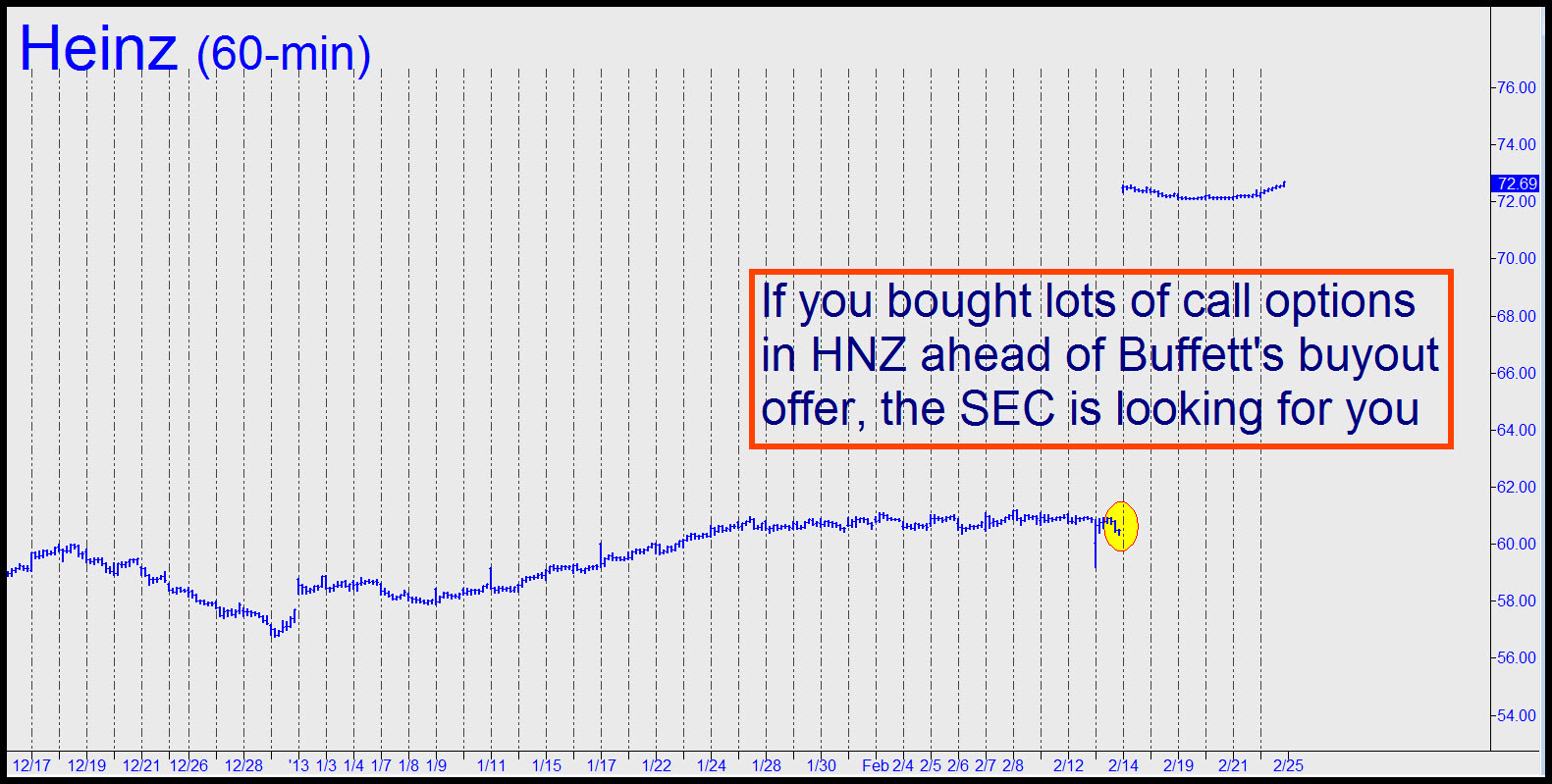

Some genius bought $90,000 worth of out-of-the-money calls on Heinz shares a day before Buffett tendered for the company, but it looks like he won’t get to collect a dime of the $1.7 million profit the trade produced. Actually, the trader is a fugitive from justice at the moment, having failed to show up at an SEC hearing last week to explain his astoundingly good timing. Don’t these guys ever learn? Buying call options to profit from insider information is like wearing a mechanical holdout device to a card game. If and when you get caught, which you will, there’s no way to lie your way out of it. Why do you think the SEC is so keen on prosecuting insider-trading cases? Convictions come as easy as shooting fish in a barrel, since the paper trail in nearly every instance is so clear and detailed that the trader might as well have presented regulators with a scrapbook celebrating his crime.

This perp reportedly bought the call options through a Swiss account managed by Goldman, so he’s not exactly your average Joe. Goldman claims they don’t have “direct access” to his name, and at this point even the regulators don’t know who he is. But you can bet they’ll collar him eventually, notwithstanding Switzerland’s zeal for protecting the identity of its banking customers, even those who deposit such large sums that the money could only have been stolen. When it comes time for the Swiss to do the right thing, we’re betting they’ll cough up the trader’s identity so that the SEC’s investigators can rack up another score.

Switzerland No Place to Hide

As a put-and-call dealer on the Pacific Exchange years ago, we ourselves were the prey of inside traders operating through brokerage accounts in Switzerland, Jordan, Saudi Arabia and Kuwait. Although it took years to finally put the lawbreakers behind bars, we can attest to the SEC’s diligence in setting things right. The trades involved the purchase, in the summer and autumn of 1981, of far-out-of-the-money call options on the shares of Santa Fe International, a contract oil driller. With the stock trading in the high teens not long before the October calls were to expire, someone was paying what seemed like ridiculous prices for ostensibly worthless October 30 calls. Exchange traders’ jaws dropped, however, when it was announced after the closing bell on expiration Friday that Kuwait had tendered an offer for the company at $53 per share. This meant that the many thousands of “worthless” October 30 calls the market makers had sold for $25 would have to be covered for more than $2300 apiece. Fortunately for the market makers, the losses were ultimately canceled when regulators figured out the scheme. Most of the insiders – there were several of them, including a Jordanian — went to prison, including Santa Fe’s treasurer and a former director.

Another case that directly involved us landed pill-tamperer Eddie Marks in prison under a 27-year sentence. He’d sought to profit from a drop in SmithKline shares after sabotaging some Contac and Dietac capsules with rat poison. We were making markets in SmithKline options at the time and therefore well positioned to see through this scheme. A call to the FBI put them on Eddie’s trail and earned us a $200,000 reward. In retrospect, we can speculate that Marks might have gotten away with it if he had done the option trade, which involved the purchase of 360 out-of-the-money put options, under an alias. But the Schwab account he used bore his real name, and it was therefore a simple matter for the FBI to match up fingerprints on the Contac and Dietac bottles to fingerprints they had on file for Marks once they had him in their crosshairs.

Bottom line: If you should ever be tempted to leverage insider information using put or call options, realize that your name is going to flash in neon on some SEC investigator’s computer screen, especially if you don’t ordinarily trade options.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Heinz Insider Was Dumber Than Dumb

Published 02/25/2013, 01:45 AM

Updated 07/09/2023, 06:31 AM

Heinz Insider Was Dumber Than Dumb

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.