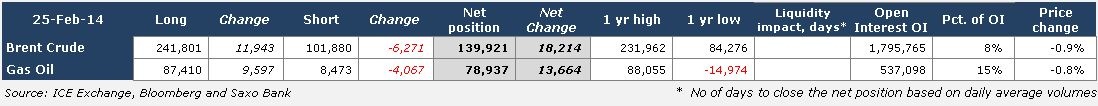

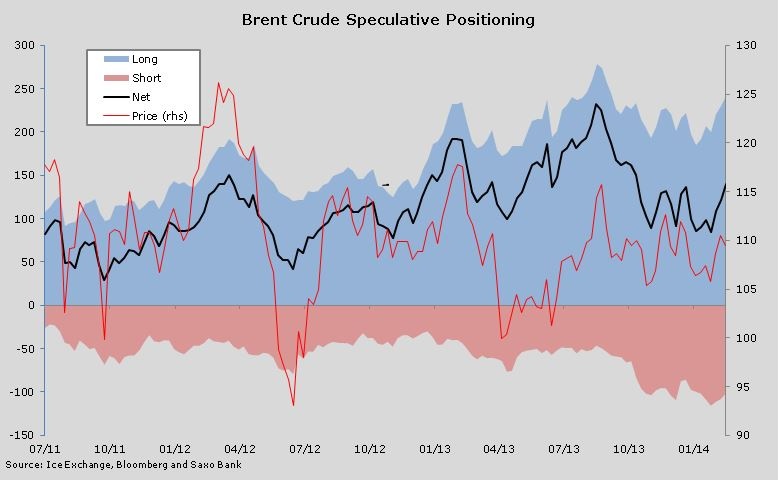

Hedge funds and other money managers were net buyers of Brent crude oil futures for a third week during the week ending February 25 according to data released by the ICE Futures Europe Exchange. The net-long rose by 18,214 contracts to 139,921, the highest level since October 22 but is still well below the record from last August.

The WTI crude contract has seen much bigger interest during the past couple of months as domestic issues helped the discount to Brent crude narrow. The current turmoil in Ukraine may now lend relative stronger support to Brent crude given its continued role as a global benchmark and considering that current events could have a global impact. Gas oil net-longs rose by 13,664 contracts to 78,937 contracts.