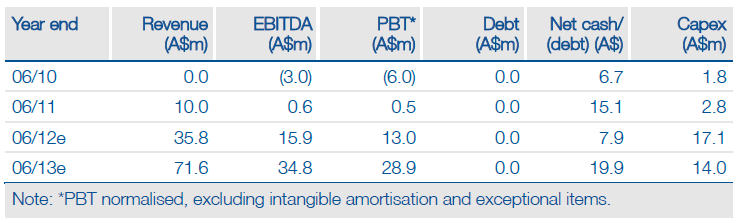

Ukraine focused Hawkley Oil & Gas (HOG.AX) offers investors solid upside via self-funded development of 7.8mmboe of 2P reserves alongside extensive appraisal opportunities across its two licences, Sorochynska and Chernetska. Low-cost production and ready access to infrastructure ensures robust economics across a wide range of commodity prices and fiscal structures. Currently fully funded for 2012/13, appraisal success could unlock significant upside requiring further funding for which a proposed AIM listing in 2012 would provide fresh routes to capital.

Robust economics provide grounds for confidence

Hawkley’s business strategy is to drill on previously explored and/or producing assets with existing infrastructure. With 100% interests across its two licences the company limits third-party risk, but at the expense of greater cost exposure. Although we would expect investors to be wary of Ukraine’s evolving regulatory regime, we consider the economics to be robust across a wide range of stress-test scenarios.

Solid cash flow funds upside potential

Hawkley’s business strategy entails a work programme fully funded through 2012/13. Management expects current Sorochynska production of 1.1mboepd to grow to 3.6mboepd bv 2014 as 7.8mmboe of 2P reserves are developed. Near-term upside to this could come from ongoing appraisal drilling of 22mmboe of net 2C resources in the B19 East block at Sorochynska, although evaluation work at Chernetska may be slower following operational problems with the recent Chernetska-1 well. Based on a recent resource assessment and improved drilling techniques, Hawkley could target up to 48.5mmboe of net 2C resources at Sorochynska and 17mmboe of contingent and prospective resources at Chernetska.

Valuation: Solid core NAV upside

Our core NAV of 33.5c, based on self-funded development of Sorochynska’s 7.8mmboe of 2P reserves, offers investors significant upside to the current share price. This could rise to 65.6c when Sorochynska is fully in production and in the event that additional possible reserves are also converted to 2P. Rising operational cash flow can currently fund drilling of Hawkley’s appraisal targets where 22mmboe of Sorochynska contingent resources feature in our risked exploration NAV (RENAV) of 61.0c. However, accelerated development in the event of appraisal success may require additional funding, for which a proposed AIM listing in 2012 would offer additional routes to capital.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Hawkley Oil & Gas: Significant Upside Potential

Published 07/08/2012, 06:08 AM

Updated 07/09/2023, 06:31 AM

Hawkley Oil & Gas: Significant Upside Potential

Cash flow sustains growth

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.