What stands out

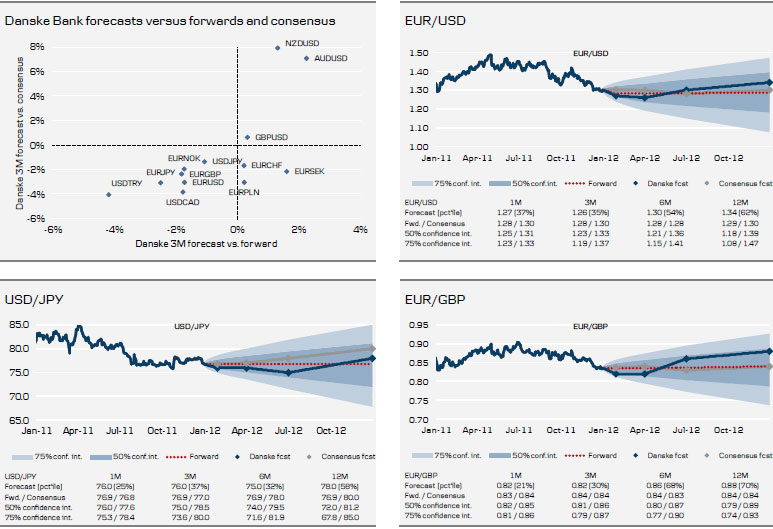

EUR/USD has corrected back towards the model estimate (1.31). We doubt that the current rebound will take the euro back above the model, but with short euro positions at record levels there is potential for short covering to take the pair higher. Due to the change in the option market skew, call spreads or call options with upside knock-out triggers seem to be the attractive vehicles for expressing a view on near-term euro upside.

