Investing.com’s stocks of the week

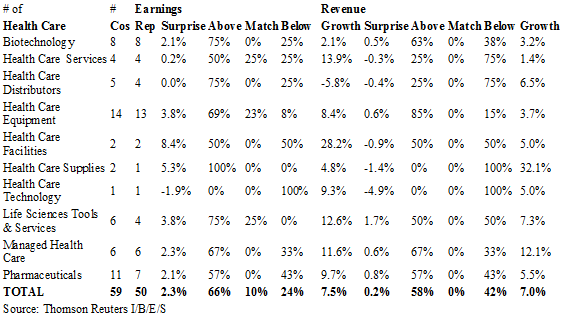

Thomson Reuter’s quick peek at Healthcare earnings as of 11/7/16:

As of Monday in terms of Q3 ’16, Healthcare is still growing revenue at 7% driving earnings growth of 7.5%.

If readers look at the above chart, “Healthcare Distributors” looks to be the trouble spot, with companies in that category reporting just 25% of those company’s reporting better-than-consensus revenue. 75% of thise companies missed their revenue estimates.

The real issue is what happens to Healthcare in 2017: here is a quick table of the Healthcare sectors “expected” 2017 earnings growth:

- 11/4/16: +8.8%

- 10/28/16: +9.5%

- 10/21/16: +10%

- 10/14/16: +10.1%

- 10/7/16: +10.2%

- 9/30/16: +10.2%

- 9/23/16: +10.3%

While there is some downward pressure as long as the numbers stay above “mid-single-digits” HealthCare should be OK.

CVS's (NYSE:CVS) guide-down yesterday morning was a shocker. Although the stock is found in Consumer Staples, CVS is tied to the Healthcare sector, and the warning around the retail drug segment for 2017 wasn’t good. I expected the PBM to be under pressure, not the retail drug segment,

Clients are currently “underweight” Healthcare with the largest position being Pfizer (NYSE:PFE). Clients do own a little iShares Nasdaq Biotechnology (NASDAQ:IBB), and some iShares US Pharmaceuticals (NYSE:IHE), and VanEck Vectors Pharmaceutical (NASDAQ:PPH), but the positions are small right now.

How Prop 61 does in California and the composition of the Senate will matter. It is price controls that are the biggest risk over the next year.

Bristol-Meyers (BMY) has gotten crushed, Pfizer is down from $38 to $31, and testing its uptrend line, Merck (NYSE:MRK) is acting very well. I do think there is still value in the old-school large-cap pharma stocks.