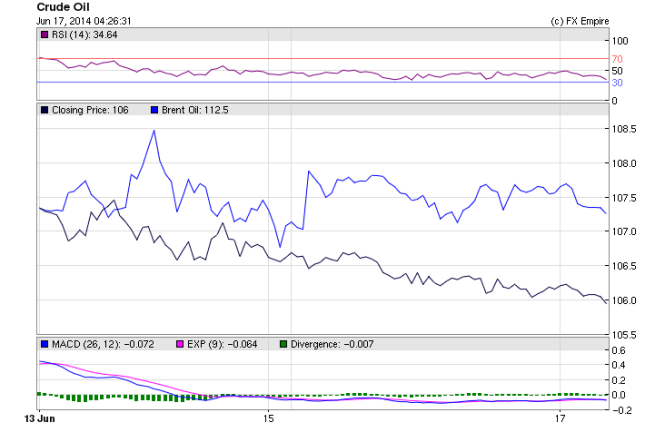

Oil prices seem to have hit a wall of resistance on Monday. Over the weekend violence and tensions in Iraq turned into a civil war between two major religious factions as the US considers military strikes to return control to the government. Over the week, speculators were sure oil prices would soar as the markets opened and would continue to gain throughout the day. But the rally did not materialize. This morning oil prices are still in the red. Crude Oil is down 23 cents at 106.08 while Brent Oil declined 34 cents to 112.63.

On Monday Bloomberg printed an article that predicted Brent oil could exceed $116.00. With violence escalating in Iraq, how far the price will rise has become anyone’s guess. The international benchmark surged above $114 on June 13 for the first time in nine months as militants routed the Iraqi army in the north and advanced toward Baghdad, threatening to ignite a civil war. The Islamic State in Iraq and the Levant, known as ISIL, has halted repairs to the pipeline from the Kirkuk oil field to the Mediterranean port of Ceyhan in Turkey. The conflict threatens output in OPEC’s second-biggest crude producer. The Persian Gulf country is forecast to provide 60 percent of the group’s growth for the rest of this decade, the International Energy Agency said June 13. Global consumption will “increase sharply” in the last quarter of this year and OPEC will need to pump more oil to help meet the demand, according to forecasts from the Paris-based IEA.

Oil-price volatility rebounded from the lowest on record as the violence escalated in Iraq. The 20-day historical volatility of Brent futures rose as high as 13 percent on June 12, according to exchange data compiled by Bloomberg. It was at 7.2 percent on June 3, the least since the contract began trading in 1988.

Crescent Petroleum Co. Chief Executive Officer Majid Jafar talked about his company’s operations in Iraq amid fighting between the military and Sunni Muslim insurgents. He spoke with Anna Edwards and Mark Barton on Bloomberg Television’s “Countdown.” He stated that the fighting and violence has not effected production and that the oil fields and production facilities were well protected and under control. The fighting hasn’t spread to the south, which the U.S. Energy Information Administration says is home to three-quarters of Iraq’s crude output. The country’s three biggest oilfields — Rumaila, West Qurna-2 and Majnoon — lie in the south, and crude production there has been increasing. The region has a Shiite majority opposed to ISIL’s Sunni militants.

An unexpected report from the IMF downgraded US growth for 2014. The report mostly cited the drop in GDP from Q1 due to the harsh winter in the US and that subsequent quarters will meet or exceed expectations but annual growth would not recover from the decline in the winter months.

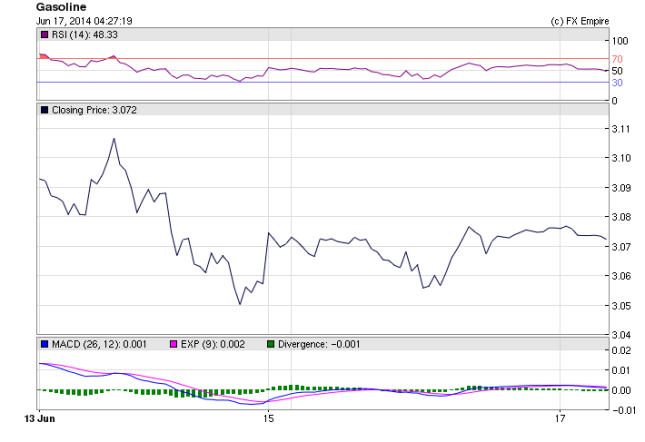

Given the current unrest in Iraq, traders can expect oil prices to reach $110 for WTI, which would mean that the national average would go towards $3.80 for gasoline. Should markets see a significant supply disruption in exports, then they can expect oil prices to go to $125 and the national retail average to exceed $4 a gallon. These are extremes but possibilities. It is unlikely that the West would allow prices to surge this high without releasing the strategic reserves to lower prices before it can effect inflation and the global recovery.