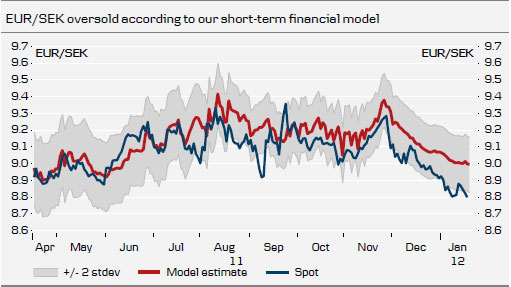

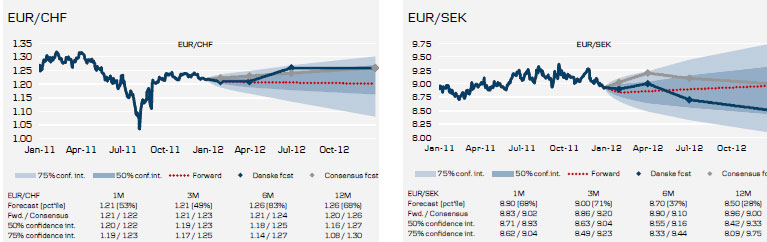

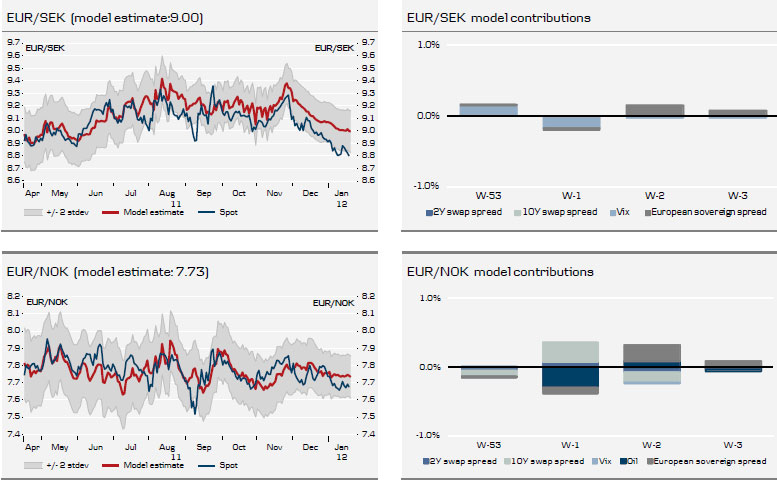

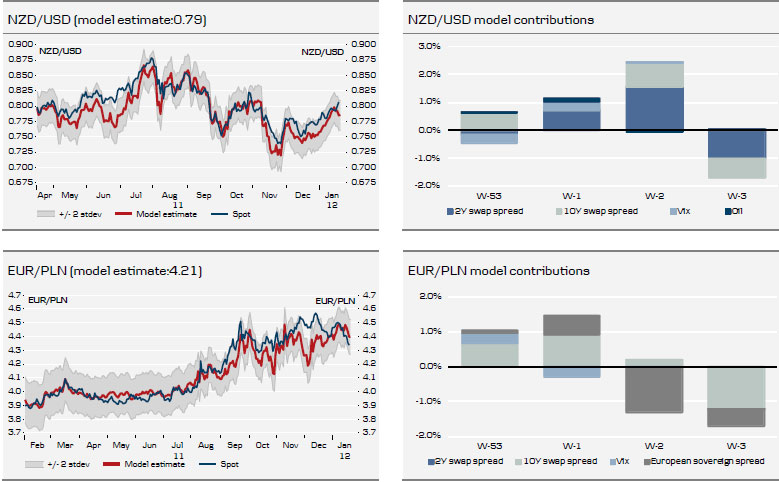

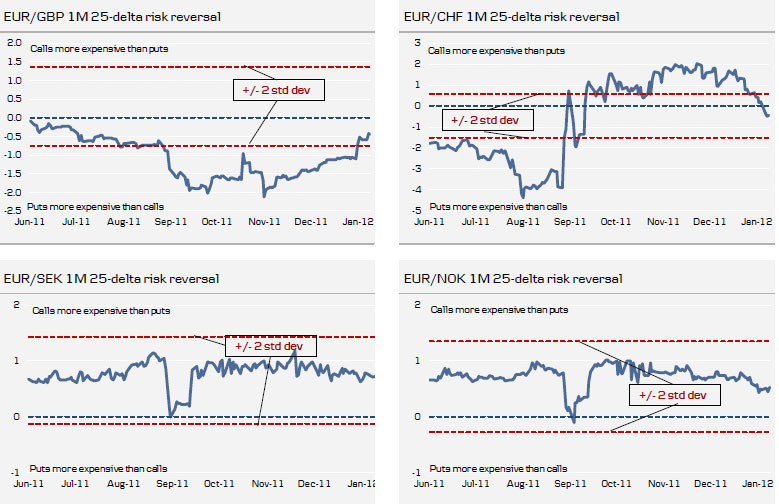

EUR/SEK is currently trading with the biggest model deviation, as relative rates have not narrowed enough and market risk sentiment is not improved enough to explain the pair much below 9.00. From a fundamental perspective we remain SEK bulls, but weak Swedish macro data could trigger a spike higher in EUR/SEK in the short term. Technical indicators also point to the pair being oversold.

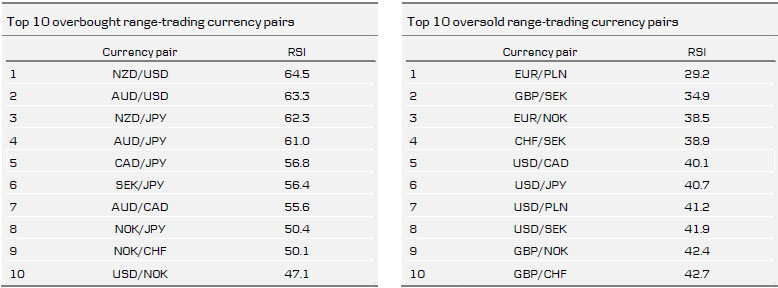

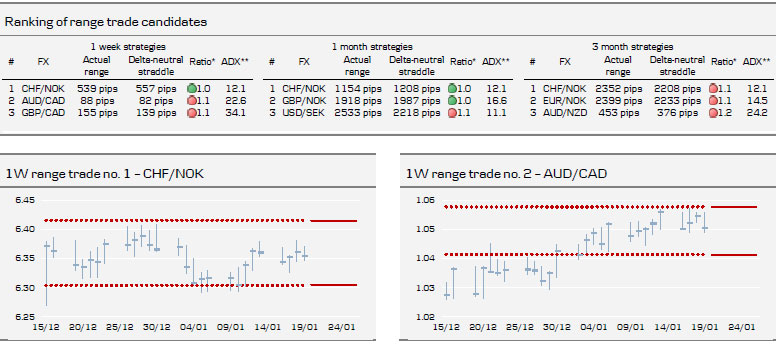

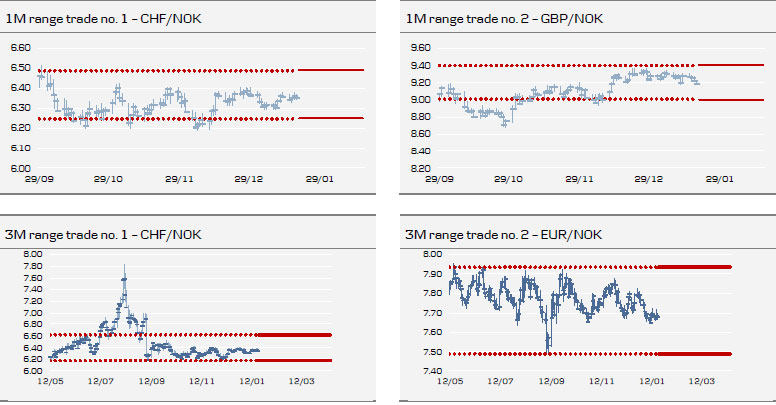

The range-trading monitor points to opportunities for positioning for CHF/NOK to within a range in the near term, which is also in line with our latest forecasts.

Strategy – bought 1M EUR/SEK call spread

Technical indicators, the outlook for weaker Swedish macro data and the signal from our short-term model all point to the recent decline in EUR/SEK being overdone. Implied volatilities are trading at a discount to delivered and given the usual positive correlation between spot and ATM volatility, we see a good case for positioning for a higher spot while retaining a long-volatility position. Thus, we suggest entering a 1M 8.77-8.98 EUR/SEK call spread at an indicative price of 0.65% EUR notional/575 SEK pips for a 1:2.7 risk:reward ratio (spot 8.7530). For a zero-cost alternative, this could be financed by selling a 1M 8.65 one-touch option. The latter option yields an (indicative) upfront premium of 50% of notional. Hence, the notional on the onetouch should be 1.30% of the notional on the call spread for a zero-cost structure (e.g. EUR13,000 on the one-touch and EUR1,000,000 on the call spread).

