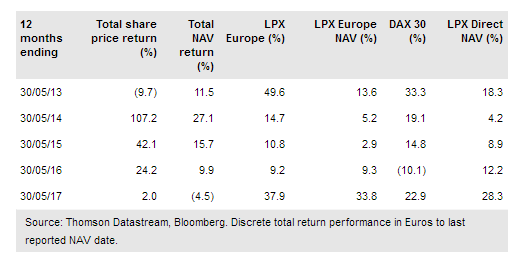

Following a difficult 2016, when the share prices of Heliad’s two biggest holdings fell, Q117 has seen a reversal, leading to 17% NAV growth in Q1 from €8.43 to €8.92 per share. This has come on the back of good results from FinTech and progress on the roll-out of MagForce’s cancer nanotherapy. Heliad’s other investments appear to have interesting potential for development, particularly in the e-commerce space. The recent acquisition of a 9.1% stake in bmp Holding, a listed company operating in a similar market to an existing investment, may provide both synergies and potential for a merger with the existing investment, Cubitabo.

To read the entire report Please click on the pdf File Below