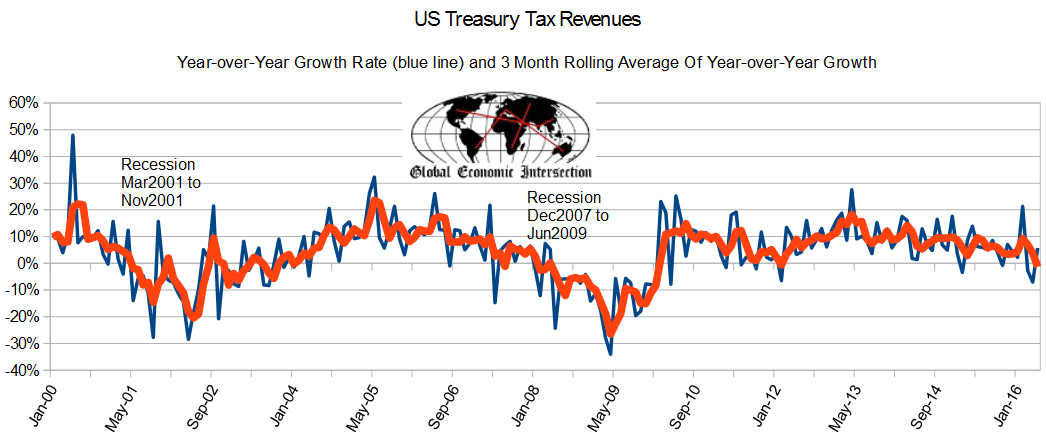

The latest data release for US Treasury Tax Revenues shows the year-over-year growth rolling averages are now in negative territory. Is this a recession flag?

Follow up:

Tax revenues are a lagging indicator.

The graph below shows the year-over-year growth of tax revenues.

Food for Thought:

- For the Great Recession, the rolling averages went negative in February 2008 - two months after the Great Recession's start. For the 2001 recession, the rolling averages for tax revenues went negative two months after the official start of the recession. In May 2016, the rolling averages for tax revenues went negative.

- Leading into the Great Recession, the rolling averages peaked in May 2005 - 32 months prior to the official recession start. Leading into the 2001 recession, the rolling averages peaked in July 2000 - 8 months prior to the beginning of the recession [however if one ignores the two-month spike, the peak was May 1997 - 48 months prior to the recession start]. The recent peak was in April 2013 - 37 months ago.

I do not believe in single litmus tests to gauge the economy. Having said that, there is little backward revision in US Treasury data making this a reliable tool to be used with other data sets to gauge the economy. At this point, no data set that I judge as a reliable recession flag is screaming. Many are coming close - but close is not a recession indication.

I do not buy into the way the economy is measured as it disproportionally measures the very rich 0.01% of the people - and ignores the median. But I accept that recessions are indicated by certain specific metrics which are not yet indicating a recession - but beware backward revisions. Therefore I continue to forecast a snail economy for the USA for the visible future.

Other Economic News this Week:

The Econintersect Economic Index for July 2016 continues marginally in contraction but insignificantly improved. The index is slightly above the lowest value since the end of the Great Recession. Although Econintersect does not buy into the proposition that Brexit is bad for the global economy, the financial markets do - and their reaction may cause a recessionary dynamic. Those alive in 1973 will remember that the oil embargo triggered a recession. Global events do indeed impact the USA economy.

Bankruptcies this Week: None

Click here to view the scorecard table below with active hyperlinks.

Weekly Economic Release Scorecard