The Advance Report on Manufacturers’ Shipments, Inventories, and Orders released yesterday gives us a first look at the latest durable goods numbers. Here is the Bureau's summary on new orders:

New orders for manufactured durable goods in May decreased $2.5 billion or 1.1 percent to $228.2 billion, the U.S. Census Bureau announced today. This decrease, down two consecutive months, followed a 0.9 percent April decrease. Excluding transportation, new orders increased 0.1 percent. Excluding defense, new orders decreased 0.6 percent. Transportation equipment, also down two consecutive months, drove the decrease, $2.7 billion or 3.4 percent to $75.4 billion. Download full PDF

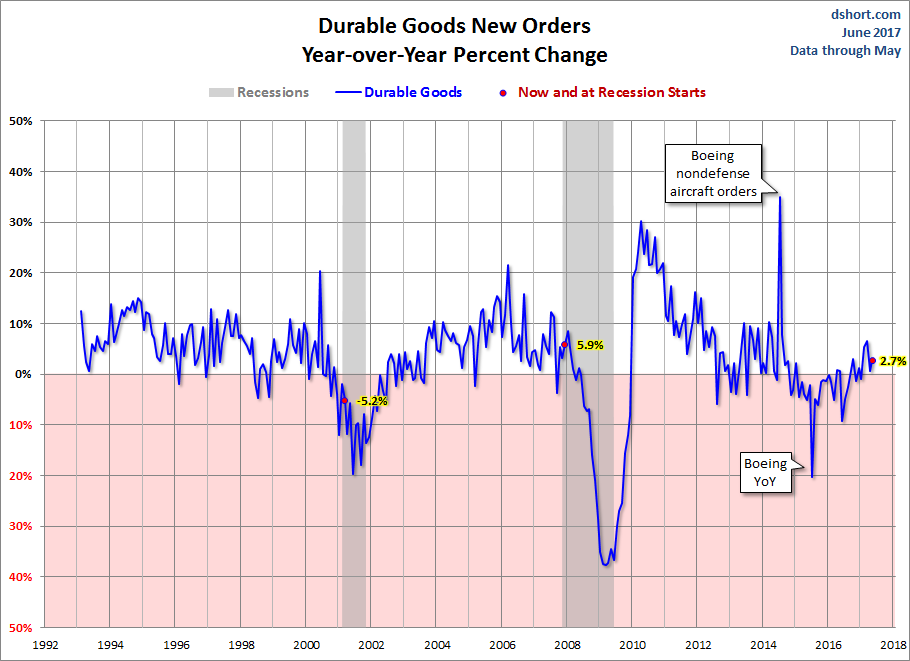

The latest new orders number at -1.1% month-over-month (MoM) was worse than the Investing.com consensus of -0.6%. The series is up 2.7% year-over-year (YoY).

If we exclude transportation, "core" durable goods came in at 0.1% MoM, which was below the Investing.com consensus of 0.5%. The core measure is up 5.5% YoY.

If we exclude both transportation and defense for an even more fundamental "core", the latest number is up 1.0% MoM and up 4.8% YoY.

Core Capital Goods New Orders (nondefense capital goods used in the production of goods or services, excluding aircraft) is an important gauge of business spending, often referred to as Core Capex. It is down 0.2% MoM and up 5.0% YoY.

For a look at the big picture and an understanding of the relative size of the major components, here is an area chart of Durable Goods New Orders minus Transportation and Defense with those two components stacked on top. We've also included a dotted line to show the relative size of Core Capex.

The next chart shows year-over-year percent change in Durable Goods. We've highlighted the value at recession starts and the latest value for this metric.

The next chart shows year-over-year percent change in Core Durable Goods (i.e., excluding transportation).

The next chart shows the growth in Core Durable Goods overlaid on the headline number since the turn of the century. This overlay helps us see the substantial volatility of the transportation component.

Here is a similar overlay, this time excluding Defense as well as Transportation (an even more "core" number).

Core Capital Goods

The next two charts take a step back in the durable goods process to show Manufacturers' New Orders for Nondefense Capital Goods Excluding Aircraft, a series often referred to as Core Capex. Here is the year-over-year Core Capex.

The next chart is an overlay of Core Capital Goods on the larger series showing the percent change of the two since the turn of the century.

In theory, the durable goods orders series should be one of the more important indicators of the economy's health. However, its volatility and susceptibility to major revisions suggest caution in taking the data for any particular month too seriously.