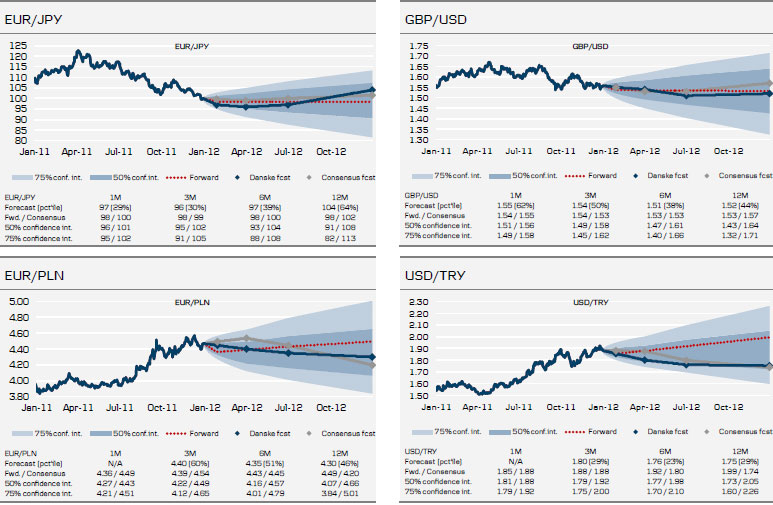

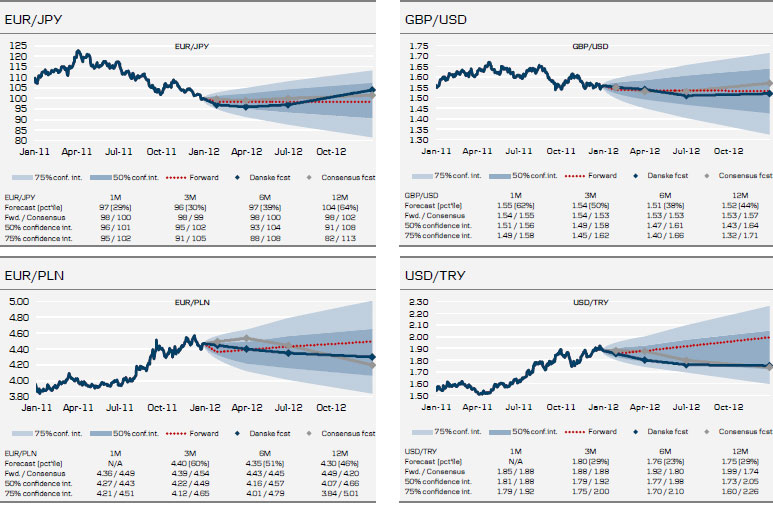

Forecasts and market pricing

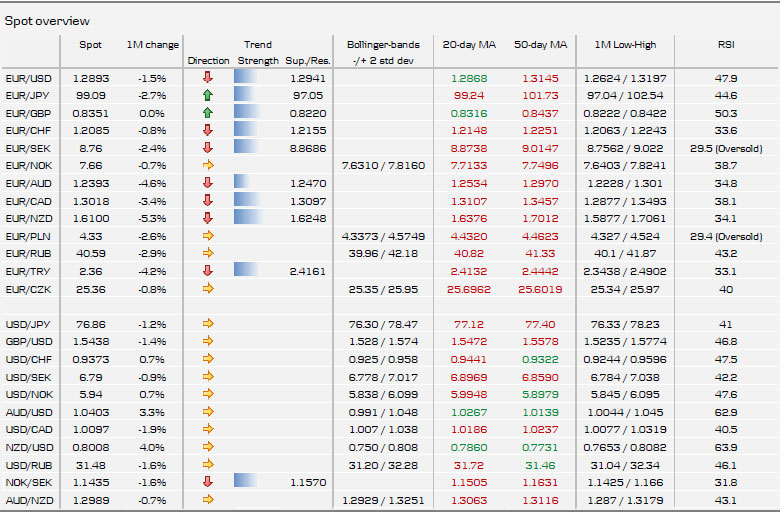

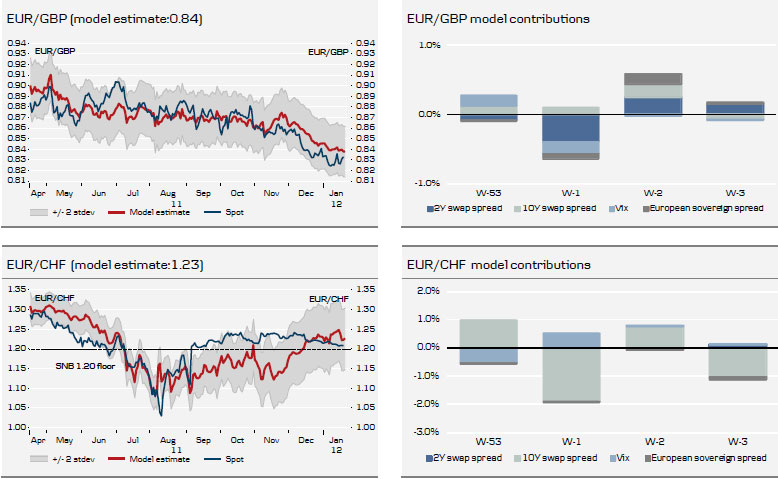

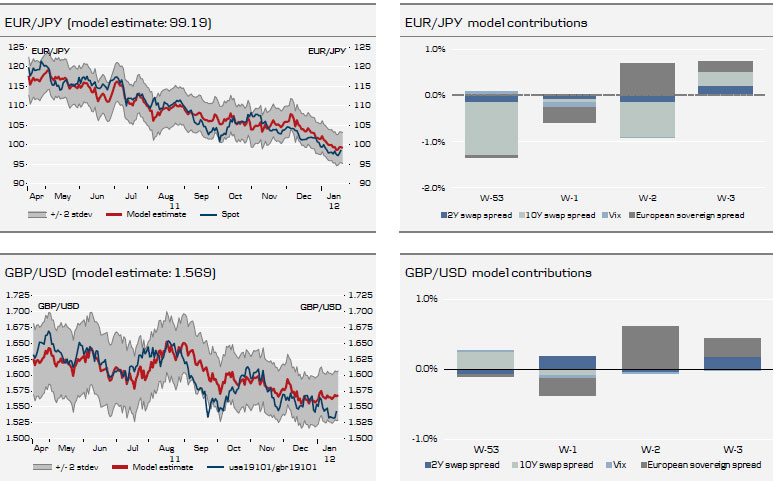

In our updated FX forecasts, we have pencilled in further nearterm EUR weakness versus all G10 currencies, except CHF and SEK.

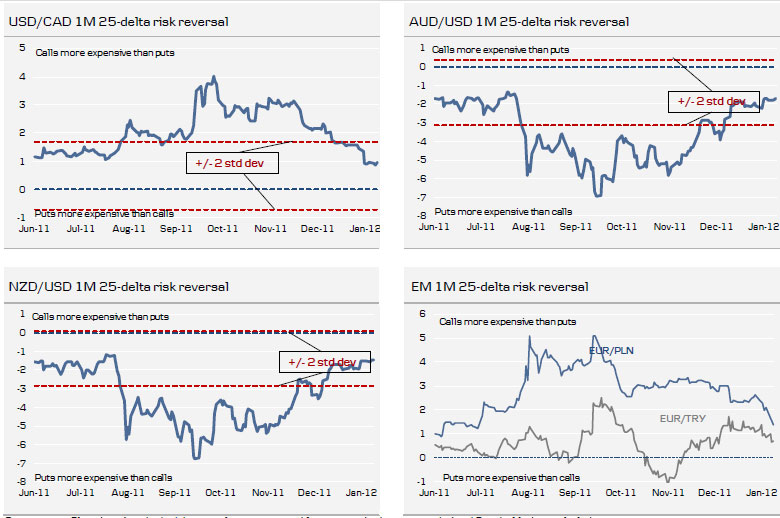

We look for a stronger Turkish lira in the coming months, which is also why we recommended a EUR/TRY put as one of our FX Top Trades for 2012. One could also position for a stronger TRY against a basket of EUR and USD, which would offer better diversification.

