The monetary tectonic plates are shifting, and predicting the next global financial earthquake is relatively easy.

I recently suggested that the devaluation of the yen was Japan's Monetary Pearl Harbor: a direct attack on the currencies of its major trading partners: the EUR (European Union), the won (South Korea), the AUD and the USD, which affects both the U.S. and China since China's currency, the renminbi, is pegged to the USD.

Though there have been no overt (that is to say, public) counter-attacks, this may not reflect monetary peace so much as an undeclared war. Correspondent Mark G. observed that the current geopolitical backdrop is considerably more unsettled than the relatively benign global chessboard in 2008:

"The Eurozone and the Pacific Rim now have a pair of regional wars being fought out primarily by financial and monetary means. We can infer that the major central banks won't be anywhere near as cooperative during a crisis as they were in 2008."

While the American-European financial sanctions against Russia and Russia's counter-moves are being waged in public, the public response of the Korean and Chinese central banks to Japan's massive devaluation has been limited to grumbling.

But it is unlikely that other central banks are limiting their response to Japan's aggressive devaluation to words.

Let's start by noting that central banks play two games: one is pure public relations: marionettes on strings beat deflation with sticks and declare they'll save financial parasites with "whatever it takes" monetary policies.

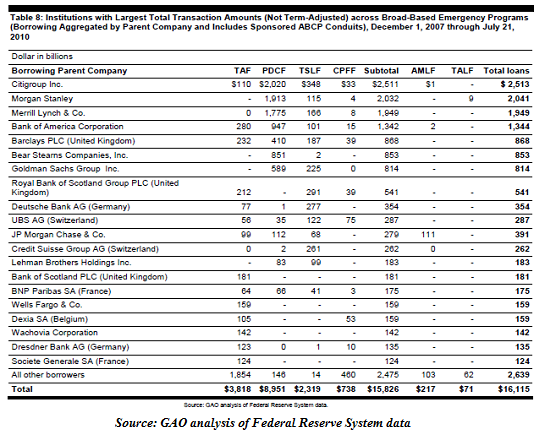

Meanwhile, their actions may be mere shadows of the bold policies being trumpeted, or they may be extremes nobody dares make public, for example the Federal Reserve's $16 trillion bailout of literally the entire Western banking sector in the last Global Financial Meltdown.

(The Levy Institute came up with $29 trillion after poring over all the data):

The U.S. Fed has remained mute, but the yen devaluation has destabilized the global monetary order, whether the Fed acknowledges it publicly or not.

Unsurprisingly, central bank public statements don't mention that competing devaluations share certain characteristics with circular firing squads. Beggar thy neighbor policies destabilize currency flows, and from there, imports and exports, and from there, domestic regimes.

Is there a beneficiary of devaluations and shadow currency wars? It's not too difficult to imagine gold will eventually be revalued to reflect the decline in purchasing power of devalued currencies. It's also not too difficult to anticipate capital flows into whatever currency isn't being actively devalued -- for example, the US Dollar.

One peculiar consequence of choosing not to devalue one's currency is the resulting inflows of capital fleeing devaluing currencies act as a form of quantitative easing: some of that capital flows into Treasury bonds, effectively replacing the Federal Reserve's QE bond purchases.

The monetary tectonic plates are shifting, and predicting the next global financial earthquake is relatively easy. Predicting the timing and the winners--now that's tricky.