Effective Jul 1, Headwaters Incorporated (NYSE:HW) has redeemed $47.25 million of its 7-1/4% Senior Notes, unsecured debt due in 2019. This effectively reduces Headwaters remaining senior unsecured debt to $99 million.

The redemption was funded with cash. The company had reported $58.5 million of cash and cash equivalents as of Mar 31, 2016. Over the past 2 years, Headwaters has repaid debts worth $112.7 million. As of Mar 31, 2016, Headwaters had total $557.6 million of debt on its balance sheet.

During the second quarter, Headwaters had repaid $4.8 million of long-term debt. Following the Jul 1 redemption, Headwaters’ total debt was $519.8 million, consisting of $420.8 million of senior term debt, and $99 million of senior unsecured debt.

During the second quarter, the company also successfully repriced its senior term debt. The company has thus lowered its interest cost by 50 basis points (bps) to Libor + 300 bps (with a 1% Libor floor). The Jul 1 debt redemption and the previous change in the senior term debt interest rate will be effective in lowering Headwaters’ annual cash interest expense by over $5.5 million to a total annual cash interest expense of approximately $24.4 million. This, in turn, will help boost its margins.

The company has been successful in cutting down its cash interest expense by over 50% from its peak of $52 million. The company has strengthened its balance sheet through overall debt reductions and also successfully completed multiple bolt-on acquisitions.

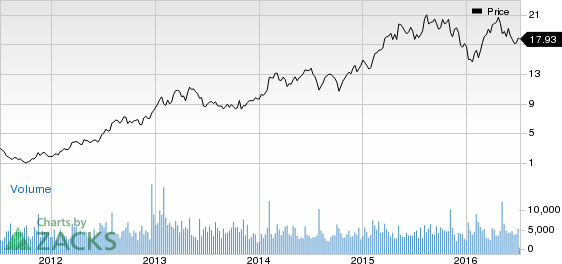

Headwaters currently carries a Zacks Rank #3 (Hold). Some better ranked stocks in the industry include TopBuild Corp. (NYSE:BLD) , GCP Applied Technologies Inc. (NYSE:GCP) and Gibraltar Industries, Inc. (NASDAQ:ROCK) . While TopBuild sports a Zacks Rank #1 (Strong Buy), GCP Applied Technologies and Gibralatar carry a Zacks Rank #2 (Buy).

HEADWATERS INC (HW): Free Stock Analysis Report

GIBRALTAR INDUS (ROCK): Free Stock Analysis Report

TOPBUILD CORP (BLD): Free Stock Analysis Report

GCP APPLIED TEC (GCP): Free Stock Analysis Report

Original post

Zacks Investment Research