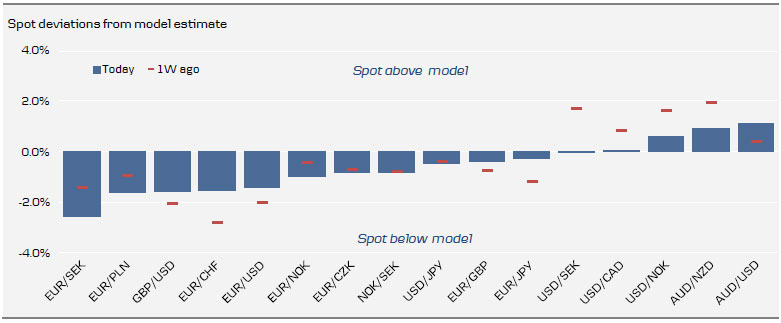

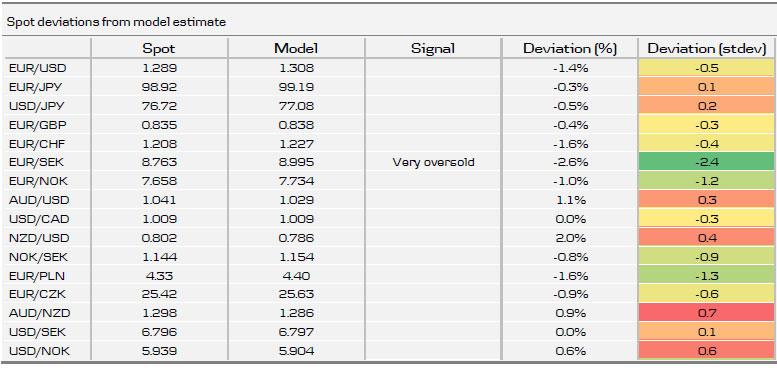

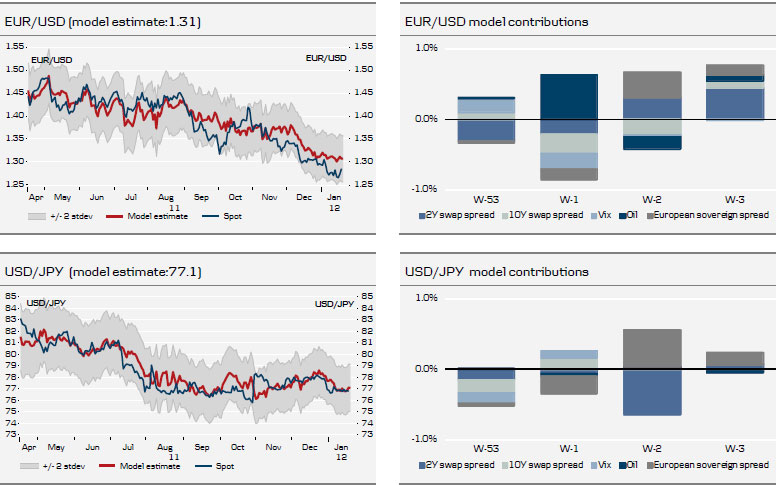

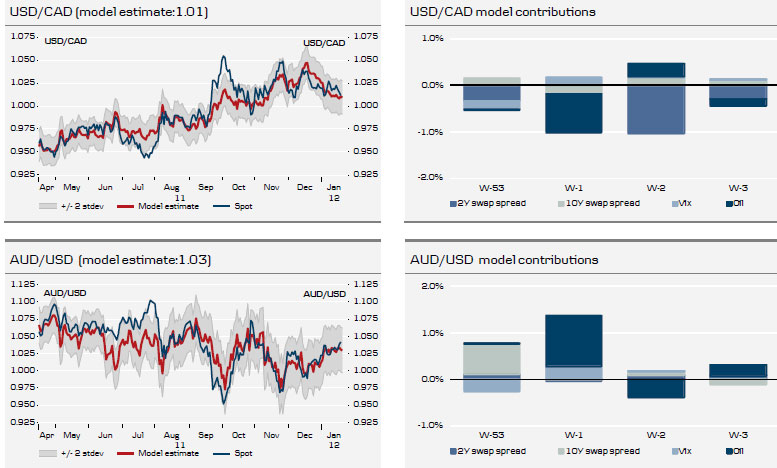

Short-term financial models

EUR/USD has corrected back towards the model estimate, which currently stands at 1.31. We doubt that the current rebound will take the euro back above the model, but with short euro positions at record levels there is potential for short covering to take EUR/USD higher currently expected.

EUR/SEK currently trades with the biggest model deviation, as relative rates have not narrowed enough and market risk sentiment is not improved enough to explain the pair