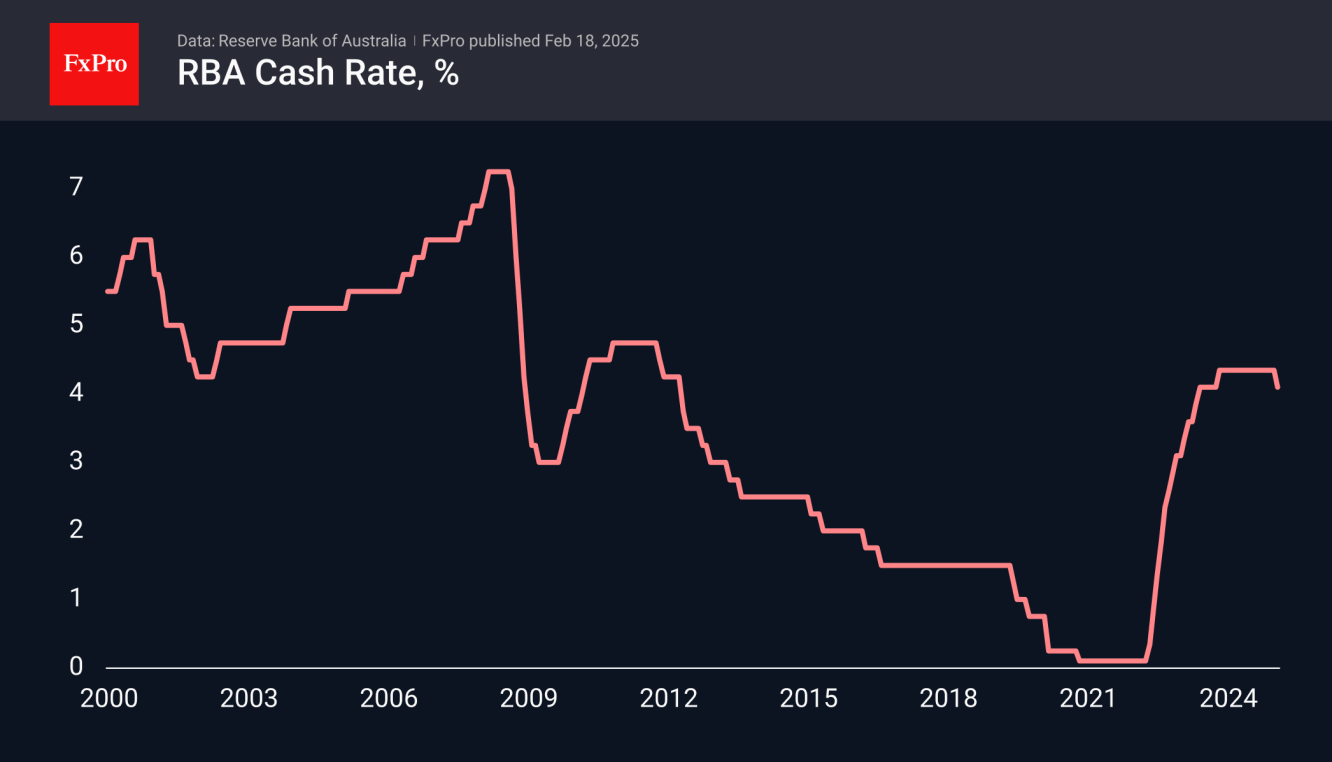

The Reserve Bank of Australia cut its key rate by 25 basis points to 4.1%, meeting market participants’ expectations and kicking off the monetary easing cycle. The rate was last cut in November 2020, and the rate hike cycle started in May 2022.

The RBA met expectations and joined the majority of Central Banks easing policy in response to lower inflation, but the commentary sounded more hawkish than might have been expected. The decision commentary points to upside risks to inflation following a series of unexpectedly strong labour market data. Australia is thus looking to the future with caution. In simple terms, this means that we should not count on another decline: much will depend on incoming data.

This makes the Australian dollar stand out from its competitors. Neighbouring New Zealand has decreased its key rate by 125 points so far in this cycle and is expected to cut another 50 on Wednesday. Unsurprisingly, the AUDNZD pair is adding 0.65% on Tuesday, trading around highs since October 2022. The difference in monetary policy approach gives an increased chance of a break of resistance at 1.1140, opening the way to 1.15 (2022 peak).

AUDUSD is behaving more modestly, rising to 0.6350. A bottom has been forming there since the end of last year, repeating in slow motion the dynamics of October 2022. This likely is the dynamic the RBA wanted to create and maintain with its rather hawkish approach to policy. Earlier this month, the Aussie consolidated above the 50-day moving average, and now a reasonable upside momentum target looks to be the 200-day average, which is near 0.6550.

The FxPro Analyst Team