Biotechnology name Intrexon Corp. (NASDAQ:XON) is slated to report fourth-quarter earnings after the market closes this afternoon. Below we will dive into the stock's chart performance, and look at what the options market is pricing in for XON for tomorrow's trading.

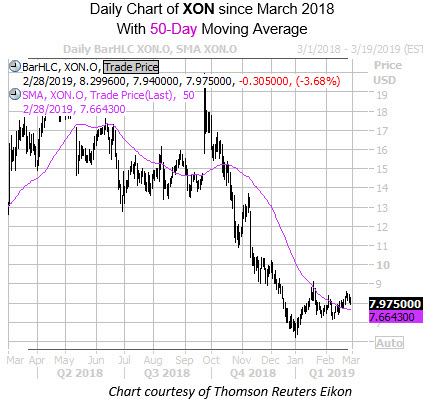

Ahead of the report, XON is down 3.7% at $7.97, though it remains comfortably above its 50-day moving average. Specifically, Intrexon stock broke above this trendline two weeks ago, and has since brought its year-to-date gain to 21.1%. This pales in comparison to a wider view of the stock, which is staring at a year-over-year deficit of 39%.

Intrexon stock has history of making extremely volatile post-earning swings, of which, five have been negative over the past eight quarters. This includes an 18.5% plunge in November. On average, the shares have swung 15.3% the day after earnings, regardless of direction. This time around, the options market is pricing in a smaller-than-usual 11.9% move for Friday's trading.

Looking at options data, XON's Schaeffer's put/call open interest ratio (SOIR) of 0.29 lands in the 22nd percentile of its annual range, suggesting near-term options traders are more call-biased than usual right now. Peak front-month open interest is found at the March 8 call.

Lastly, short interest surged 5.1% during the past two reporting periods, and now represents a lofty 29.4% of Interexon stock's total available float. At XON's average pace of trading, it would take a lengthy 24 days for shorts to cover their bearish bets.