much below 9.00. From a fundamental perspective we remain SEK bulls, but weak Swedish macro data could trigger a spike higher in EUR/SEK in the short term – if not all the way back to the model, then potentially back towards the 8.87-8.93 technical resistance.

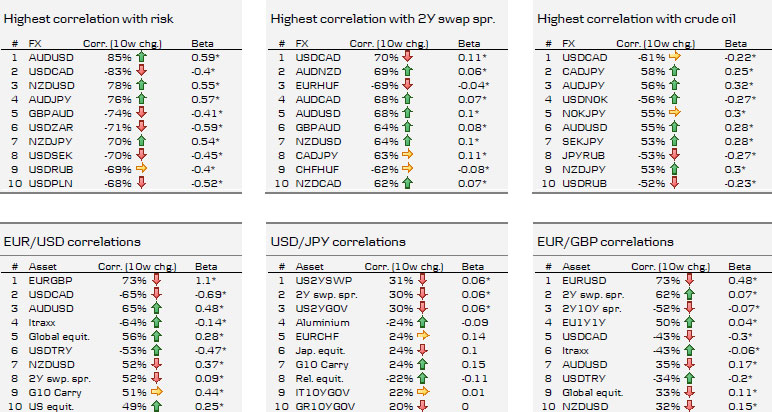

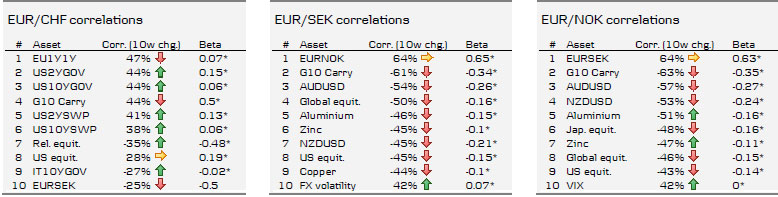

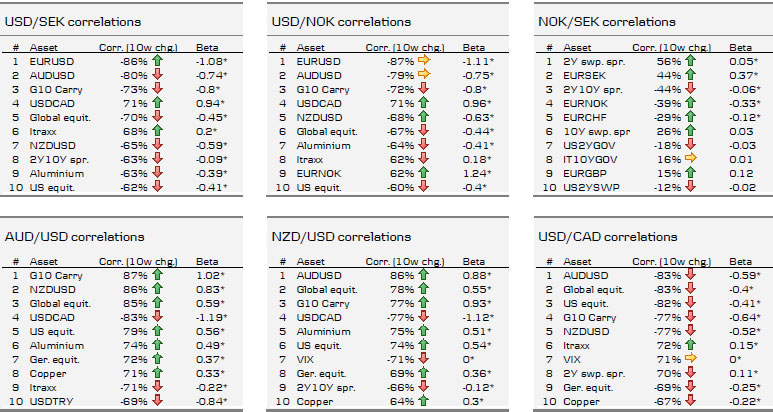

Correlation monitor

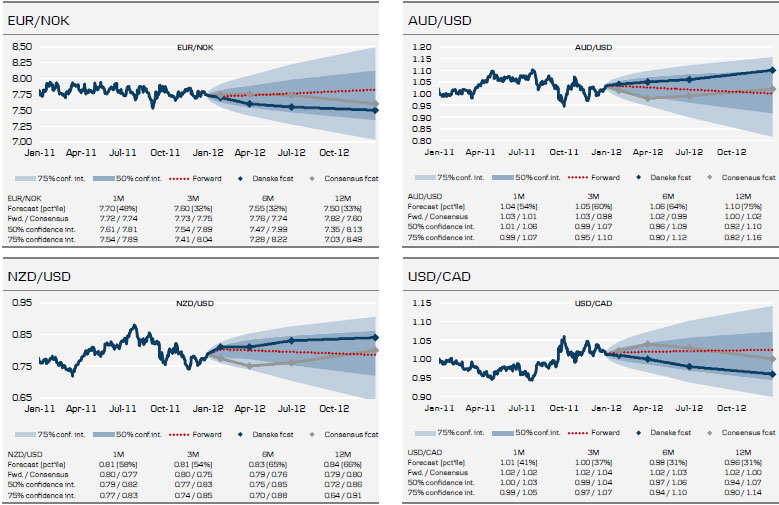

AUD/USD currently has the highest correlation with risk, whereas a bullish view on the price of crude oil is best expressed through USD/CAD. Note that we expect the price of oil to average USD112/barrel in 2012.

