Most people are familiar with Hasbro Toys (NASDAQ:HAS). If you ever played the Monopoly board game, with a G.I. Joe action figure, or a Mr. Potato Head, you have played with a Hasbro toy. And while toy fads come and go, there will always be kids looking to have some fun with toys. This is where Hasbro comes into play.

So what does the current and future environment look like for Hasbro Toys? Should you consider investing in this company or are there better options for your money out there?

Hasbro Toys Background

The Hasbro company as we know it started back in 1923 by the Hassenfeld brothers. The original company was a textile business, but expanded into pencil cases and school supplies. In the 1940’s the company expanded into making doctor and nursing kits for kids, but hit gold when in 1952 it bought Mr. Potato Head from its creator. Two years later, Hasbro signed a licensing deal with Disney to sell Disney characters as toys.

Fast forward to the 1980s and its toy line really took off. With G.I. Joes, Transformers and My Little Pony, among others, Hasbro was riding high. Since then, business has been primarily good for Hasbro.

Hasbro currently markets toys under its name as well as a handful of subsidiary companies. These include Funskool, Playskool, Tonka, Milton Bradley, Parker Brothers, and Tiger Electronics.

Some the top performing toys for Hasbro include G.I. Joe, Start Wars, Transformers, Nerf, Monopoly, and The Game of Life.

The Economics of Hasbro

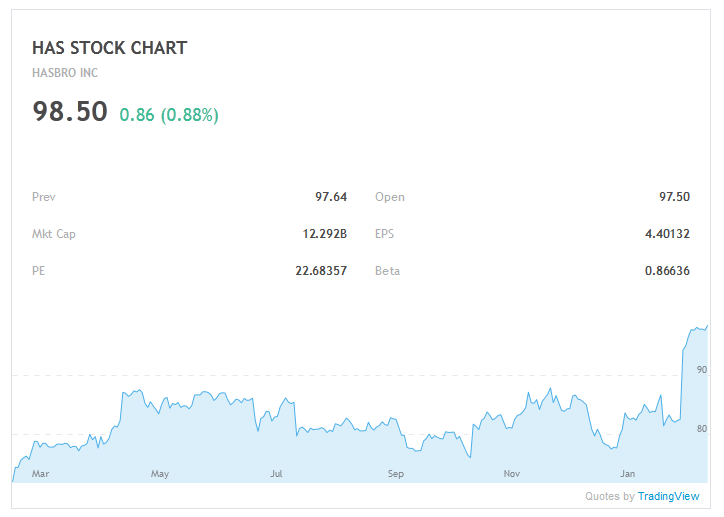

Last year Hasbro reported earnings of $4.46 a share. The year before that, earnings were $3.51 a share. While the stock is pricey, trading at 22 times earnings, there is a lot of room for continued growth.

The main reason for the bullish outlook on Hasbro is from the company themselves and their plans for 2017. Hasbro still owns the rights to Disney Princess, which was a huge success for them in 2016. They also are the creator of Pie Face Showdown, which has been a top selling toy on Amazon for 3 months now.

And new toys are on the horizon. With new Star Wars, Marvel and Transformers movies coming out in the next couple of years, Hasbro will be debuting many new toys for these lines. This will help to further solidify the boy’s toy segment for the company.

For girl’s toys, look no further than Disney. With Hasbro continuing to license Disney products, sales from Disney Princess and Frozen will continue to add to Hasbro’s bottom line as will new films from Disney in the coming years.

Is Hasbro A Buy?

The answer to the question of whether or not Hasbro Toys is a buy lies in the person asking the question. There are two outlooks for Hasbro.

The first, is a cyclical toy company. It has its hit toys one year and they fall off to a new hot toy the following year. Most times, it is not the same toy manufacturer who makes hit after hit, so you have unpredictability when it comes to the toy industry.

The second is a marking company. Since Hasbro has sold off its manufacturing plants, it is solely a company that markets and sells toys. This allows for greater stability over the long term. It focuses its efforts and investments into figuring out what kids want and is better able to market and sell to them, thus improving the bottom line.

In addition to this, Hasbro has taken a different approach to toys. It sees itself as a storyteller now. It focuses on brands that last a long time. For example, girls will always be interested in princesses and boys will always be interested in robots. As a result, you have toys that span years of popularity and not just one holiday season.

Many investors like what they hear in regards to the second point. By re-inventing themselves, Hasbro has turned its highly volatile business into a more stable company and can better anticipate results. This doesn’t mean it won’t have bad years, but most believe that the bad years won’t be as bad or come at such a surprise any longer.

Because of this, many analysts are expecting the company to grow in the high single digits per year for the next couple of years. While some may argue that some of this growth is already priced into the stock, which is currently trading at $98 a share, many believe there is still a lot of room for the company’s stock to push higher.

Estimates for 2017 earnings are at $4.66 a share and for 2018, $4.91 a share. If Hasbro Toys can hit these numbers, you can expect the stock to be more than $100 a share.

The time to buy the stock is now. It is up to you as to whether or not you wait for a dip or market pullback before getting in. The only downside to this strategy is getting outpriced if the pullback never comes.

This author has no positions in any stock mentioned and does not plan to open any positions in any stocks mentioned for at least 72 hours after publication of this article.