Tumult in the Middle East has trends in global markets being heavily affected, with traders moving in herds toward haven assets as their sentiment on risk takes a turn. A Russian fighter jet recently brought down by Turkish military forces and quickly following statements from the US to traveling citizens have also affected risk appetite in market participants. Terrorism and the rift growing between Turkey and Russia have the ability to rapidly turn prevailing trends around, as evidenced by the quickly swinging trend from stability Monday to volatility Tuesday, in moves that have seen exodus from the lira and the ruble into safety instruments. This is an indication that capital investment is moving further away from these two countries, which have become too unpredictable for many investors tastes. Prices of gold and crude oil were seen to rise after the attack, though inherent instability in these industries has been enough to reverse some price gains as the week goes on.

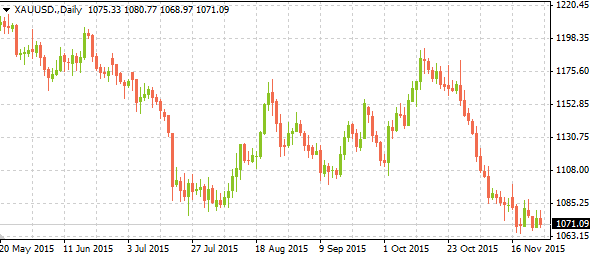

Recent days in gold have seen the precious metal hit $1080 as troubles in Syria between several countries contribute to the risky outlook. But in a move that reveals some investors may have been hasty, the first increase in gold in three days was quickly reversed on expectations of a Fed policy shift. The potential for the current situation to entangle major oil players in the region saw the price of crude rise as well, before reports revealing new large stockpile additions drove prices back lower. Saudi Arabia’s willingness to sit down and discuss price stabilization may also have contributed to the short price boom, but the price of oil can only float on these irresolute expectations for so long. Additionally, numbers from Cushing, Oklahoma in the United States illustrate a 1.90 million barrel inventory deposit that pushed the WTI benchmark off of 2-week highs. Currently, Russian hesitancy to declare a course of action has haven assets declining slightly, with further inaction ready to drop prices even more.