USD/CAD also has the closest correlation with relative rates, making the cross an attractive vehicle for positioning for further Fed easing. The correlation between EUR/HUF and the two-year swap spread is currently very negative, due to the broad sell-off impacting both Hungarian bond yields and the forint.

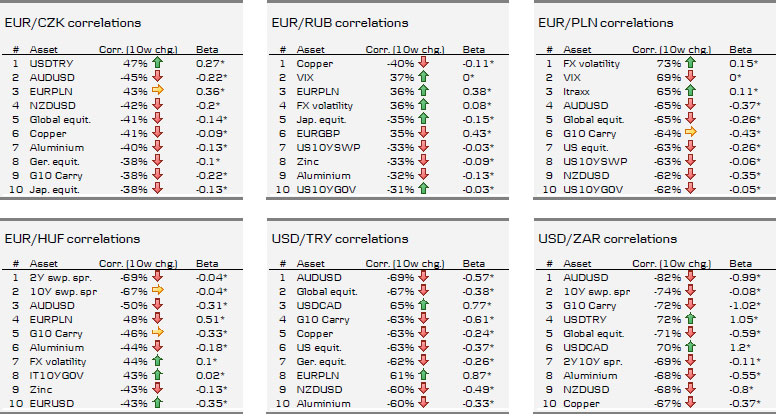

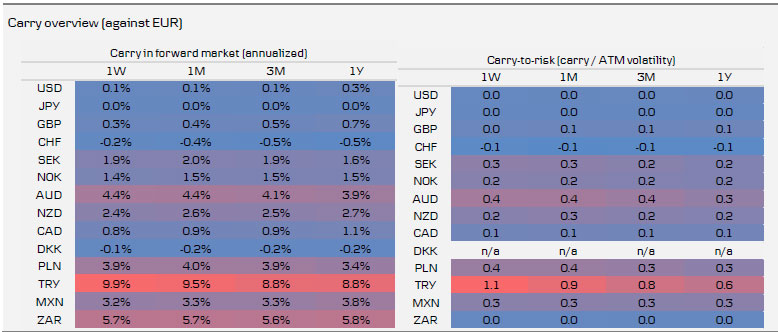

Carry

TRY continues to yield the highest carry and with both realised and implied volatility collapsing long TRY is now also by far the most attractive carry target currency from a risk/reward perspective.

AUD also continues to look attractive – even with EUR/AUD trading at record lows. We are long an equal weighted basket of AUD, MXN and SGD against USD as part of our 2012 FX Top Trades.

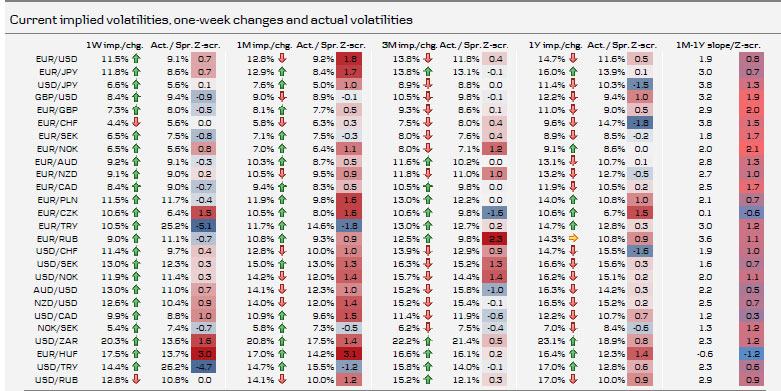

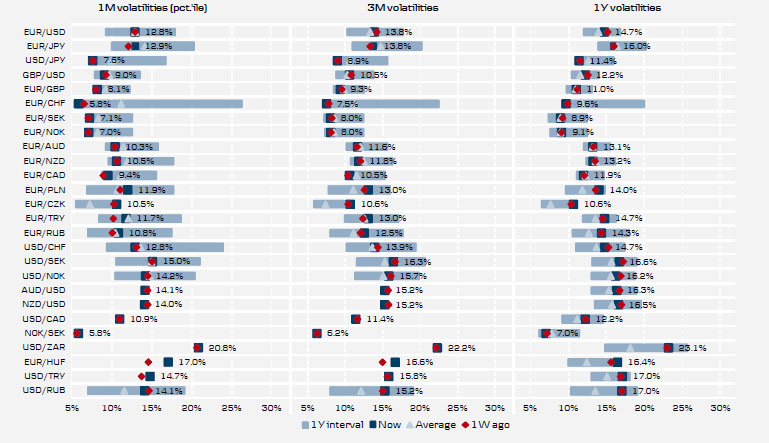

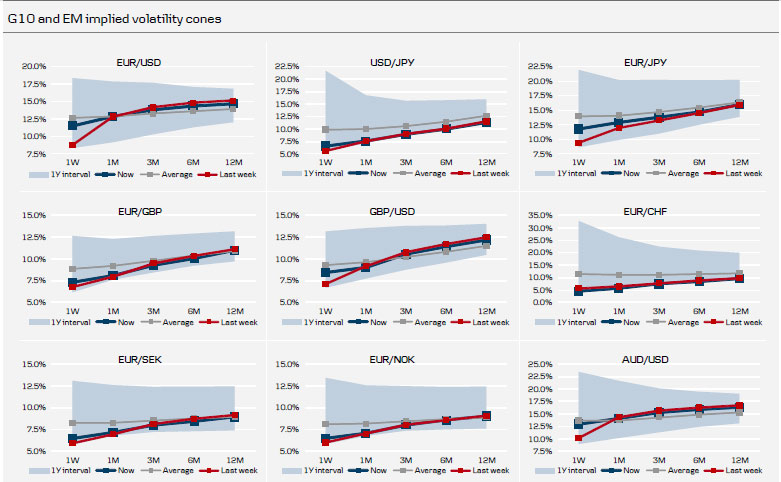

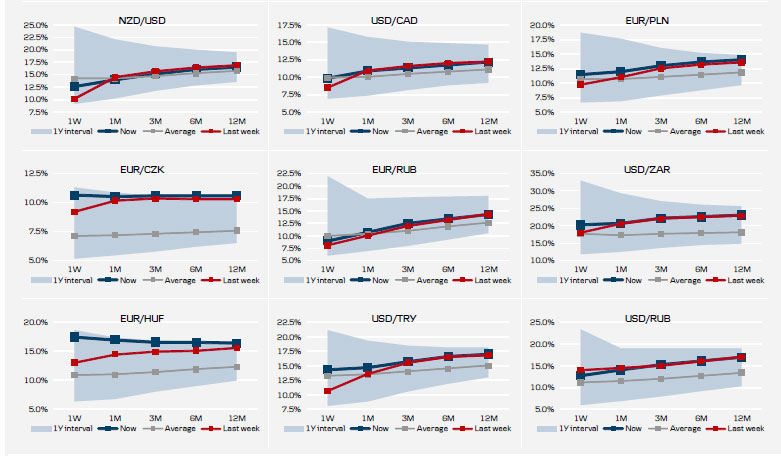

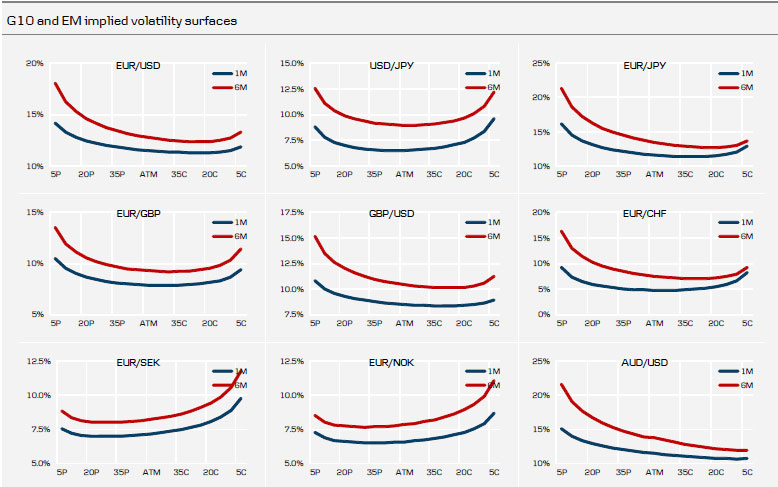

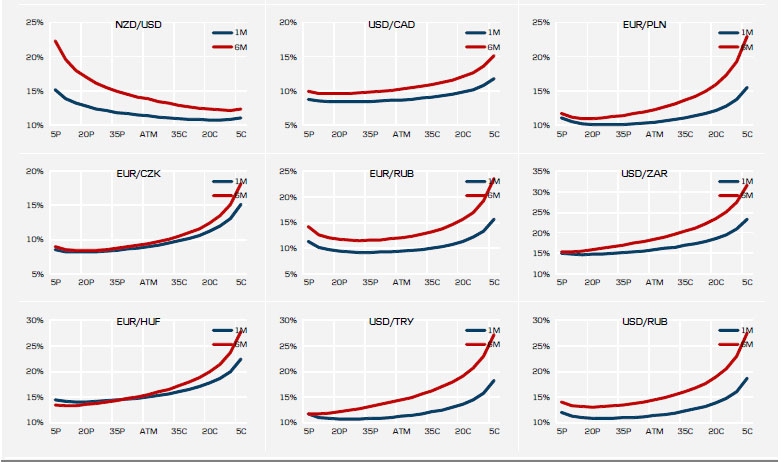

Volatility overview

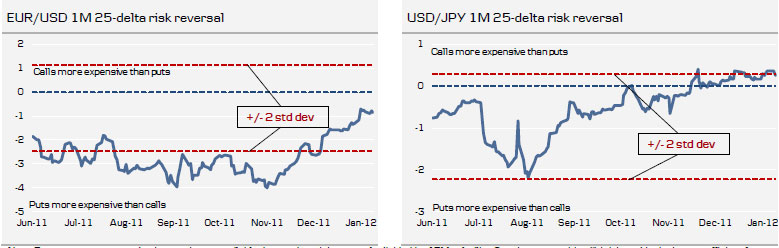

Over the past week, front-end EUR/USD implied volatilities have climbed higher, following the sovereign downgrades in the euro area by the S&P. Currently, particularly the one-month tenor in EUR/USD looks expensive and should the current positive sentiment prevail, we would look for lower levels. Also, note that the skew of the volatility surface in EUR/USD has decreased significantly, making hedging of the downside considerably less expensive.

Range trading monitor

This week, the monitor points to opportunities for expressing views on range trading in CHF/NOK. The technical indicator suggests that the pair is range-bound and the pay-off from selling straddles exceeds the historical trading range on one-week and one-month horizons. From a fundamental perspective, we also expect the cross to trade around the current level for the coming month (1M forecast: 6.36).

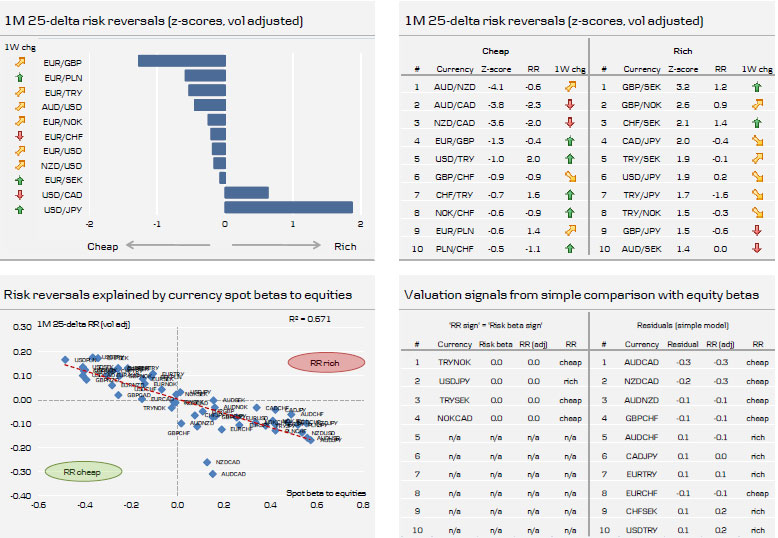

Option market positioning and skew valuation

USD calls are cheapening across the board, possibly mirroring the stretched aggregate USD longs in the futures market. Notably, the normalisation of the front-end EUR/USD skew has continued, taking the one-month risk reversal close to neutral levels, while the one-month USD/JPY risk reversal is trading in positive territory. The latter marks a deviation from the usual negative relationship between the sign of an FX cross’ betas to overall market sentiment and the sign of the risk reversal.

Clients seeking to hedge EUR/USD downside may thus take advantage of the change in the skew, which has rendered risk reversals more attractive as a hedging structure. On the other hand, clients who are long USD no longer get the same benefit of stretched option market positioning. They may, however, consider hedging EUR/USD upside by means of call spreads.

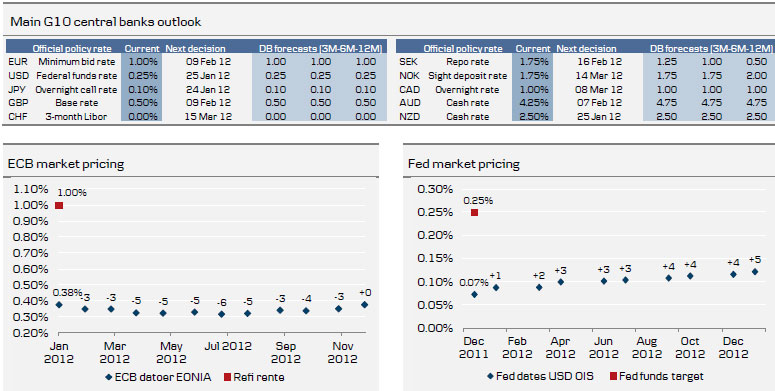

Central bank overview

We continue to expect the ECB to keep rates on hold for a prolonged period of time, possibly until 2014. The ECB may deliver further rate cuts and more non-standard measures if downside risks materialise. See our ECB meeting Flash Comment for details.

Overall, we do not expect further stimulus measures from the Fed in terms of QE3. However, from the next meeting, the Fed will for the first time publish its own forecasts for the federal funds rate.

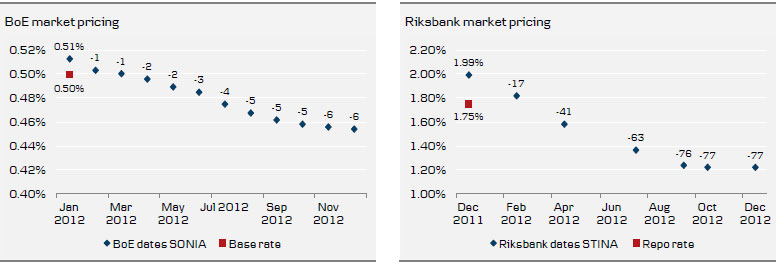

The BoE kept the asset purchase target as well as the base rate unchanged at the January monetary policy meeting. More QE is likely to be announced in February. Total QE will probably amount to £400bn by end-2012.

The Riksbank cut rates by 25bps in December, but has indicated that there is not much more to come. In our view, however, weaker macro data should prompt more rate cuts during 2012 (down towards 0.5bp).

Norges Bank cut rates by 50bps in December. We do not expect further easing, but rather look for a hike towards end-2012.

In Switzerland, deflation risks leave potential for further monetary easing, but a near-term hike off the EUR/CHF floor has become less likely – not least following the resignation of SNB Chairman Hildebrand.